Nigeria Labour Congress (NLC) Development Policy Analyst, Hauwa Mustapha has stated that macro-economic trends are yet to display positive signs in the economy.

She stated this based on the notion that monetary policy has been striving to tame inflation through significant hikes and interventions in the forex market.

She also mentioned that effective policy implementation in Nigeria often overlooks the historical socio-economic environment in which these policies are expected to operate.

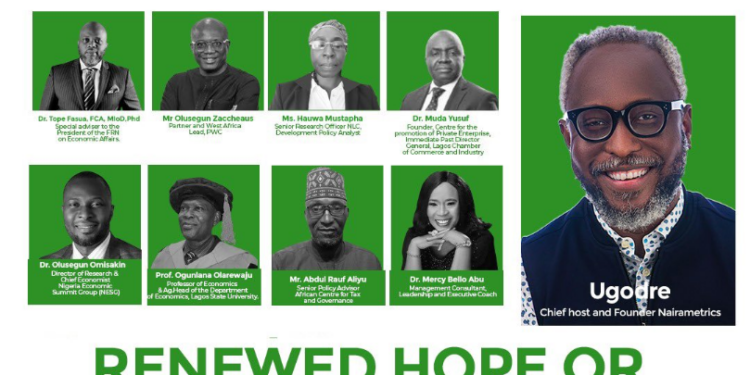

This was shared recently at Nairametrics Economic Outlook Q3 titled: Renewed Hope or Reality Check?: Identifying opportunities in a volatile economy.

What she said

Mustapha noted that while Nigeria is proficient at creating laws, the problem lies in its effective implementation.

She highlights that a crucial and often overlooked aspect of policy implementation is the historical socio-economic environment in which these policies are meant to function.

“We are good in bringing up laws but positive implementation is the issue.

“However, the important and fundamental issue that should underline the policy implementation process which is not often put into consideration is the historical socio-economic environment over which these policies are expected to operate”, she points out.

Macroeconomic trends yet to reduce inflation

Mustapha further emphasized that despite monetary policies, inflation remains high.

“The question remains if the impact of current policies is weak or if they require more time.

“Despite the efforts of monetary policy in Nigeria, inflation remains high with the Naira fluctuating”.

Using the removal of the subsidy as an example, she explains that in an economy where approximately 85% of the population lives in poverty, and where productivity, consumption, and per capita income are extremely low, such actions have a significant ripple effect on both the micro and macro economy.

She therefore argues that implementing such policies without creating an enabling framework to absorb the shock is ineffective.

“The policy will not have the desirable outcome and will not connect to the people,” she asserts.

The need for policies to be holistic

Hauwa believes that policies need to be holistic and inclusive both horizontally and vertically to be effective.

She stresses the importance of understanding various demographic factors such as gender, location, and income levels to assess the differentiated impact of these policies.

“These are fundamental issues, so I think moving forward, these policies should connect with the people by being holistic and incusive horizontally and vertically.

“We need to understand the gender of the people, location, income levels and and see the differentiated impact that these policies have”.

“These policies should connect with the people,” Hauwa concludes, advocating for a more integrated approach in policy-making.