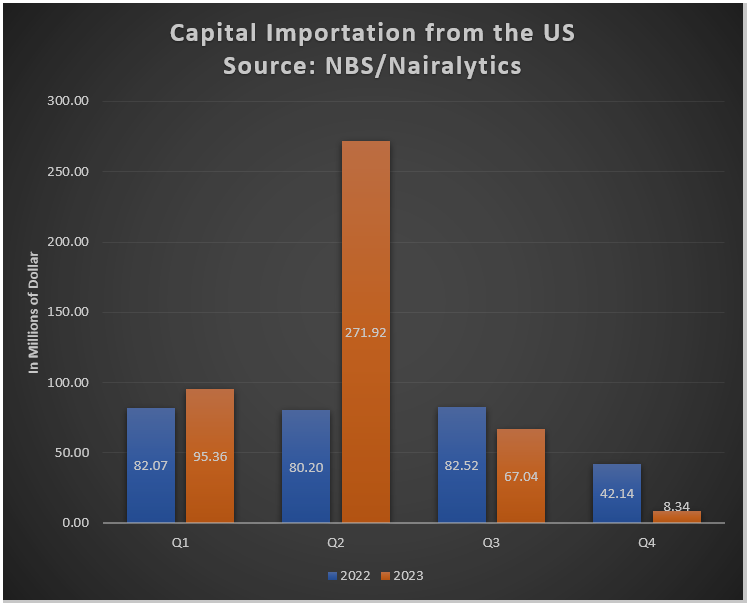

In an unexpected turn of events, sharply contrasting with prior optimistic outlooks on US-Nigeria economic relations, Nigeria observed a dramatic 88% fall in its foreign capital intake from the United States during the last quarter of 2023, according to the National Bureau of Statistics (NBS).

This pronounced decrease saw capital inflow from the U.S. plummet from $67.04 million in the third quarter to $8.34 million in the fourth quarter, marking the lowest level of U.S. capital importation into Nigeria ever recorded.

This downturn is not merely a quarterly anomaly but also signifies a distressing 80% year-over-year decline from the $42.14 million recorded in the same quarter of the preceding year, highlighting a notable waning of American economic interest in Nigeria as the year concluded.

Recommended reading: “Foreign investors interested in returning to the Nigerian market” – Yemi Cardoso

Despite this slump in the fourth quarter, it is essential to recognise that the United States remained one of the top 10 contributors to Nigeria’s foreign capital pool for 2023. The U.S. notably increased its economic engagement with Nigeria, with investments soaring to $442.66 million, up from $286.92 million in the previous year, indicating a broader trend of escalating economic interactions despite the end-of-year downturn.

Decline defies assurance from US government officials

This Q4 2023 decline starkly contradicts previous assurances from U.S. government officials regarding strengthening economic ties and sustained investor interest in Nigeria.

David Greene, the Chargé d’Affaires for the U.S. Embassy in Nigeria, articulated an intense eagerness among American investors and corporations to engage with Nigeria, highlighting the nation’s substantial economic potential.

Moreover, he pointed out the significant U.S. support, surpassing $1.2 billion across diverse sectors such as technology, agriculture, and health for the fiscal year 2022.

Greene also noted the satisfaction of U.S. businesses and investors with the policies of President Bola Tinubu’s administration.

Further reinforcing this narrative, U.S. Secretary of State Anthony Blinken reassured the readiness of American companies to partner with and invest in Nigeria, albeit acknowledging the challenging business environment and the essential need to combat corruption and foster a more inviting business landscape.

However, contrasting perspectives emerged from the U.S. Deputy Secretary of Treasury, Wally Adeyemo, who highlighted Nigeria’s absence of a solid macroeconomic framework capable of attracting more dollar-denominated foreign direct investments.

Adeyemo emphasised Nigeria’s need to showcase a commitment to economic fundamentals to draw foreign investors and achieve economic prosperity.

Recommended reading: FDI to manufacturing sector drops by 53.80% to $279.51 million in Q3

More Insights

- Nigeria’s economic landscape experienced a remarkable resurgence in the final quarter of 2023, with capital inflows witnessing a substantial 27% increase compared to the figures reported in the year’s third quarter.

- This upswing propelled the numbers from a previous standing of $654.65 million in Q3 2023 to an impressive $1.09 billion by the year’s end, marking a significant milestone in the nation’s economic recovery efforts.

- This remarkable growth not only signals a robust recovery but also attests to the positive impact of the economic strategies implemented by President Bola Tinubu’s administration. These strategies, aimed at bolstering Nigeria’s investment appeal, have paid dividends, underscoring the administration’s effectiveness in enhancing the nation’s economic milieu.

- Moreover, the resurgence in capital importation highlights a commendable year-on-year growth, with the Q4 2023 figures marginally outpacing the $1.06 billion recorded in the corresponding period of 2022. This represents a modest yet significant year-on-year improvement of 2.62%, further affirming the positive trajectory of Nigeria’s economic recovery and the fruitful outcome of its strategic economic policies.