The Central Bank Governor, Yemi Cardoso speaking at the 58th annual dinner of the Chartered Institute of Bankers of Nigeria in Lagos announced plans to direct banks to increase their capital base.

This, he said, is to ensure banks have adequate capital to service a projected US$1trn

economy.

The new administration in its policy advisory council report had set a goal to achieve a Gross Domestic Product (GDP) of US$1.0 trillion from the current FY 2022 GDP of N202.4trn (US$254.6bn based on I&E window closing rate of N794.89/US$) over the next seven years.

The CBN governor however noted that the banks have shown resilience amidst the adverse economic conditions and based on current assessment, are stable.

He also gave no indications of how much more capital will be required and over what time frame.

In dollar terms, banks have seen a significant reduction in capital given the recent steep devaluation of the Naira.

During the banking consolidation exercise of 2004, the minimum capital requirement for banks was raised from N2 billion to N25 billion.

The dollar equivalent of N25bn at that time was significantly lower than what it is today, and many believe this may be the reason behind the proposed recapitalization.

At this point, since the CBN has not given details on how much capital will be required, it is impossible to say what amount of capital will be needed by each bank and which of these banks may likely resort to a merger to meet the CBN’s new requirements.

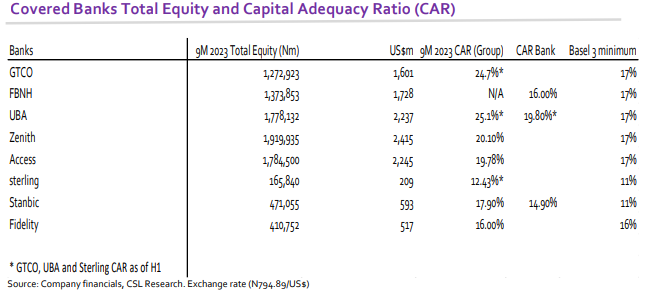

However, looking at the disparity in shareholders’ funds between the Tier 1 and Tier 2 banks, one can conclude the smaller banks may be the most affected.

Currently, the CBN requires that banks with international subsidiaries maintain a capital adequacy ratio (CAR) of 15.0% while banks without international subsidiaries maintain a CAR of 10.0%.

The minimum requirement for systemically important banks is 16.0% (although the CBN has been giving a forbearance).

Following the implementation of BASEL III, an additional tier 1 capital is required for a Capital Conservation Buffer (CCB1) of 1.0% of TRWA.

A Countercyclical Capital Buffer (CCB2), to be determined by the CBN periodically taking into consideration the prevailing macroeconomic conditions and developments within the financial sector may also be required.