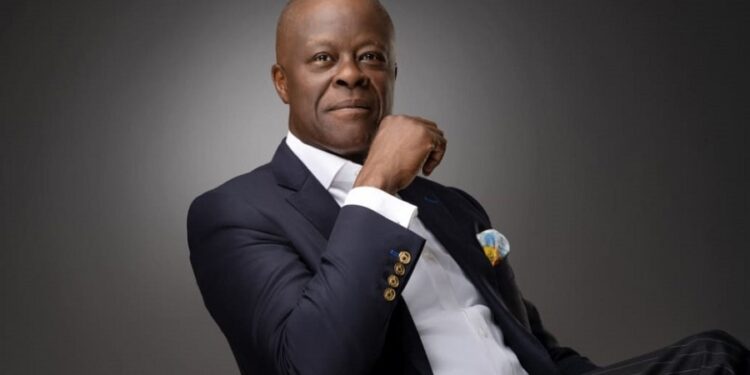

Nigeria’s Minister of Finance and Coordinating Minister for the Economy, Wale Edun, says the successful implementation of the ongoing domestic reforms will increase Nigeria’s revenue to Gross Domestic Product (GDP) ratio by 17% in the next 3 years.

This was made known by Edun during a presentation at the launch of Afrinvest’s 2023 Nigerian banking sector report on Tuesday, November 15, 2023, in Lagos.

Edun, who was represented by the Managing Director of the Ministry of Finance Incorporated, Armstrong Takang, said the revenue-to-GDP ratio will increase to 25% in 2026 from 8% in 2023.

He said the successful implementation of the reforms will also raise the tax-to-GDP ratio from 10% this year to 18% by 2026.

Benefits of the ongoing reforms

Speaking on the ongoing domestic reforms, Edun said restoring macroeconomic stability is a critical foundation for setting the country on the path to rapid and sustained inclusive economic growth.

He listed some of the benefits of the ongoing reforms to include forward sales transactions, attracting international capital flows in advance funding arrangements, executive orders to increase the domestic supply of foreign exchange and reforming FX markets.

Edun said part of the ongoing reforms have led to increased revenue through the removal of petrol subsidy, establishing a fiscal policy and tax reforms committee, eliminating smuggling and theft, as well as rigorous application of existing rules.

According to Edun, attracting international investments through foreign direct investments (FDI) and foreign portfolio investments (FPI) are part of the ongoing domestic reforms to grow Nigeria’s economy.

Government crowding out private sector in Capital market

Speaking on the sideline of the event, the Group Managing Director Afrinvest, Abiodun Keripe, said the government needs to find other sources of income to fund its activities rather than always going to the capital market to raise money.

Keripe said the government is crowding out the private sector in the capital market because investors would rather invest their money in government bonds — which he said is averaging 15-16% as of Monday — than give their money out to the private sector because the companies cannot offer competitive rates.

He pointed out that should the private sector attempt to compete with such rates, investors will still opt for government securities because it is difficult for the private sector to pass down such a level of cost of borrowing to their customers.

What you should know

- The newly appointed Chairman of the Federal Inland Revenue Service (FIRS) Zacch Adedeji, had in September 2023, stated his commitment to surpass Africa’s tax-to-GDP ratio of 16% and extend Nigeria’s ratio to 18%.

- The immediate past FIRS Chairman, Muhammed Nami, had earlier said that the service increased the Tax-to GDP ratio to 10.86% within a period of 2 years from the initial 6% as against the earlier promise to achieve that in 4 years.

I don’t subscribe to these wild predictions, sometimes aimed at justifying current pattern of expenditures, taxation etc. I have not seen anyone held liable by the public for not realizing such projections, as there would always be a plethora of excuses to present on such an occasion. Rather, I expect this government to put all their energy into boosting local production and export to meet imports by all means; eliminating wasteful spending and economic sabotage such as oil theft, etc; total eradication of obstacles to businesses such as multiple taxation and exploitation by political thugs and government agencies; fighting insecurity and pushing power companies to sit up. This is not too much for a government to achieve. They just need to stamp their authority, work diligently and conscientiously, realizing that these foreign aids, loans and investment prospects are mere stopgaps and cannot solve the economic woes of the country sustainably.