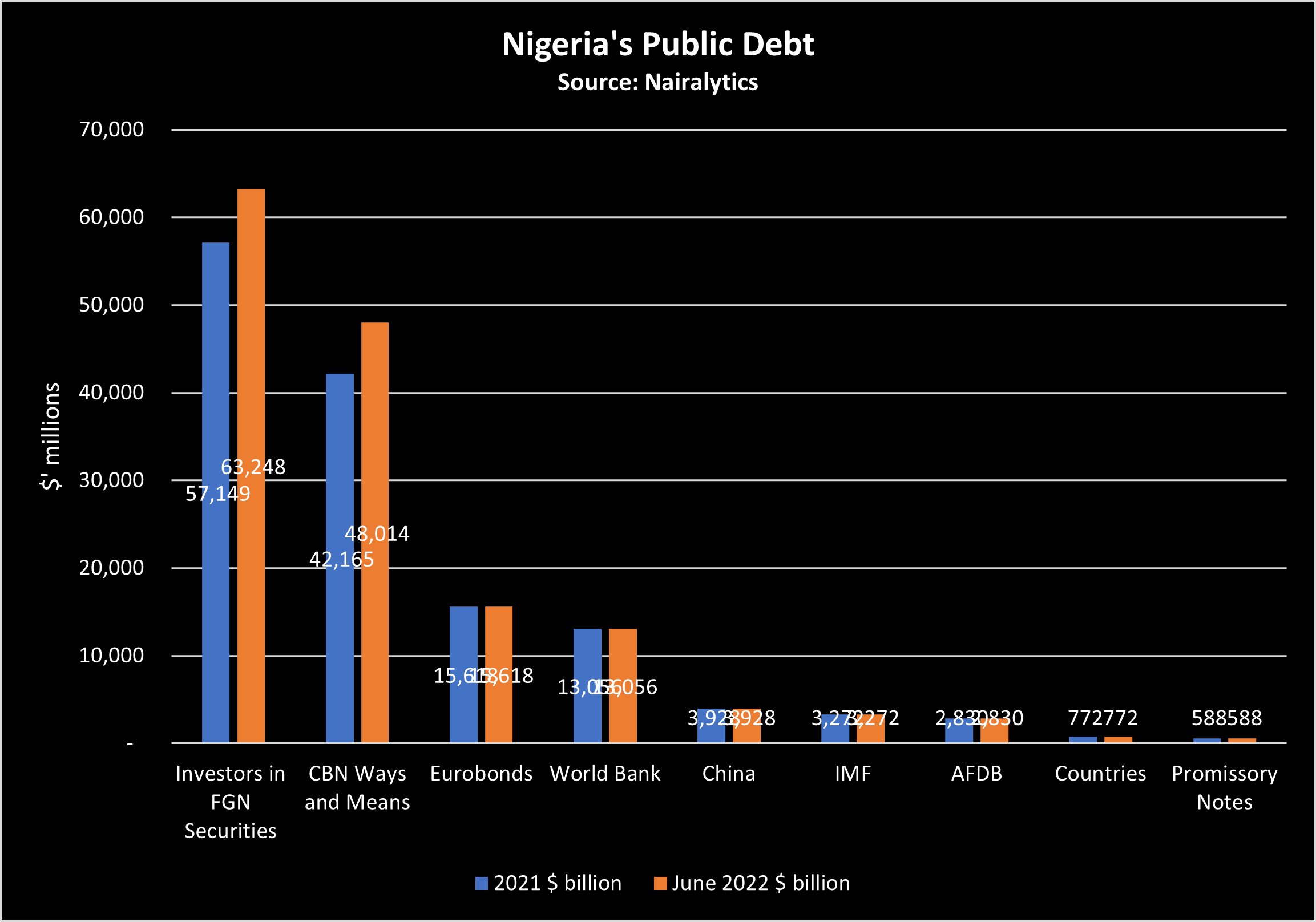

As of December 2022, Nigeria’s public debt runs in the billions of dollars and the majority of creditors are Nigerians.

According to data from the Debt Management Office, the total public debt in Nigeria is an estimated $153.9 billion as of June 2022, relative to an estimated $103.3 billion reported by the Debt Management Office (DMO).

The difference is the CBN’s whopping N20 trillion ($48 billion) in Ways and Means lending to the government, which rose further to N22 trillion as of September.

The DMO is yet to classify the amount as part of Nigeria’s public debt, even though there are plans to convert it into a 100-year bond.

Our estimates also assume the official exchange rate of N414/$1 used by the Debt Management Office.

The federal and state governments owe a combination of domestic and foreign debts. Domestic debt is made up of FGN securities, treasury bills, and more recently, CBN’s Ways and Means. On the foreign scene, Nigeria owes countries (bilateral debts) and multilateral institutions like the world bank, IMF, and the African Development bank.

Domestic Debt: The federal and state government borrows money by issuing bonds to the domestic market in the local currency, the naira.

- The bonds are also listed on the Nigerian Exchange or the FMDQ where traders can buy and sell the bond.

- According to the data from the DMO, Nigeria’s total domestic debt is about N26.3 trillion out of which the states owe N5.2 trillion.

- Most of the debts are denominated as FGN Bonds, State Bonds, Sukuks, Treasury Bills, and Green bonds.

- More recently, Nigeria’s central bank reported an additional N20 trillion as of June 2022, a debt that is heavily relied upon by the government.

Foreign Debt: The latest data as of June 2022, confirms Nigeria’s total external debt balance is $44.6 billion up from $43.1 billion as of December 2021.

- Nigeria’s foreign debt is owned by several countries and institutions and from our records, Eurobonds make up the largest chunk with about $15.6 billion about 36% of the external debt borrowing of the government.

- Multilateral institutions such as the World Bank and IMF come next with about $13 billion and $3.2 billion respectively.

- The AFDB, which Nigeria partly owns as one of its largest shareholders, lent Nigeria about $2.8 billion in loans.

- Nigeria is also indebted to about five countries owing them a combined $4.73 billion as of June 2022. China is owed the highest with about $3.95 billion or about 83.5% of the total owed to countries.

- This makes China, Nigeria’s single lender country in the world.

Nigeria’s Largest Creditors: Having parsed through the entire data, what is clear is that Nigeria’s largest creditors are Nigerians.

- Government securities total about N26 trillion or $50.5 billion (assuming the official exchange rate), and this is owed to pension funds, banks, mutual funds, companies, collection investment schemes, etc. They are all represented by contributions made by Nigerians.

- Drawing from their net asset value data for June, Pension funds alone have over N9 trillion in FGN securities, treasury bills, Sukuk, and agency bonds.

- After Nigerians, the next largest creditor on the boos is the central bank with over N20 trillion in Ways and Means loans.

What this means: Nigeria’s total public debt of about N62.8 trillion is about 33% of the country’s gross domestic product, which according to international standards is well within limits.

- More importantly, Nigeria is largely exposed to debts owed to Nigerians with about 73% of the debts in local currency.

- This effectively means the Nigerian government has a better grasp and control over how it manages its domestic debts. It can, for example, in an unlikely situation where it is unable to pay down local debts as and when due, print more naira to meet this obligation.

- Only 27% of the total value of debts are in foreign currency totalling $40 billion. Most of the debts are also medium to long-term Eurobonds and owed to diverse creditors.

- While this is a manageable figure, it is more than Nigeria’s external reserves and is becoming expensive to service.

Nigeria is not in any favourable position to take on more foreign debts at the current rates considering the state of government revenues. However, to meet its large budget deficits, it is likely to keep borrowing from the central bank and issuing more FGN securities which continue to expose Nigeria to its governments.