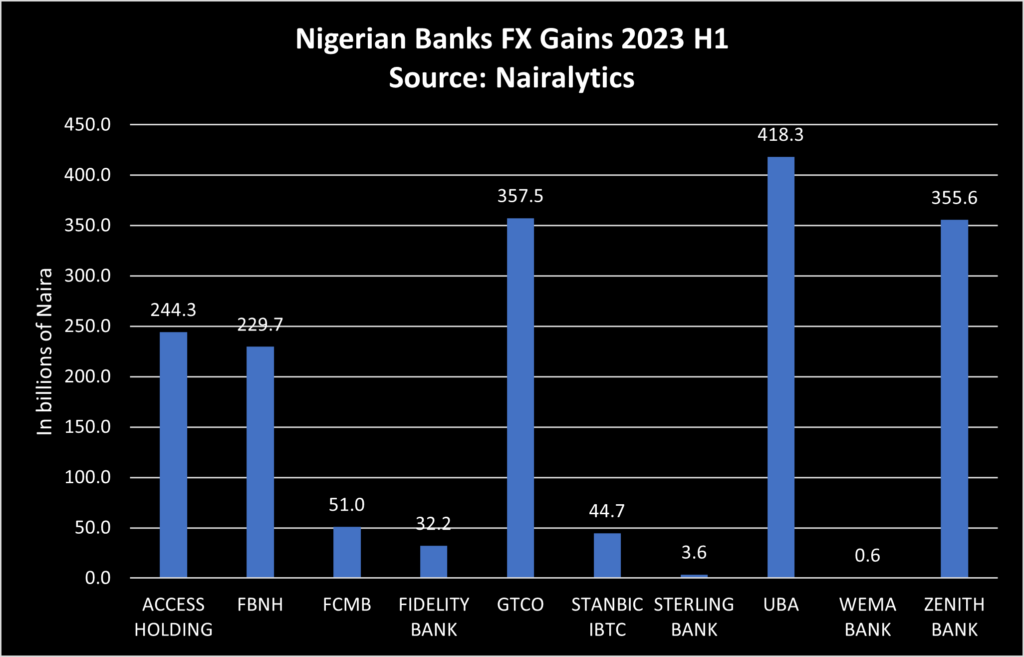

Nigerian leading commercial banks recorded significant FX revaluation gains estimated at a combined gain of about N1.7 trillion in the first half of 2023, a significant increase compared to a combined gain of N66.559 billion in H1 2022.

This is according to data collated from the 2023 half-year financial statements released by the banks.

The lenders are Access Holdings, FBNH, FCMB, Fidelity, GTCO, Stanbic IBTC, Sterling Bank, UBA, Unity Bank, Wema Bank, and Zenith Bank. Ecobank is not included due to its pan-African status. Union Bank is also yet to release its half-year results when we went to press.

Except for Unity Bank which incurred an FX revaluation loss of about N35.42 billion, the other banks reported significant FX revaluation gains.

Nairametrics has learned that the Central Bank is most likely the principal counterparty involved in the forex transactions responsible for these significant gains.

According to well-informed sources, the magnitude of the forex profits appears to have unsettled high-ranking officials at the Central Bank, prompting them to release a regulatory circular two weeks ago.

Naira Devaluation fuels surge in the FX revaluation gains

The surge in FX revaluation gains can be attributed to the devaluation of the Naira, which reached N769.25/$ in June 2023, compared to its 2022 closing rate of N461.50/$.

For instance, UBA, which recorded the highest FX revaluation gain of N418.278 billion, attributed it to the harmonization of the currency exchange rates in Nigeria.

The Group Managing Director/ Chief Executive Officer, Mr. Oliver Alawubam in a statement noted:

- “Whilst the Group recorded strong double-digit growth in revenues and profits from its operations, the result also reflects the effect of sizeable revaluation gains, arising from the harmonization of currency exchange rates in Nigeria. Our reporting currency found a new exchange level at about N756 to 1US$ as of 30 June 2023, compared to N465 at the beginning of the year”

Similarly, GTCO, which recorded the second-highest FX revaluation gains of about N357.471 billion attributed it to:

- “The effect of exchange rate movement (the Naira devalued in the I&E Window from ₦461.5/$1 in December 2022 to ₦769.25 in June 2023) on the Group’s long USD1.15bn Position and an increase in the forward rates applied to revalue its US$563mm swap positions comprising 3 tranches with outstanding maturities ranging between 4 months to 1 year.”

Access Holdings, FBNH, FCMB, Fidelity, etc., also recorded impressive growth in FX revaluation gains.

The underlying Impact

While several banks reported triple-digit expansion in their gross earnings, the remarkable surge in profit after tax (PAT) was largely fueled by substantial gains in foreign exchange (FX) revaluations.

The influence of FX revaluation gains on overall profitability was so pronounced that top-tier banks, even in the face of dwindling net interest income due to impairment charges, still managed to achieve double-digit growth in their bottom lines.

This highlights the pivotal role that FX gains have played in boosting profitability.

The ripple effect of this was evident in the collective bottom-line performance of these banks, as reflected in their post-tax profits.

The aggregate profits for these institutions skyrocketed by 197% in the first half of 2023, reaching N1.455 trillion, in stark contrast to the N489.354 billion reported for the same period in 2022.

While a decline in net interest income after impairment charges may not have an immediate negative impact on a bank’s overall profitability, it warrants attention.

This is especially crucial considering that the decline is due to loan impairments and more so that the primary driver of overall profitability stems from non-interest income, the sustainability of which remains volatile.

CBN Kicks back

The CBN’s directive to banks, to set aside FX revaluation gains rather than using them for dividends or operational expenses, is undoubtedly a precautionary and prudent regulatory measure aimed at safeguarding the financial stability of the banks

However, the timing of such directives is a point of concern. When regulatory directives arrive after financial results have been reported, they may not align with market expectations.

Investors often factor in FX revaluation gains when assessing and valuing banks, as these gains can significantly impact metrics like earnings per share (EPS).

Regulatory directives and corporate announcements can trigger responses in the market. If investors had previously expected that FX revaluation gains would contribute to dividend payouts or other purposes, any change in plans may lead to investor reactions that could impact stock prices.

For instance, Access Holdings Plc recently saw its share price close at N15.55, marking a 9.86% decline from its H1 2023 level.

This reaction may be attributed to the company’s dividend announcement of 30 kobo, which deviated from prior expectations.