Companies related to Tony Elumelu closed 2023 as one of the top performers of the year, marking a remarkable year for the billionaire investor.

Combined the companies gained a whopping N1.6 trillion in market capitalization, one of the largest gains for a group of companies owned by a billionaire on the NGX.

Transcorp Group, Transcorp Hotel, UBA, Africa Prudential, and United Capital, all listed companies, are associated with Mr. Elumelu where he has majority ownership.

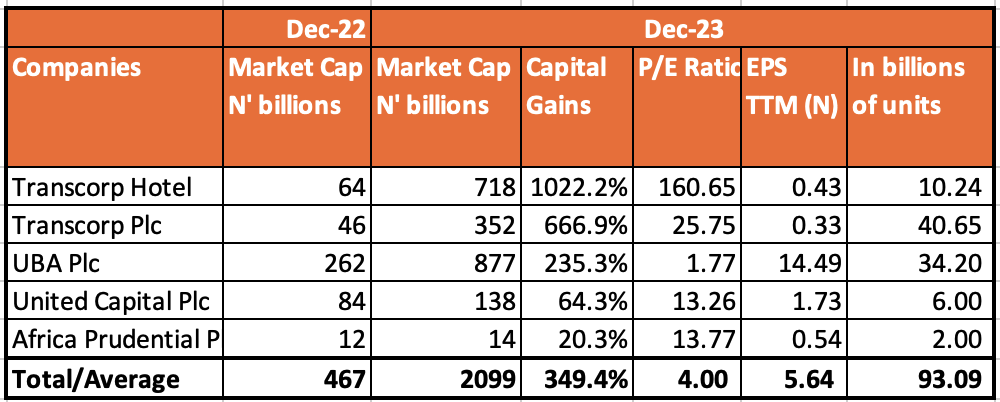

The companies ended the year with a combined market valuation of N2.1 trillion compared to N467 billion at the start of the year, an astonishing N1.6 trillion in additional value.

While Elumelu does not own all of the shares in the company he controls the entities as the largest single shareholder.

- This also compares to the NGX which experienced a remarkable bull run, boasting an impressive 45.9% YoY gain in its All Share Index (ASI).

- Despite grappling with challenges such as high inflation, a depreciating exchange rate, and persistent security concerns, Elumelu’s companies have delivered outstanding performances sure to propel the billionaire into the revered Forbes List, according to Nairametrics estimates.

- Known as a banking whiz kid in the late 90’s, Elumelu’s businesses now span hospitality, oil, and gas, financial services, banking, Agro-allied, power, and insurance.

He is also widely known for his promotion of Africapitalism and his philanthropic work through the Tony Elumelu Foundation.

How the companies have performed

In terms of market valuation, the companies as a group gained a combined 394% gain a massive return under the harsh economic conditions.

As with most equities listed in Nigeria, capital appreciation is achieved via impressive fundamentals, market sentiments, insider dealings, news of a potential merger and acquisition, or potentially positive corporate action.

The companies controlled by Elumelu appear to have been driven by all the factors listed above leading to an impressive performance.

- For example, two of the billionaire’s companies, Transcorp Hotel and Transcorp Group all made it to the top ten best-performing stocks for the year.

- Transcorp Hotel posted the best return at a whopping 1022% the best return for all Nigerian stocks combined.

- Transcorp Group gained 667% and UBA 253% return all in a year that started with cash scarcity and a heated election.

In general, the companies reported a combined profit of N524.8 billion and a market valuation of about N2.1 trillion.

This represents a combined price-to-earnings multiple of around 4x largely influenced by banking behemoth, UBA.

Source: Nairametrics Research.

Individual Performances

Tony Elumelu’s flagship, United Bank for Africa (UBA), has carved an enviable position as the top-performing financial institution, experiencing a stock surge exceeding 237.5%.

- UBA shares soared from N7.60 as of December 2022 to a current standing of N25.65 gaining 237.5%.

- In terms of fundamentals, the bank’s profit rose 264% in the first 9 months of 2023 when compared to the full-year 2022 profits.

- Return on average equity is also 40% in the first 9 months of the year according to information in its 9-month financial results for 2023.

United Capital, an investment firm, also recorded an impressive year-to-date return of 64%, closing the year at N138 billion in market valuation.

- In terms of fundamentals, the company reported an earnings per share of N1.88 in the first 9 months of the year, already beating the N1.61 reported in the full year of 2022.

- The company’s security subsidiary also came 6th when it comes to the total value of transactions carried out on the NGX in 2023 with over N157 billion in transactions.

Where Elumelu’s companies perhaps made the biggest impressions were his Transcorp Companies, with both Transcorp Group and Transcorp Hotel leading the way with 666.9% and 1022% growth respectively.

- While most analysts will also point to the impact of Femi Otedola’s acquisition of a significant position in Transcorp Group shares earlier in the year, the fundamentals of the company also came out strong.

- Otedola eventually sold his stake to Elumelu when the share price was trading publicly at around N5 per share, however, the stock closed the year at a whopping N8.66 per share after opening at just above N1 per share.

- In terms of fundamentals, Transcorp Group has also delivered solid numbers, posting an earnings per share of 36 kobo already beating the 19 kobo reported in the full year of 2022.

- Transcorp Hotel also reported similar solid numbers in the first 9 months, posting an earnings per share of 40 kobo significantly higher than the 26kobo reported in the full year of 2022.

The year, 2023 will probably go down in history as one of the best-performing years for companies related to Tony Elumelu in terms of fundamentals and capital appreciation.

One will also expect this performance to be followed with impressive dividend payments as a reward to shareholders who have kept faith by investing in the companies.

Note: This story is part of our series of analysis of the performances of companies owned by major billionaire investors in 2023.

This is great. Keep the flag flying. You will do more exploit.

Interested