- The Board and Management of NGX Group have urged the Tinubu administration to quicken the planned Initial Public Offer (IPO) of NNPC Limited to enable it to get listed on the Exchange.

- The NGX Group also expressed its commitment to working with the Federal government, as well as stakeholders towards improving the country’s credit profile and creating a favourable environment for both domestic and foreign investors.

- The Group achieved a 10.3% increase in gross earnings to N7.5 billion, despite a challenging economic environment.

The Board and Management of Nigerian Exchange Group Plc (NGX Group) have urged the Tinubu administration to quicken the planned Initial Public Offer (IPO) of the NNPC Limited to enable it to get listed on the Exchange.

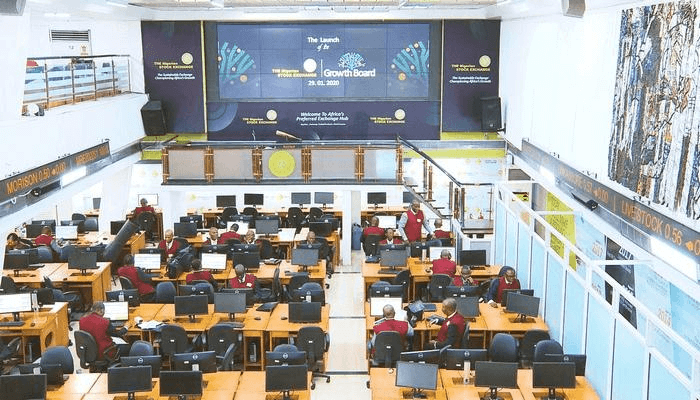

This was disclosed by the Group Chairman, NGX Group, Alhaji Umaru Kwairanga, during the Group’s 62nd Annual General Meeting (AGM) which took place in Lagos on Friday.

Addressing shareholders at the meeting, Kwairanga, lauded President Tinubu-led administration for the various reforms that have resulted in the impressive performance of the market.

“The group is hopeful that the planned Initial Public Offer (IPO) of the NNPC Limited will be fast-tracked by the Tinubu-led administration,” he said.

Improving the country’s credit profile

Kwairanga noted that the Board and Management of Nigerian Exchange Group Plc (NGX Group) are open to working with the Federal government, as well as stakeholders towards improving the country’s credit profile and creating a favourable environment for both domestic and foreign.

- “The capital market community is excited by the new government and the steps it has so far taken concerning the economy as reflected in the tremendous growth in our market indicators.

- As a group, we are committed to working with the government to stimulate further growth in the economy, and address higher capital costs, as this will go a long way to enhance Nigeria’s credit profile and create a favourable environment for both domestic and foreign investors”, he said.

Friendly market policies

Kwairanga further noted that the Federal government needs to eke out more friendly market policies that will engender growth as consistent and faithful implementation of market policies will help businesses to thrive.

Financial performance

Speaking on the performance of the group, Kwairanga noted that NGX Group demonstrated resilience in 2022, achieving a 10.3% increase in gross earnings to N7.5 billion, despite a challenging economic environment.

- “The Group’s total revenue grew primarily due to a 6.8% increase in revenue to N6.2 billion, and a 30.1% increase in other income to N1.3 billion.

- The growth in its revenue was further bolstered by a 51.2% increase in treasury investment income and a 9.0% increase in transaction fees.

- However, its total expenses rose by 35.5% to N8.8 billion, primarily due to interest costs on borrowed funds used for strategic acquisitions.

- “Achieving an efficient capital mix and broadening our access to capital remain fundamental to our mission. The Board will continue to assist the Management team in addressing long-term risks, strengthening the global NGX brand, and assessing progress toward our goal of being Africa’s preferred exchange hub”, Kwairanga said.

While welcoming the new board members, Kwairanga commended the contributions of the outgoing board members including Mr. Oscar Onyema who said the 62 AGM will be his last as GMD to the growth and development of the organization.

Commending the group’s performance, the Group Chief Executive Officer, Oscar Onyema said the performance reflects NGX Group’s commitment towards driving growth in Nigeria and Africa’s capital markets.

Value Creation in Nigeria

Onyema further added that the group is proud to have generated multiple income streams that enabled it to overcome economic headwinds.

Speaking on the group’s outlook, Onyema expressed optimism about the opportunities and challenges ahead and emphasized the group’s commitment to leveraging its strengths and expertise to drive growth and value creation in Nigeria and other financial markets in Africa.

- “NGX Group will continue supporting its operating subsidiaries, associates, and investee companies to deliver sustainable value creation for its shareholders.

- “We will look to enhance our performance by continuously striving to optimize operations, increase revenue streams and expand our market reach.

- “We are confident that these measures will enable us to build on the positive momentum we have achieved in recent years and drive growth in 2023 and beyond”, he said.

Approval of resolutions

Shareholders approved all resolutions on the agenda, which included the appointment of six Directors of Nigerian Exchange Group Plc: Mr. Nonso Okpala (Non-Executive Director), Mr. Sehinde Adenagbe (Non-Executive Director), Mr. Ademola Babarinde (Non-Executive Director), Mrs. Mosun Belo – Olusoga (Independent Non-Executive Director), Mr Mohammed Garuba (Non-Executive Director) and Mrs Fatima Wali- Abdurraham (Independent Non-Executive Director).

Nairmetrics reported recently that the appointment of the new directors is part of NGX’s efforts to reconstitute its board following its demutualization in March 2020, which transformed it from a member-owned entity to a public limited liability company owned by shareholders.

The demutualization also resulted in the creation of three operating subsidiaries: Nigerian Exchange Limited (NGX), the operating exchange; NGX Regulation Limited (NGX REGCO), the independent regulatory arm; and NGX Real Estate Limited (NGX RELCO), the real estate company.

A Giant stride.Allah yayi jagora mr chairman