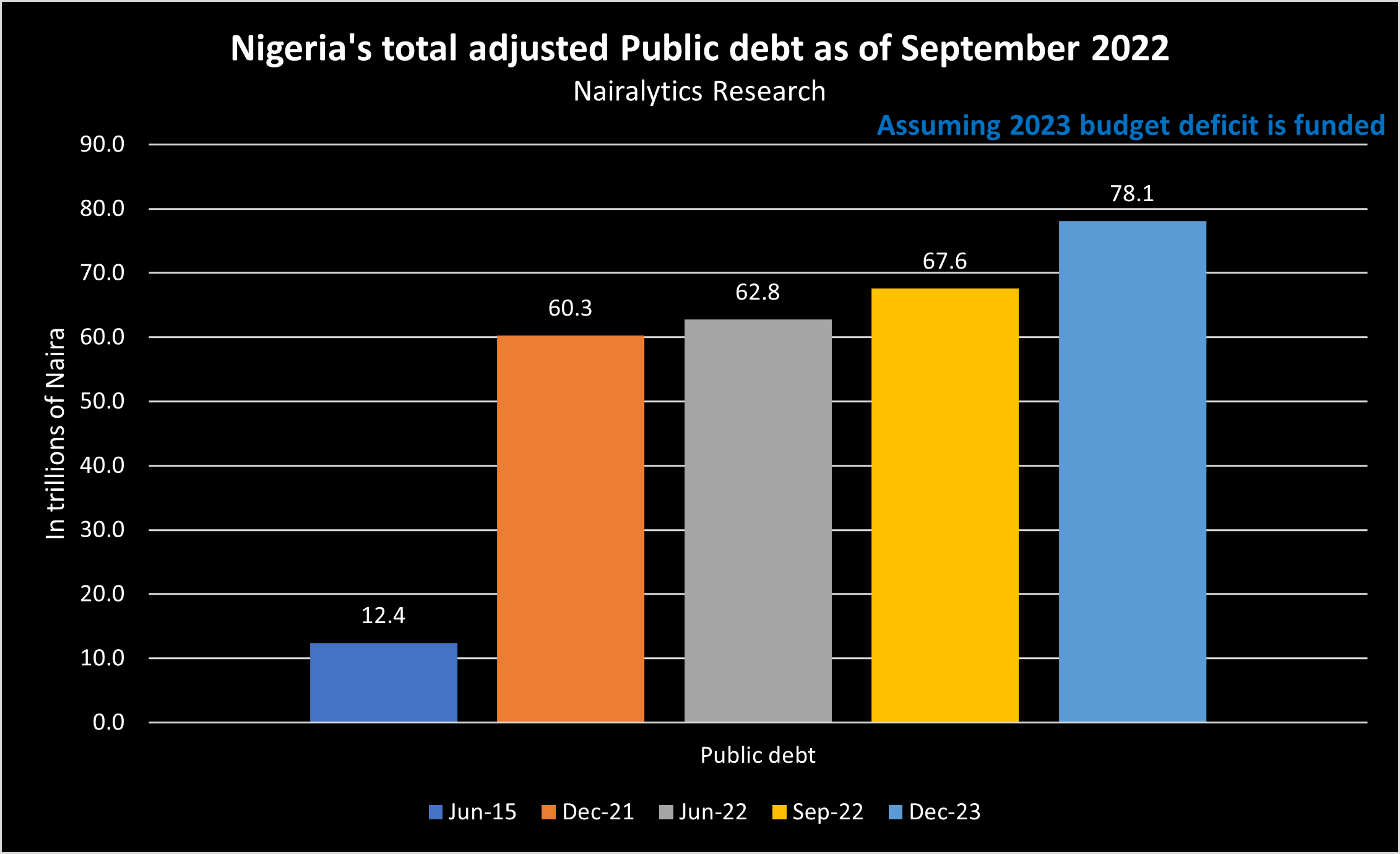

Nigeria’s total public debt stock rose to N67.58 trillion as of September 2022 according to data compiled from the website of the Debt Management Office and the Central Bank of Nigeria.

Nairametrics calculates the total adjusted public debt stock in the country by adding the debt management-issued debts and the credit extended to the federal government by the central bank via Ways and Means provisions.

