The Nigerian stock market has been on a bullish run in the first half of 2023, with the NGX All-Share Index reaching its highest level in 15 years.

The month of June saw the All-Share Index rise by 9.32%, breaking a four-year streak of losses for stocks during this month. It also represents the best monthly performance for the stock market in approximately two and a half years.

Equity trading on the Nigerian Exchange Limited (NGX) concluded the first half of the year on a positive note, with the NGX All-Share Index gaining 18.9% and closing at 60,968.27 index points.

The impressive performance of the market has also been reflected in the fortunes of some of the country’s richest businessmen, who have seen their net worth increase significantly from their holdings in various listed companies.

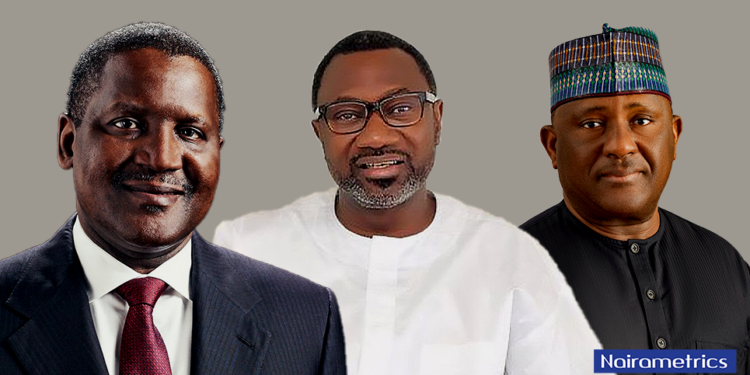

According to Nairametrics, three of Nigeria’s top billionaires – Aliko Dangote, Abdul Samad Rabiu, and Femi Otedola – collectively gained $2.28 billion from the stock market in the first six months of 2023.

This represents an increase of 18.9%, from their combined investment in their respective companies quoted on the stock market valued at $11.1 billion as of December 31, 2022.

In Naira terms (we used N765/$1 as the exchange rate), which is the official currency for stocks, the three billionaires own a combined stake of N10.6 trillion up from N8.7 trillion as of December 2022. However, for context, we used the dollar values.

The three billionaires own the highest stake in any quoted company on the exchange which is worth up to one billion dollars.

The breakdown of their gains is as follows:

Abdul Samad Rabiu, the founder and chairman of BUA Group, a conglomerate with interests in cement, sugar, oil, and gas, among others, was the biggest gainer among the trio.

- He added $1.3 billion to his net worth, which rose from $5.67 billion as of December 31, 2022, to $6.97 billion as of June 30, 2023.

- This was largely due to the appreciation of his shares in BUA Cement Plc, which increased by 23% in the first half of the year.

- The analysis includes his stake in BUA Foods and BUA Cement.

Aliko Dangote, Africa’s richest man and the founder and chairman of Dangote Group, a diversified conglomerate with interests in cement, sugar, salt, flour, oil, and gas, among others, gained $504 million from the stock market in the first half of 2023.

- His net worth increased from $4.9 billion as of December 31, 2022, to $5.4 billion as of June 30, 2023.

- This was mainly driven by the growth of his shares in Dangote Cement Plc, which rose by 10% in the first half of the year.

- The analysis includes his stake in Dangote Cement, Dangote Sugar, and NASCON.

Femi Otedola, the chairman of Geregu Power Plc and a former chairman of Forte Oil Plc (now Ardova Plc), a downstream oil and gas company, gained $488 million from the stock market in the first half of 2023.

- His net worth jumped from $491 million as of December 31, 2022, to $975 million as of June 30, 2023.

- This was largely due to the surge of his shares in Geregu Power Plc, which soared by 99% in the first half of the year.

- The analysis includes his stake in FBN Holdings and Geregu Power.

The table below shows the details of their gains in naira and dollar terms:

The three billionaires are among the most influential and philanthropic business leaders in Nigeria, who have contributed immensely to the development of various sectors of the economy and society.

would really want to know why Geregu with an installed capacity of 493mw is trading at over N290 but Transcorp Power with combined capacity of approx 2000mw is trading at N3.50. That’s notwithstanding the oil and gas subsidiary. It’s really a puzzle to me. Also, what’s moving the price of Transcorp Hotel at the expense of the parent company. The hotel is not even as profitable as the other subsidiaries or is it the Elumelu not paying good dividends effect?

I personally believe Transcorp should be trading at nothing less than N100.

They all have one thing in common, deep interest in the prosperity of all shareholders.

That is a rare trait Tony Elumelu lacks otherwise Geregu will not be trading at N290 and Transcorp with circa 5x its capacity and an oil and gas subsidiary trading at N3.50.

From the moment Otedola revealed his plans for Transcorp Hotel, we have all witnessed what happened to the share price. That’s a man who genuinely wants others to prosper, not one flaunting jet set lifestyle all over social.media not knowing nobody cares.

Those who invested in Geregu or BUA when they listed know the returns they have made both in dividend receipt and Capital appreciation. How can somebody be paying peanuts year in year out but all over the place doing paparazzi? That’s not the hallmark of real billionaires like Aliko, Samad Rabiu, Otedola, Jim Ovia and lately Wigwe.

The market and even government needs to demand more accountability from the management of Transcorp on Transcorp Power and Transcorp Energy.

That’s one company that can help deepen liquidity in the market when it starts trading llike peers. The stock alone can attract millions of dollars in FPI flow.