The Federal government, 36 states, and all LGAs across the country shared around N2.517 trillion as FAAC exchange rate gain for the year 2023.

This is from a gross FX gain of N2.836 trillion recorded during the 12 months.

This is according to a review of the Federal Accounts Allocation Committee (FAAC) report from January to December 2023.

According to the reports, the federation received N2.836 trillion during the period and deducted N318.29 billion from the non-oil excess account for the period.

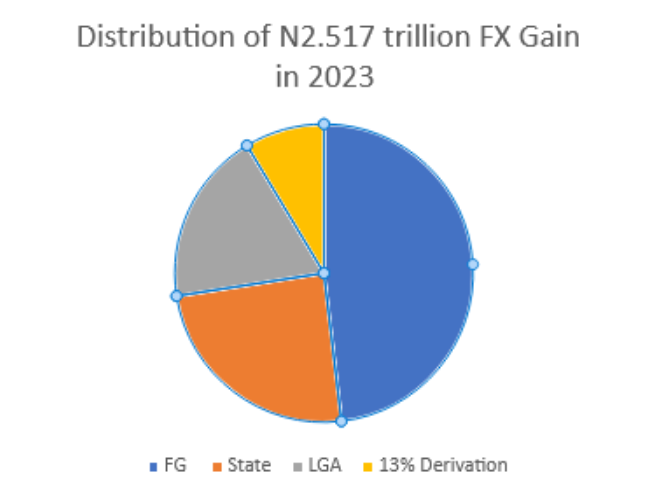

From the N2.517 trillion, the federal government received N1.211 trillion while the 36 states shared N614.49 billion and the LGAs received N473.92 billion. States producing mineral resources like oil received N217.38 billion as 13% derivation during the period.

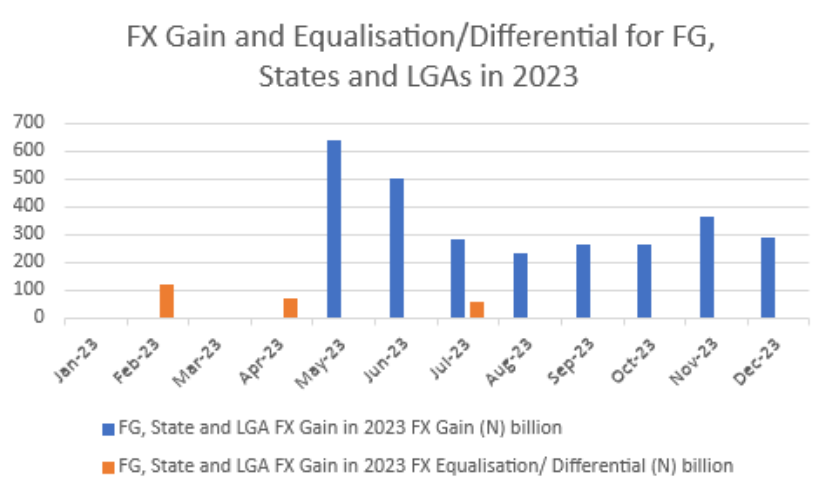

An in-depth analysis of the figures reveals that between January and April, FAAC allocation shared by the component units of the federation did not include any FX gain. However, from May to December, the federation recorded the N2.836 trillion reported above.

The highest gain from forex was recorded in May with around N639.39 billion accruing to the federation’s account.

The period of consistency in FX gain nearly coincides with the time the Central Bank of Nigeria (CBN) unified the forex market- a move analysts described as a partial float.

FX Differential/Equalisation

The FAAC report for the 12 months also contained FX differential/equalization payments for February, April, and July which totalled N246.31 billion.

For February, the FX differential/equalization stood at N120 billion, for April, it was at N70 billion. In July, the payment stood at N56.31 billion.

What you should know

- Upon assumption in office in May, President Tinubu removed the subsidy on petrol which has gulped significant government revenues in the past. The CBN under the President’s tenure announced the unification of the foreign exchange market in June.

- The FX gain allocation recorded by the government stands in contrast with the balance sheet of the private sector and businesses that have recorded record levels of FX losses. For example, Dangote Cement, Notore, and BUA Cement reported a combined foreign exchange loss of -N129.811 billion.

- In 2023, foreign-owned subsidiaries trading in the Nigeria Exchange reported losses amounting to N900 billion mainly due to the unification of the forex market and the naira’s shift to a floated rate. The companies cut across diverse industries to include MTN, Airtel, Unilever Nigeria, International Breweries, Nigerian Breweries, Cadbury Nigeria, etc.

I am sure all this figure will transform into a meaningful impact on the masses. As we speak the Federal government has not pay the January salary. This is a shame and insensitive. Tinubu administration is a pain.

Nigeria is a country, where those who having nothing to do with economic and finacial matters are given the opportunity to head them. We always put round pegs in square hole, hoping that it will give us the best of results. Nemo dat quod non habet.

Nigeria is a country, where those who having nothing to do with economic and finacial matters are given the opportunity to head them. We always put round pegs in square holes, hoping that it will give us the best of results. Nemo dat quod non habet.