The total adjusted public debt stock of N67.5 trillion represents a debt-to-GDP ratio of 35.2%. Nigeria’s total nominal GDP from the 4th quarter of 2021 through to the 3rd quarter of 2022 added up to N191.8 trillion.

Breakdown of Nigeria’s Public debt

September 30th, 2022, public debt data published in December by the debt management office reveal Nigeria’s total issued third-party debt including debts owed by states and the FCT summed up to about N44.7 trillion.

- However, the total Ways and Means of N22.8 trillion for the same period takes the total adjusted public debt to about N67.5 trillion.

- This compares to a total of N42.8 trillion and N19.9 trillion for issued third debts and Ways and Means respectively. The total adjusted public debt of N67.5 trillion is a whopping N4.8 trillion or 7.7% higher than the N62.7 trillion debt stock as of June 2022.

Domestic Debt: The federal and state government locally issued debts include FGN securities, Treasury Bills, Green Bonds, and Sukuk.

- According to the September data, total domestic debt stock rose to N26.9 trillion from N26.2 trillion. States portion of domestic debt stock is estimated at N5.2 trillion.

- FGN Bonds continue to dominate as the largest portion of the Government’s issued debt pull summing to N15.7 trillion. Issued treasury bills for the period amounted to N4.5 trillion.

- Ways and Means which has in recent times added to Nigeria’s total domestic debt stock rose from N19.9 trillion to N22.8 trillion an increase of N2.9 trillion in 3 months.

Foreign debts: The September data reveals total foreign debt portfolio for the country was $39.6 billion or N17.8 trillion (assuming an official exchange rate of N450/$1) compared to $40 billion as of June 2022.

- The drop in foreign debts is a result of a drop in the World Bank loans outstanding which was stated as $12.5 billion in September compared to $13 billion as of June 2022.

- Nairametrics cannot immediately confirm if the reduction was due to the repayment of some parts of the loans by the government.

- Eurobond remains the dominant portion of Nigeria’s foreign loans with about $15.6 billion unchanged from the comparable period of June 2022.

Total Public debt in dollars: Nairametrics estimates the total public debt in dollar terms is now $150.1 billion assuming the exchange rate of N450/$1 is used.

Debt to GDP: Nigerian government has often cited the country’s low debt-to-GDP ratio (when compared to more developed countries) as a reason not to be alarmed by its ballooning debt.

- However, the recent addition of the Ways and Means paints a different debt-to-GDP ratio equivalent which is now 35.2% compared to 22.9% when taken out.

- At the end of December 2021, Nigeria’s total adjusted public debt was N60.2 trillion representing a debt to GDP figure of 34.7%.

- The analysis suggests Nigeria’s rising debt profile appears to be largely driven by the central bank’s Ways and Means loans which as risen from N789.6 billion when the current administration assumed power in May 2015 to over N22 trillion as of September 2022.

- Nigeria’s adjusted public debt as of June 2015 was just N12.4 trillion (inclusive of Ways and Means), meaning we have added N55 trillion in debt in less than 8 years.

- Thus as of June 2015, Nigeria’s debt-to-GDP ratio was about 13.1% compared to 34.7% in September 2022.

Public debt set to rise with 2023 Budget: Nairametrics estimates Nigeria’s public debt could rise to as high as an unprecedented N78.1 trillion if the FG’s planned deficit borrowing in the 2023 budget is fully actualized.

- The federal government plans to borrow N7.04 trillion from Domestic sources and another N1.76 trillion from Foreign sources while the balance of N1.77 billion is targeted at Multi-lateral/bi-lateral loan drawdowns.

- The Director General of the Debt Management Office, Patience Oniha weighed in on the notion that the current government could hand over debts in excess of N70 trillion to the next government when it hands over this year.

- According to Oniha, “the estimated figure (N77 trillion) can be expected only if the Ways and Means Advances from @cenbank are securitized. Nevertheless, it should be noted that the securitization will enhance debt transparency as the @DMONigeria will then be able to include the debt in the total public debt stock.”

Correction: An earlier version of this article titled the debt to GDP ratio as 34.7%. It has now been corrected and updated.