Data from the National Bureau of Statistics reveals that Nigeria spent a staggering N3.5 trillion on fuel imports in the second half of 2023.

Fuel subsidy was removal was announced on the 29th of May but it took weeks to be fully implemented.

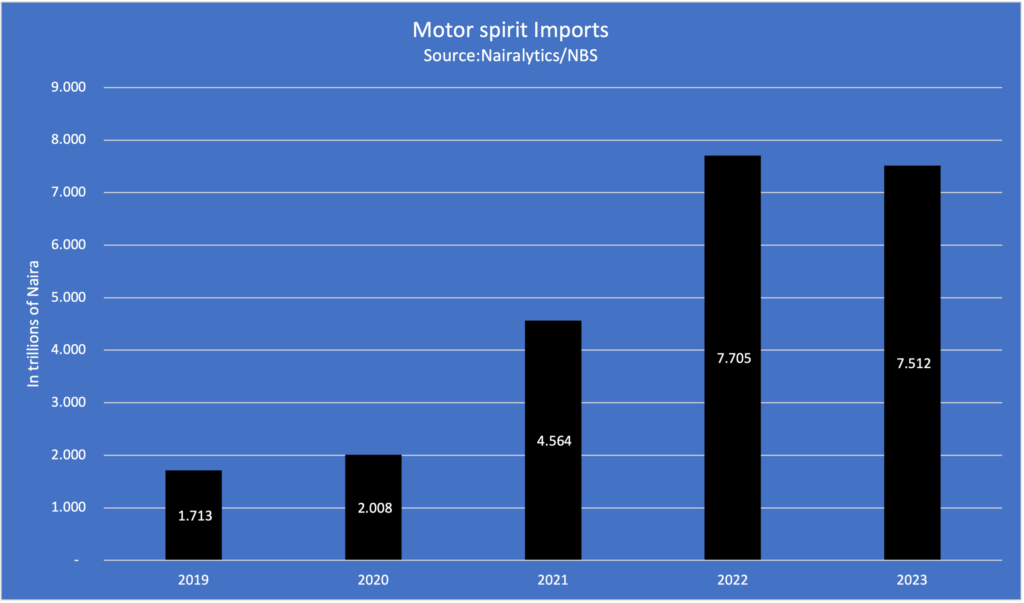

According to the 2023 full-year foreign trade data, Nigeria incurred about N7.5 trillion in fuel import costs throughout 2023, compared to N7.7 trillion in the previous year.

However, fuel importation costs for the country in the second half of the year amounted to N3.5 trillion, versus the N3.9 trillion recorded in the first half of the year.

Using the 2023 exchange rate, the country has spent approximately $7.7 billion on fuel importation in 2023.

Why this matters

The Tinubu administration discontinued fuel subsidies on May 29, 2023, during his inauguration speech.

- This removal set off a chain of reactions, initially triggering a tripling of fuel prices, which then escalated to other sectors.

- The inflation rate as of May last year was 22.41%, but it has since risen to 29.9% as of January 2024.

- Nigeria has relied on petroleum imports for nearly two decades, as refineries have failed to operate and meet the growing demand.

- The private sector’s capacity to refine and meet local demand is also years away, despite the commencement of operations at the Dangote Refinery.

Some reports suggest that the removal of subsidies may result in lower demand for petroleum products due to higher prices. However, the ensuing depreciation of the naira also meant that it became more costly in naira terms to import products.

- For example, as of July 2023, following the unification of the naira, the official exchange rate was N743/$1.

- However, by the end of the year, it had weakened to N907/$1 on the official market and above N1000/$1 on the black market.

- The implication is that while the government may have saved revenue by eliminating subsidies, the country spends a significantly higher amount on importing the product, adding to the demand pressure on the US dollar.

What the data is saying

The importation of motor spirit, also known as fuel, has cost Nigeria a staggering N23.5 trillion over the last five years.

- Fuel importation has proven particularly costly for Nigeria in 2022 and 2023, with a combined expenditure of N15.2 trillion—more than half of the total cost incurred in the last five years.

- This increase can largely be attributed to the depreciation of the naira against the dollar in the last two years, meaning Nigeria has had to spend significantly more in naira to import fuel than ever before.

What next? As Nigeria awaits the full operations of the Dangote Refinery and the availability of domestic supply, fuel imports will continue.

- However, Nairametrics anticipates that both the volume and the cost in naira of these imports will decrease, further alleviating demand pressures on the dollar.