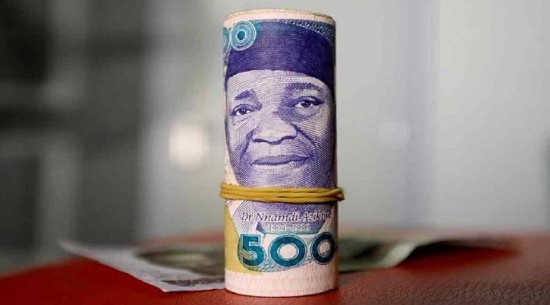

The Naira has lost over half of its value in one year since Yemi Cardoso assumed office as the Governor of the Central Bank of Nigeria (CBN).

According to data from the FMDQ, the value of the local currency dropped from N747.76/$1 on September 22, 2023, to N1,541.52/$1 as of September 20, 2024, representing a 51.49% depreciation.

This decline in the value of the naira has occurred amid efforts by the CBN to stabilize the currency, including a notable increase in Nigeria’s foreign exchange (forex) reserves.

FX reserves rise by $4.12 billion

Nigeria’s foreign exchange (FX) reserves grew by 12% over the past year, rising from $33.28 billion on September 22, 2023, to $37.39 billion on September 19, 2024, reaching its highest level under the administration of Bola Tinubu.

This $4.12 billion increase in reserves signals efforts by the CBN to shore up liquidity in the forex market and manage external shocks.

However, this growth in reserves has not been sufficient to curb the sharp depreciation of the naira, which continues to struggle under external pressures and internal fiscal imbalances.

Yemi Cardoso, who took over the leadership of the CBN on September 22, 2023, has introduced several policies aimed at combating inflation, strengthening the local currency, and promoting transparency within the market.

However, these reforms have yet to yield the intended stabilization, as the naira’s depreciation highlights ongoing challenges in managing the nation’s currency.

While the increase in FX reserves is a positive signal for liquidity management, the growing gap between supply and demand in the forex market, combined with high inflation and wavering investor confidence, continues to exert pressure on the naira.

Hike in interest rates

The CBN, under Yemi Cardoso, increased the monetary policy rate (MPR) four times to combat inflation and foster economic stability.

The first hike increased the rate from 18.75% to 22.75%, the second to 24.75%, the third to 26.25%, and most recently, in July 2024, the Monetary Policy Committee (MPC) raised the rate by 50 basis points to 26.75%.

These increases, totalling 800 basis points since Cardoso’s appointment, have been driven by efforts to tackle the country’s persistent inflation challenges, which include high core and food inflation.

The MPC is expected to meet on September 23 and 24, 2024 to decide on decreasing, retaining or increasing the MPR.

Financial experts have called for a pause on interest rate hikes to stabilize Nigeria’s struggling economy. A financial economist and Director at the Institute of Capital Market Studies, Nasarawa State University Keffi, Professor Uche Uwaleke, urged the MPC to refrain from increasing interest rates, citing the need to stabilize the economy. Uwaleke emphasized that the recent moderation in inflation, recorded in July and August, provides a compelling case for halting further rate hikes.

Nairametrics earlier reported that at least three members of the MPC voted to retain the MPR at 26.25% during the MPC meeting of the CBN on July 22-23, 2024.

While the majority opted for a moderate increase to curb inflationary pressures, three members, including Lydia Shehu Jafiya, Murtala Sabo Sagagi, and Aloysius Uche Ordu, argued that maintaining the MPR at its previous level was more appropriate given the current economic environment.

The three members, who stressed the need for a cautious approach to balancing inflation control with the need to support economic growth and stability, makeup about 27% of the 11 MPC members.

Meanwhile, Nigeria’s inflation rate dropped for the first-time in 19 months, at 33.40% in July, down from 34.19% in June 2024. This marked the first decline in the headline inflation rate since December 2022, when it last dropped to 21.34%.

Also, data released by the National Bureau of Statistics (NBS) revealed that Nigeria’s headline inflation rate eased to 32.15% in August 2024 down from the 33.40% recorded in July 2024, reflecting a decrease of 1.25%-points. It marked the second consecutive monthly slowdown in inflation after easing in the previous month.

Experts rate Cardoso’s one year in office

Speaking with Nairametrics on Sunday, a development economist, Dr Aliyu Ilias, described Cardoso’s approach as “topsy-turvy”, which has yet to yield significant results.

On the decelerated inflation rate, he said “What we saw recently in terms of reduction in inflation is too marginal. Also, it is the harvest period that has led to the drop.”

Rating the CBN governor, Ilias added: “He is sacrificing growth because he wants to reduce inflation. I will score him below average. He needs to do more and be more strategic with his approach.”

However, a financial analyst and founding partner at McBrain & Company, Brain Essien, told Nairametrics that: “he (Cardoso) hasn’t done too bad. Cardoso was handed an economy that was sickly.”

He added: “His objective was inflation-targeting, and so far so good, we have had two consecutive decelerated inflation, which is good.”

Essien further urged the CBN to stop dollarisation in the country and make the naira a focal point of the economy.

He stressed the need for the apex bank to ensure that the naira has more value, adding that: “The CBN should look for more creative ways to strengthen the naira itself. Or else, it will keep sinking against the dollar, and there is very little we can do about it.”

Essien also recommended that the CBN’s MPC retain the current MPR of 26.75%, as increasing or decreasing it may have more consequential impact, especially if such an adjustment exceeds +/- 25 basis points.