The central bank has announced that all bank accounts without BVN and NIN will be placed on “Post no Debit” effective April 2024.

This was contained in a circular issued by the apex bank on Friday, 1st of December 2023, and sent to all deposit money banks in the country.

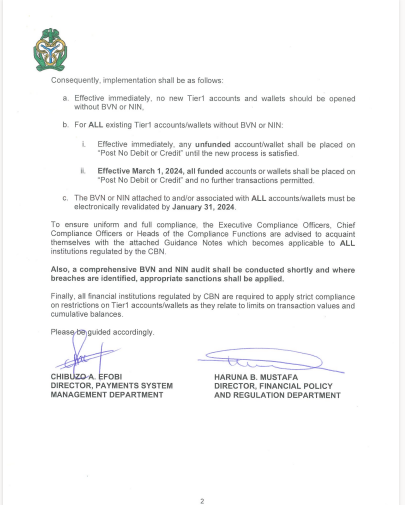

The central bank also stated that all the BVN or NIN attached to and/or associated with accounts or wallets must be electronically revalidated by January 31, 2024.

According to the CBN, this is part of their effort to promote financial stability in the country.

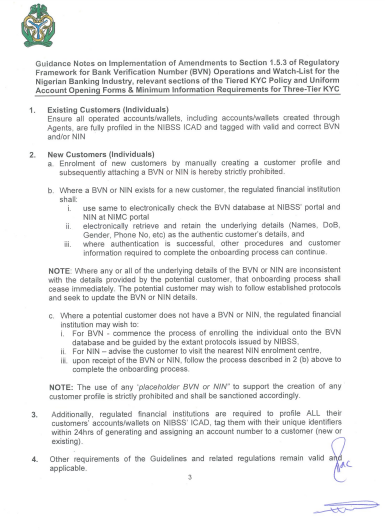

Accordingly, the financial institution therefore stated that it will enforce section 1.5.3. of the Regulatory Framework of Bank Verification Number (BVN) and Watch-List for the Nigeria Banking Industry to implement the new policies.

What this means to account holders

Consequently, the CBN claimed that the implementation will mandate that:

1. All Tier-1 bank accounts and wallets for individuals to have NIN and/or BVN

2. It remains mandatory that all Tier 2 and 3 accounts and wallets for individual accounts have NIN and BVN.

3. The process for account opening shall commence by electronically retrieving BVN and NIN information on their respective database.

4. All existing customer accounts and wallets for individuals with validated BVN shall be profiled in the NIBSS’ ICAD within 24 hours of opening the account.

What you should know

Furthermore, the CBN therefore stated that any account holder that violates the stipulated guidelines will have his account placed on “Post no Debit or Credit” until the new process is satisfied.

In addition, all BVN and NIN registrations associated with all accounts and wallets must be revalidated before January 1, 2024.

Lastly, the CBN noted that all financial institutions under the apex bank must adhere to the new guidelines as they relate to limits of transaction values and cumulative balance.

Find the attachment below:

CBN also needs to mandate ERP software systems for all banks to enhance integrity and internal governance, data archiving that includes all email received and sent for the last 15yrs

Come now – we all know these banks have two sets of books…or maybe 3….