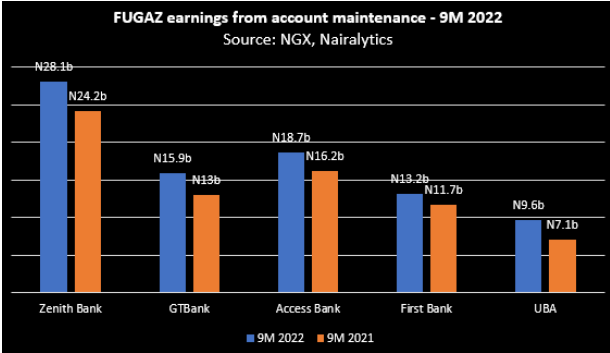

The five top-tier Nigerian banks usually referred to as FUGAZ raked in a total of N85.5 billion from account maintenance charges between January and September 2022.

This is according to a compilation by Nairalytics, the research arm of Nairametrics, extracted from the financial statements of the FUGAZ banks.

The banks — Access, GTB, First Bank, UBA, and Zenith — increased their account maintenance income in the period under review by 18.3% compared to N72.29 billion recorded in the same period last year.

A further breakdown shows that the five banks generated N28.57 billion in Q3 2022 alone, a 17.2% increase compared to N24.38 billion made in the corresponding period of 2021.

What banks charge on: According to the Central Bank of Nigeria (CBN), the account maintenance fee is imposed only on current accounts following customer-induced debit transactions to third parties. Debit transfers/lodgments to the customer’s account in another bank also attract the same fee.

- Nigerian banks are allowed to charge their customers a “negotiable” N1 per mille. In other words, the banks can charge N1 per N1,000 debit transactions on the current account.

- These charges come in the form of COT (i.e., Commission on Turnover) which is a charge levied on customer withdrawals by their banks.

- Meanwhile, the banks made a sum of N649.2 billion as post-tax profit in the nine months, outperforming its previous year’s N557.6 billion profit by 16.4%.

- Below is a list of account maintenance revenue of the banks.

Zenith Bank – N28.15 billion

Zenith Bank topped the list with a total income of N28.15 billion from account maintenance charges between January and September 2022, a 16.4% increase from the N24.19 billion recorded in the corresponding period of last year.

- In the third quarter of the year, the bank made N8.38 billion from account maintenance, in contrast to the N8.28 billion generated in the same period of 2021.

- Zenith Bank also posted a profit after tax of N111.41 billion in nine-month 2022, representing a 5% increase compared to N106.12 billion printed in the corresponding period of 2021.

Access Bank – N18.71 billion

Access Bank, the largest commercial bank in Nigeria by total assets earned a sum of N18.71 billion in 9-month 2022, an increase of 15.3% compared to N16.22 billion recorded in the corresponding period of 2021.

- The bank accounted for 22% of the total earnings of the five banks. Meanwhile, Access Bank recorded a 24.2% increase in its account maintenance earnings in Q3 2022.

- In terms of profit, the banking giant posted a net profit of 137.15 billion in the nine-month, boosting profit by 12.3% year-on-year from N122.15 billion recorded in 9-month 2021.

GT Bank – N15.88 billion

GT Bank made a sum of N15.88 billion from account maintenance between January and September 2022, which is 21.9% higher than the N13.03 billion recorded in the corresponding period of 2021.

- Meanwhile, in Q3 2022 its revenue from account maintenance charges increased by 23.4% year-on-year to N6.45 billion.

- GT Holdings posted a net profit of N130.35 billion in the review period, a marginal increase of 0.7% compared to N129.4 billion posted in the corresponding period of 2021.

First Bank – N13.15 billion

First Bank grew its account maintenance income by 12% year-on-year in nine-month 2022 to N13.15 billion compared to N11.74 billion recorded in the corresponding period of 2021.

- In the third quarter of the year, the financial institution made a sum of N4.04 billion from accountant maintenance, which is 5.9% higher than the N3.82 billion recorded in the corresponding period of 2021.

- Its profit after tax in the same vein surged by a whopping 123.5% year-on-year to N91.29 billion in 9-month 2022 from N40.85 billion recorded in the same period of the previous year.

UBA – N9.64 billion

United Bank for Africa posted N9.64 billion as revenue from account maintenance between January and September 2022, a 35.5% increase from the N7.12 billion recorded in the same period last year.

- Interestingly, UBA saw its account maintenance income surge by 80.5% in Q3 2022 to N3.05 billion from N1.69 billion recorded in Q3 2021.

- Net profit grew by 10.9% between January and September 2022 to N116.04 billion from the previous year’s N104.6 billion.