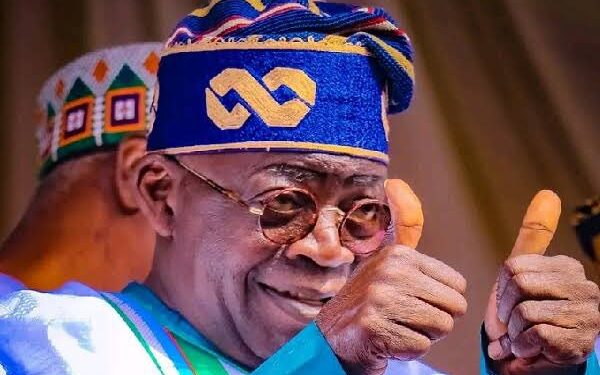

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun has stated that President Tinubu will adhere to statutory limits when seeking budget support facilities from the Central Bank of Nigeria (CBN) through the Ways and Means Advances.

Mr. Wale Edun said this during the ongoing World Bank/International Monetary Fund (IMF) Annual Meetings in Marrakech. He emphasized that Tinubu is dedicated to “keeping with the spirit and the letter” of CBN’s autonomy.

Nonetheless, Edun disclosed that the nation is in discussions with the World Bank for a 1.5 billion dollar budget support.

- In his words, “The World Bank is the number one development bank that assists developing countries in funding their projects and programs. We are delighted that this funding will be available soon, as World Bank financing is highly cost-effective.”

Climate financing

- The minister also underscored the government’s concerns regarding financing. He mentioned the global need for approximately one trillion dollars to address climate change. “There is a climate financing fund that offers relatively inexpensive options,” he stated.

Additionally, there is a commitment to aid Africa and other developing regions in their climate transition efforts, as they bear little responsibility for significant contributions to climate change.

- He further noted, “One of the ways to support them is through climate financing, and we will explore green bonds and various other climate financing avenues.”

Backstory

Stakeholders and financial experts had criticized former President Muhammadu Buhari for exacerbating the country’s debt burden by securing over N22.7 trillion in Ways and Means Advances from the apex bank.

Section 38 of the CBN Act states that funds the federal government can borrow must not exceed 5% of the previous year’s actual revenue of the government. However, the loans received by the FG under Ways and Means exceeded the previous year’s revenue.

It states, “(1) Notwithstanding the provisions of section 34 (d) of this Act, the Bank Advances may grant temporary advances to the Federal Government in respect of temporary deficiency of budget revenue at such rate of interest as the Bank may determine,”

In 2022, actual revenue generated by the Federal government was N6.49 trillion whereas ways and means advances stood at N6.2 trillion, representing 138% of the 2021 revenue.