Following last year’s suspension of virtual dollar card service by major fintechs, including Flutterwave’s batter app and Eversend among others, buying from international stores has become very difficult for many Nigerians.

This problem was furthered compounded recently after more Nigerian banks suspended international transactions on naira cards, as Nigeria’s forex scarcity scarcity crisis worsens.

While the initial $20 daily spending limit on naira cards was an issue for many Nigerians who had higher international transactions to make daily, the total suspension by banks left many with no other alternatives.

However, there are still a few Nigerian fintech firms offering virtual dollar card services in Nigeria. These include Chippercash and Payday.

The two platforms are two of the few fintech remaining that are still offering this important service to enable Nigerians to carry out international transactions. The only caveat is that the exchange rates on these platforms are high; and that is understandable considering the difficulty in sourcing forex, which is the main reason Nigerian banks suspended international transactions on naira cards.

Here’s a look at the two apps and what they have to offer:

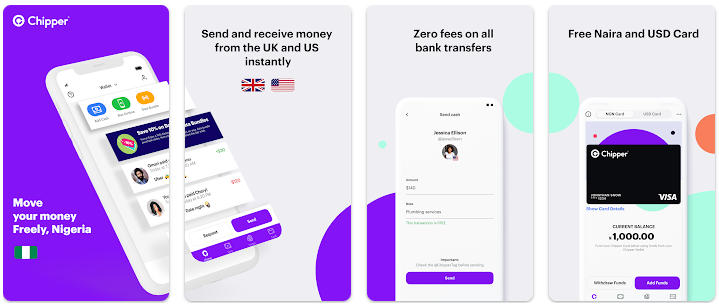

Chipper Cash

Chipper Cash, is a cross-border payments app that allows people to send and receive money in and between Nigeria, South Africa, the United States of America 🇺🇸, Ghana, Uganda, Rwanda, and the UK. You can use the Chipper Card for online purchases anywhere Visa cards are accepted globally. The app also allows users to Pay bills with no extra fees charged.

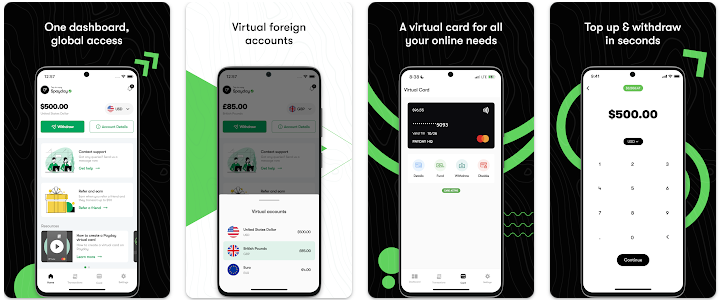

Payday

Payday prides itself as a Global Neobank for remote workers and digital professionals that allows its customers to open USD, EUR, and GBP bank accounts for free and spend with the Payday Mastercard. Payday allows Africans to receive and send payments to and from anywhere in the world. With the app, you get a wallet that can accept international transfers and a virtual card to spend anywhere.

While these two apps offer similar services, they have some unique differences in their functionalities and values. These are up for comparison.

Spending limit: With international spending at the heart of the request for virtual dollar cards, the platforms offering the service have placed limits on the amount a user can spend daily. Chipper Cash has a daily maximum limit of $1,000 on its virtual card and $4,000 monthly limit. Payday, on the other hand, allows its customers to spend a maximum of $4,000 daily and $120,000 monthly on its virtual card, thus giving users more milage than Chipper Cash.

Exchange rate: The exchange rate on the two platforms is not fixed as they are dependent on the prevailing market rates at the time of transaction.

Number of downloads: Both Chipper Cash and Payday apps are available for download on the two app stores, Google Play Store for Android users and iOS Store for iPhone users. While the iOS Store does not show the number of downloads on apps, Google Play Store shows that the Payday app has been downloaded 100,000 times, whereas, Chipper Cash has 5 million plus downloads.

Ratings on both apps: Based on users’ experience, Chipper Cash is 4.2 out of 5 on both the iOS Store and Google Play Store. Payday, on the other hand, is rated 3.5 on iOS Store and 3.6 on Google Play Store.

Number of Reviews: In terms of the number of reviews, is far ahead with a total of 100,000 reviews on the Google Play Store. Payday on the hand has been reviewed by 1,000 users on the Google platform.

App sizes: Memory space is one major challenge for mobile users, especially the Random Access Memory (RAM) which houses all apps on a phone. A heavy-sized app occupies a lot of space on the users’ phones and may not function optimally if the user does not have enough memory, which is why the lighter an app comes, the better.

Comparing the two apps on the basis of size, Payday is better in this regard as it is the lighter of the two. On Google Play Store, the app is 23MB, while its size on the iOS store is 86.2 MB. The Chipper Cash app comes heavier and will occupy more space on the users’ phones with its 43MB size on the Play Store and 115.1MB on iOS Store.

Users’ experiences: While the two apps enjoy positive reviews from users in terms of the service, one constant complaint by most users of Chipper Cash Payday is that their exchange rates are too high. Here’s what they are saying about their experience with the apps:

Chipper Cash users: Bisola Onaolapo believes the Chipper Cash app is great despite its high exchange rate. She said:

- “I had an issue logging in and got a prompt response from customer support. The app is really great and has a seamless customer experience. The rate is really high though and when you convert money to USD, they use the black market rate but when you want to convert back to naira, they use the bank rate which is crazy. Other than that, it is a great app!”

According to Efuntade Gbayi, Chipper Cash does what it promises to do by enabling international purchases with a virtual card, but the exchange rate is high.

- “Accounts are really easy to make and now I have a virtual card I can use to make online purchases. Transferring between currencies is flawless. My only irk is that the exchange rate is pretty high but honestly, it’s understandable. There are also some messages that pop up from failed transactions providing solutions to the problems. Good app,” he said.

Like other users, Chase Mood said he has had an amazing experience on the Chipper Cash app.

- “My experience so far has been an amazing one even though the exchange rate is high, it’s very much understandable. And they do give nice transaction bonuses which make up for the high rate,” he said.

Payday users: Daniel Olatunde has used them and his main concern was the exchange rate on the platform, which he considers too high. He said:

- “If only you’re comfortable with the exchange rate then this might be the best app you’ll find on the play store because it does what it says apart from the affordability. Buying foreign currencies is no way close to affordable at all, exchange rates are way too high.”

For Wilson Uloko, withdrawing from the Payday app was a challenge, even though every other feature of the app works well.

- “I have been using the app for almost six months now and I have been enjoying it. It works well with online stores and receiving payments is very fast. I’ve only had problems with withdrawal once and had to contact support before it was rectified. It is a great app nonetheless,” he said.

Sodipe Ifetayo said the app saved him from the headache of international payment, even though he is also not comfortable with the exchange rate. He said:

- “This app has saved me a great deal. I tried so many apps for international payment and none came close to Payday. It felt as though I have superpowers when I came across Payday because it just works. Though the exchange rates are on the high side it gets things done.”

Bottomline: Both Chipper Cash and Payday apps are bailing out many Nigerians that would have been stranded as a result of the suspension of international transactions on naira cards by Nigerian banks. While their services seem the same and the customer experience is similar, Payday is better technically based on the size of its app which is lighter for users. Again, Payday is offering a higher daily and monthly spending limit on the virtual dollar card than Chipper Cash.

Thanks