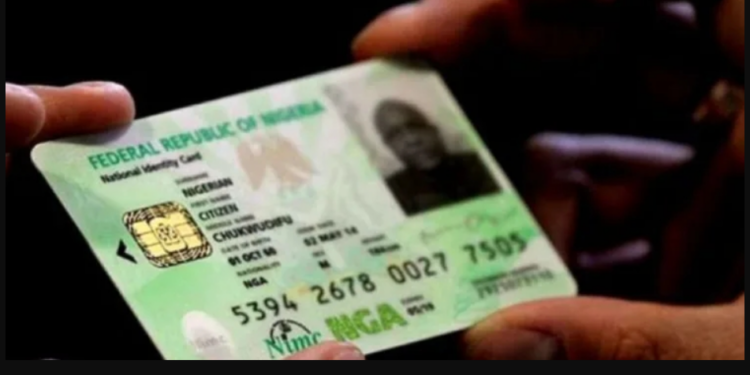

Nigerian banks have been sending messages to their customers to link their National Identification Numbers (NIN) with their bank accounts or risk their accounts being placed on post-no-debit as instructed by the Central Bank of Nigeria (CBN).

While the directive was issued on December 1, 2023, banks did not start the awareness until about a week before the end of February 2024, which created a rush to beat the deadline.

Although bank customers with tier 1 accounts have the option of linking either their Bank Verification Number (BVN) or NIN, customers with tier 2 and tier 3 accounts must link both BVN and NIN, according to the CBN.

One part of the exercise that has got many bank customers confused is the request for virtual NIN by the banks. Until now, many are only familiar with the regular 11-digit NIN issued by the National Identity Management Commission (NIMC).

What is Virtual NIN?

Virtual NIN is an encrypted, coded representation (“disguised”) version of an individual’s actual NIN, which another party verifying the number cannot retain and use in a way that puts the individual’s data privacy at risk.

- The virtual NIN consists of a set of 16 alphanumeric characters. According to NIMC, this number expires 72 hours after being generated.

- You can use the Virtual NIN when digitally verifying your identity with a verifying agent or enterprise who needs to confirm your identity before offering you a service (banks, airports, shopping delivery, and so on).

How to generate virtual NIN

You can generate your Virtual NIN via USSD or through the NIMC MWS Mobile ID App by following the steps below:

To generate a Virtual NIN via USSD, dial *346*3*Your NIN*AgentCode#

- An SMS message will be sent back to you containing the Virtual NIN generated for you.

To generate a Virtual NIN via the NIMC MWS Mobile ID App, launch the MWS Mobile ID app installed on your device (Android or iOS).

- Make sure you have the current version of the app installed or updated on your mobile device.

- Enter your PIN on the lock screen to continue.

- Select the “GET VIRTUAL NIN” button on the “Home” screen.

The CBN’s directive

The CBN on December 1, 2023 announced that all bank accounts without Bank Verification Number (BVN) and National Identification Number (NIN) will be placed on “Post no Debit” effective April 2024.

The new directive was contained in a circular issued by the central bank and sent to all deposit money banks. The central bank also stated that all the BVN or NIN attached to and associated with all accounts/wallets must be electronically revalidated by 31 January 2024.

- “It is mandatory for all Tier-1 bank accounts and wallets for individuals to have BVN and/or NIN.

- It remains mandatory for Tiers 2 and 3 accounts and wallets for individual accounts to have BVN and NIN,” the apex bank stated.

It added that beginning from 1 March 2024, any such accounts or wallets that are funded will carry the “Post no Debit or Credit” tag and be forbidden from all transactions.

Good morning, please I did my change of name over a month now but up till now it’s still not reflecting on Virtual NIN at the bank , please what do I do thank you