Risk consultancy firm, SBM Intelligence, has said that allegations of bribery request levelled against Nigerian government officials by the CEO of Binance, Richard Teng, could hinder the country’s foreign investment drives.

In its analyses of recent events in the country and possible impacts on the economy, SBM Intelligence said that the circumstances that led to the detention of Binance officials in Nigeria were also a negative signal to foreign investors.

Although the Nigerian government had denied the allegation, SBM said there is a need for the government to thoroughly investigate and bring any official found guilty to book.

“Accusations of bribery involving high-profile government officials like those in the Tinubu Administration can further damage the country’s reputation and that of the administration itself.

“Such allegations can undermine investors’ trust in the government’s integrity and ability to conduct fair and transparent business dealings.

“When government officials are perceived as corrupt or willing to engage in unethical behaviour, it can deter foreign investment, undermine the rule of law, and hinder efforts to combat poverty and inequality,” the consulting firm said.

Nigerian government and cryptocurrencies

While noting that the Nigerian government has demonstrated its opposition to anything related to cryptocurrency, SBM Intelligence said the government’s position is contrary to how individual citizens view crypto.

“The truth is Nigeria has a love-hate relationship with cryptocurrencies. Individual citizens love them because of the investment and transaction opportunities they present, but the government and their agencies hate them because they take away the power of control,” it said.

The company noted that it has now been more than two months since the Nigerian government detained two Binance executives, although one escaped.

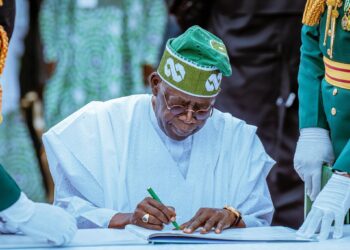

SBM Intelligence observed that since President Bola Tinubu assumed office, he has been travelling to various countries to woo investors. It, however, said that it would be difficult for a country that detains foreign business officials to attract investors.

“No matter the allegations against Binance, it is essential to remember that the story of one foreign business will serve as a cautionary tale to others. If Nigeria is tagged as a country where company officials can be solicited for bribes and then detained indefinitely, convincing investors to invest will become exceedingly challenging,” it added.

The consultancy firm added that the ongoing narrative around the arrest of the Binance executives is unflattering to the Nigerian government, adding that it would be in the best interests of the Tinubu Administration to resolve the issue as quickly, fairly, and diplomatically as possible.

Backstory

On Tuesday, May 7, Nairametrics reported that the CEO of Binance, Richard Teng, alleged that some unknown persons sought a bribe of cryptocurrency from its executives, Tigran Gambaryan and Nadeem Anjarwalla, before their detention on February 28, 2024.

Teng claimed in a blog post, detailing how the Binance executives tried to engage with Nigerian authorities, including a January 8 meeting in Abuja, before they were accused of criminal acts.

He said the meeting was set up with the Nigerian government through a committee consisting of about “30 agencies.”

Currently, Binance’s officials, Tigran Gambaryan, a U.S. citizen and head of financial crime, and Nadeem Anjarwalla, a British Kenyan, are facing trial for laundering more than $35 million in Nigeria.