Article summary

- The CEO of Cowrywise said the exchange rate and inflation are the two major factors that will determine if the financial service sector will grow under the Bola Tinubu administration.

- He also observed that despite the increase in the number of fintech in Nigeria, financial service indicators for Nigeria are still very low, which shows huge growth opportunities.

- He said the opportunities can only be realized if the government put in place the right policies to achieve forex stability and drive down inflation.

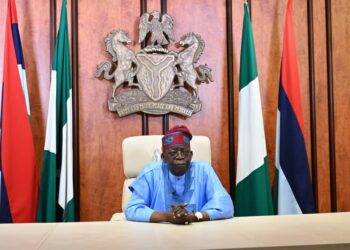

The Chief Executive Officer of Cowrywise, Mr. Razak Ahmed has identified two factors that will be critical to the growth of the financial service sector under the new administration of President Bola Tinubu.

Speaking during the Nairametrics Q2 2023 Economic Outlook Webinar, which was held on Saturday, Ahmed said the factors include foreign exchange and inflation. According to him, whatever policies the government put in place regarding these two will determine how well the financial sector will do.

Ahmed noted that despite the increase in the number of fintech and other financial service providers under the immediate past administration, every indicator in terms of financial services providers is still very low. He said this shows that there are still very huge potentials for growth, which can only be realized with the right policies.

Opportunities for financial service growth

While noting that opportunities for banks and fintech have not changed despite the growth recorded during the last administration, Ahmed said:

- “There are structure opportunities that exist and they will continue to exist by the state of our economy, by our population, or more importantly, by the level of penetrations of key financial service indicators, right from credits to payments to the number of people who have bank accounts, and the number of people who have access to basic financial services. Those indicators are still pretty low right now.

- “So, even when you look at the size of the size of players in the financial services ecosystem in Nigeria, say for example, the average size of Nigerian banks compared to say an average bank of banking in Egypt or South Africa, they’re still pretty small, not talk of when you compare them with banks in more developed countries. The indicators of financial service provisions are still very low.”

Right policies for the exchange rate, inflation

He added that to realize these existing opportunities the new administration will need to put in place the right policies that will stabilize the exchange rate and address the current rising inflation.

- “The exchange rate is the primary linkage between any economy and the rest of the world. And because the world today is globally interconnected, if your exchange rate is extremely volatile, what you’ve done technically is you’ve injected volatility into how your economy is linked to the rest of the world. You want to ensure that stability because stability is what will engender the flow in or out of the country.

- “And if you look at the financial services, I’m talking about banks, I’m talking about insurance and even the fintech, there is a strong linkage between the performance of the sector and global capital movements. So, if FX instability is what we’ll experience daily, then the growth of the financial service industry and fintech will be affected because there’s a strong linkage between the sectors and global capital mobility. So if the new administration can tackle that as an example, it will naturally enhance the realization of these opportunities as quickly as possible,” Ahmed said.

While noting that Inflation is very volatile right now in Nigeria, he said this continues to impact interest rates and every business in the country.

- “Inflation has long-term implications on what the purchasing power of an average individual will be. And it has long-term implications for what people will eventually buy and the various sectors where they are purchasing from. So, if the Tinubu administration can tackle key macro indicators like exchange rates, inflation, and interest rates, I think it will not only increase the existing opportunities within the financial service industry, but it will enhance the realization of those opportunities as quickly as possible” he said.

Watch the full video here: