SME Scale-Up has concluded another session of its bi-monthly event on November 15, 2024. Held at the Radisson Blu Anchorage Hotel in Lagos, with both physical and virtual participation options, the event featured a strategic collaboration with First Bank to reaffirm its dedication to helping small and medium-sized enterprises (SMEs) overcome growth challenges and scale effectively.

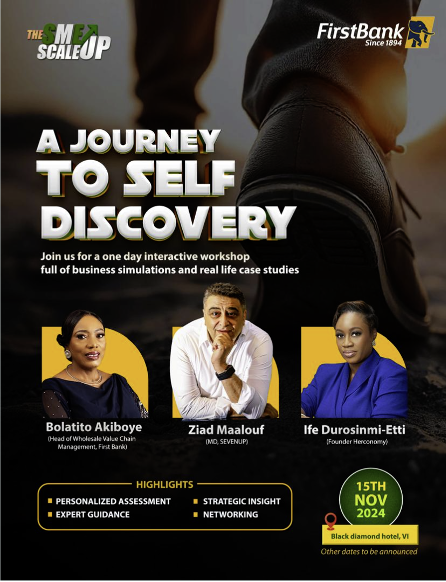

Themed “A Journey To Self Discovery,” the one-day workshop adopted an interactive format that leveraged real-life case studies and business simulations to equip CEOs, entrepreneurs, executives, and small business owners with practical tools and actionable insights for success.

The session featured distinguished speakers such as Ziad Malouf, Convener of SME Scale-Up; Bolatito Akiboye, Head of Wholesale Value Chain Management at First Bank; and Ife Durosinmi-Etti, Founder of Herconomy who all brought their wealth of experience to the workshop.

Through their engaging sessions, these thought leaders provided actionable advice, delivered personalized assessments, and offered strategies to help SMEs navigate business challenges.

Speaking on this year’s edition, Ziad, the Convener of SME Scale-Up, commended the outcome:

“This year’s SME Scale Up is exceeding expectations, delivering on its promise to inspire entrepreneurs, business owners, and CEOs, providing them with the tools to overcome growth barriers. I’m confident that the strategic blend of the practical sessions coupled with case studies will leave the attendees equipped with actionable steps to take their businesses to the next level.”

Bolatito Akiboye, Head of Wholesale Value Chain Management, at First Bank expressed her excitement at being a part of the SME Scale-Up’s third edition.

“It was an absolute privilege to be part of SME Scale-Up and contribute to the growth and development of small businesses in Nigeria. Having First Bank partner with SME Scale-Up aligns perfectly with our mission to provide innovative solutions and support for entrepreneurs to thrive. I’m also excited to have shared insights and strategies that will help business leaders achieve sustainable growth.”

Similarly, Ife Durosinmi-Etti, Founder of Herconomy, praised the consistency of the annual workshop in delivering on its commitment to empowering SMEs:

“SME Scale-Up continues to set the standard for empowering small and medium businesses every year. It is inspiring to see how this platform keeps evolving and creating lasting value for SMEs across Nigeria. I am proud to be part of this impactful journey and look forward to witnessing even greater successes in the years to come.”

The event ended with photos and networking sessions as participants at the event also attested to the success of the workshop which gave them key pointers on how to chart their business on the right course.

About SME SCALE UP

The SME Scale-Up platform is designed for CEOs and founders of Small and Medium Enterprises (SMEs) in Nigeria, offering resources to help them grow and expand their businesses. SME Scale-Up empowers businesses to overcome growth challenges and achieve lasting success through practical knowledge sharing, capacity building, and networking.

For more information about SME Scale-Up, visit www.smescaleup.org or reach out on social media at @smescaleup.