Unilever Nig. Plc. announced the discontinuation of its homecare and skincare–cleansing brand segment which included the popular OMO detergent, Sunlight and Lux soaps.

Analysis of the company’s core business segments i.e., Food Products, Beauty/Wellbeing & Personal Care, and, Home Care/Skin Cleansing, showed the latter of the three units being the worst financial performer for 12months, 31st December 2023, with an Operating Loss off N3.5bn, whilst the former two returned Operating Profits of N11bn, and N6bn respectively.

Though no official statement was offered to exact reasons for the discontinuation(s), the numbers speak for themselves.

Though it is envisaged this move would result in an overall profitability improvement and a more sustainable business for the company, surging inflation, rising interest rates, foreign exchange volatility, and high energy costs however, can be said to have affected input costs, and the general profitability of said segment thus leading to its shutdown.

Add to this, the recent NBS Q4 2023 report of the manufacturing industry’s contracting contribution to GDP of 8.23%, down from 8.40% in Q3 due to the above-stated malefactors, and the numbers speak in even greater volumes.

However, and despite contracting economic conditions, and sad as it may seem to no longer see some of Nigeria’s oldest brands on our supermarket shelves going forward, let us consider the great words of Sir. Winston Churchill as we explore the opportunities that may have presented themselves with the OMO exist, “A pessimist only sees the difficulty in every opportunity, whilst an optimist sees the opportunity in every difficulty…”

Detergents and their uses come in myriad forms;

i) Laundry detergents

ii) Dishwashers

iii) Hand soaps

iv) Surface cleaners,

v) Stain removers,

vi) Fabric softeners

vii) Carpet/upholstery cleaners

vii) Toilet–ware cleaners

viii) Industrial purpose cleaners (manufacturing, healthcare, aviation, etc.)

ix) Pet–care detergents/soaps

x) Specialty detergents formulated for specific needs include automotive degreasers, jewellery cleaners, and even rust removers.

These many uses, uniquely position detergent production to serve a long list of clients, including; households/hospitality (hotels/restaurants/food services, nightclubs, etc.), laundromats/dry cleaners/textile & garment–care, educational institutions/daycares, government institutions, car washes & auto dealers, agric./farming sectors.

If well packaged and marketed, can even serve a potential export market. This will, however, depend on your start–up budget, preferred manufacturing process, of which there are many, and the types of raw materials, including colourants, agents, enzymes, fragrances and bleaching agents, you wish to employ to your specific product class and offerings.

Little wonder then that the global market, according to research company, EMR Claight, in its recent 2023 global detergent report, was worth more than $70.8 billion.

The company projects the market will grow at a year–on–year cumulative average of 4.1% to surpass $101bn by 2033.

This growth will be fueled by a growing global population, particularly in Sub–Saharan Africa, increased adoption of personal and environmental hygienic habits in combating common ailments and other diseases, and the increasing penetration of washing machines in homes and offices, especially in developing nations like Nigeria. Home & Hospitalities are said to make up more than 55% of core users within the industry and accounted for over $40 billion in global revenue in 2022 alone.

On the continental side, with a local market of over 200 million people, data from Report Linker shows that Nigerian demand for soaps is estimated to reach 1,300 tonnes by 2026, up 3.5% on a yearly average from 1,003 tonnes in 2021.

Since the turn of the century, the report states that yearly demand for soaps in Nigeria has steadily increased by 15.9%.

Further information from Statista.com reveals that the expected revenue to be generated in only the dishwashing segment of the Nigerian market is projected to top $0.80bn in 2024.

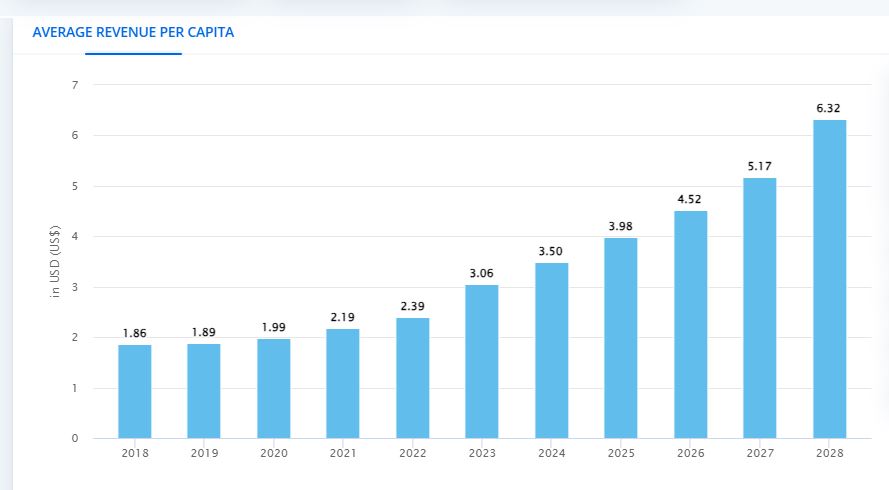

This segment is expected to experience an annual growth of 18.73% to reach $1.59bn by 2028. Per capita, each person in Nigeria is expected to contribute +$3.50 in projected 2024 revenue.

This is expected to exceed $6 per capita revenue by 2028.

Fig. 1.0. Average Liquid Dishwashing Detergent Revenue Per Capita, Projected…

Source: Statista.com, t.ly/jZey6

Despite the relatively deep internet penetration in Nigeria, data shows that the predominant sales channel for dishwashing and other detergents in Nigeria has been offline (supermarkets, open stores, etc.) and will continue to be, for the foreseeable future. So, be ready to spend a small sum on ‘direct marketing’ efforts.

For detergents, however, disposable sachet packs are the most popular SKUs, whilst homemade dishwashing liquids sold mostly in unbranded plastic bottles are the major market movers.

Fig. 2.0. Sales Channels Dishwashing Detergent, Nigeria.

Source: Statista.com, t.ly/jZey6

Research also shows that appealing fragrance, competitive pricing and rich lather composition are the utmost considerations when shopping for a detergent.

To understand how to achieve these best, however, you must first seek training and the necessary licenses and certification.

After these, be ready to fork up +N400k–N10mil minimum, depending on your desired production method (mechanized or manual), product type (liquid or powder), packaging type (sachet or makeshift), and marketing/sales strategy.

However, be warned, the sector is competition–heavy, so be ready to spend a tiny bundle to research a unique identifier for your own brand.

Other attendant challenges to consider before setting up shop include, sourcing raw materials locally since imports are now untenable, infrastructure (Power) and logistics (fuel) challenges, quality consistency, regulatory compliances, skilled manpower retention, and economic uncertainties which may require some level adaptability as pertains adjusting to changing consumer preferences and organizational throughput where need be.

Overall, with a growing national population, increased technological adoption and improving hygiene habits, the Nigerian detergent market is growing and still quite viable despite seeming insurmountable challenges. The magic words to success will therefore amount to organizational adaptability and nimbleness, local sourcing prowess, a happy and loyal workforce, a continually evolving pricing matric, design innovation, and a ton of gorilla marketing.

Brain Essien is a financial analyst and business process consultant, with expertise in investment banking, business plan formulation, pitch deck design, brand management, crowd/private equity and seed fund brokerage. mcbrainandcompany@gmail.com.