Industry Update: On 18 October 2022, the National Pension Commission (PenCom) released its latest monthly report which contained unaudited information on how pension fund managers (i.e., PFAs) invested pension funds from the beginning of the year till 31 August 2022.

Nairametrics in partnership with Money Counsellors presents an analysis of the performance of Pension Fund Administrators for the first 9 months of 2022.

The report also included information on the total number of RSA registrations to date as well as the total assets under management for the fund group. Below is a summary analysis of the information released.

RSA Registrations

New RSA registrations YTD stood at 228,734, bringing the total number of Retirement Savings Accounts (RSA) since the inception of the scheme to 9,757,861.

With the data we have, it is currently difficult to say which period records new registrations consistently. Nevertheless, as seen in the tables and charts below, since 2011 RSA registrations have averaged 453,000 new registrations per annum. The highest growth came in 2018, at 580,698. It has been tailing off since.

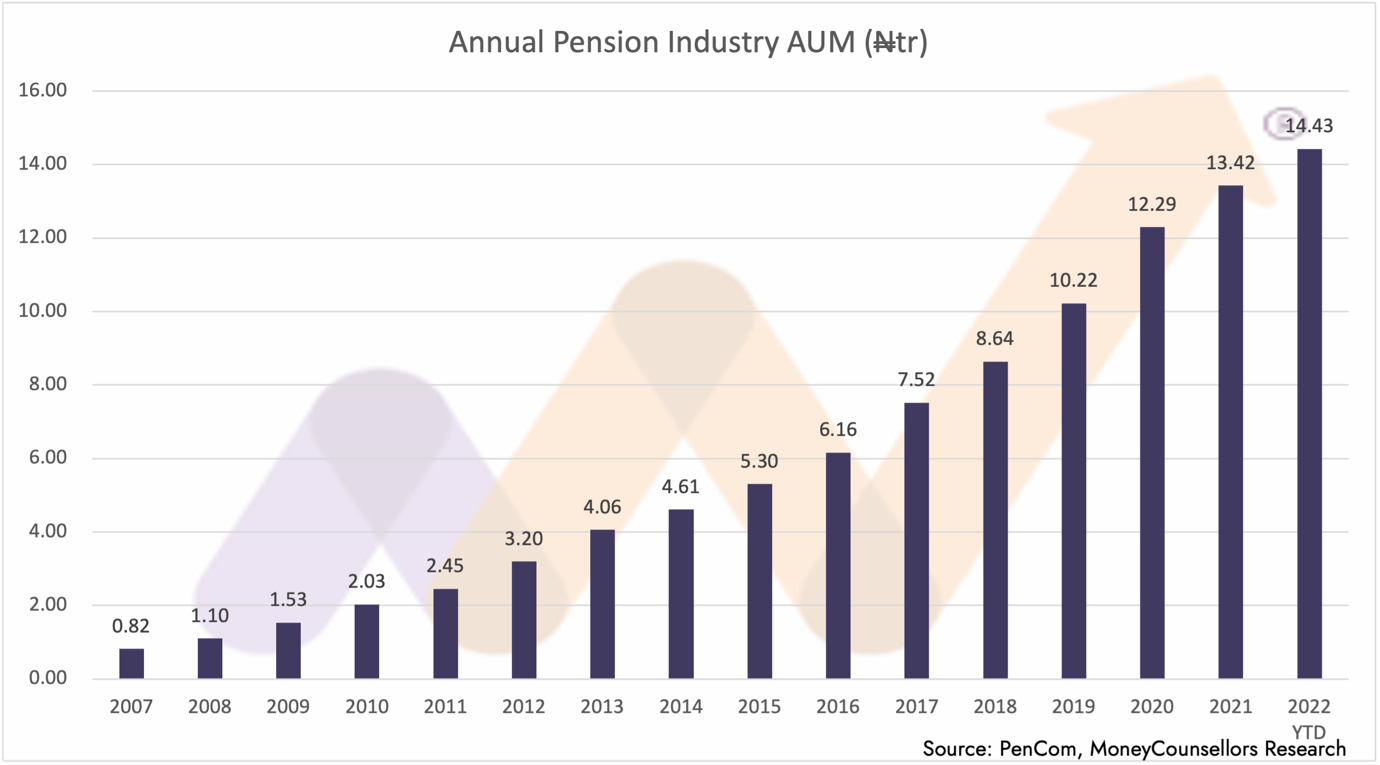

Pension Fund Assets Under Management (AUM) as of 31 August 2022

Assets under management for the whole industry grew slightly by 0.46% between July and August from N14.36 trillion to N14.43 trillion. Year to date, AUM has grown by 7.46% from N13.42 trillion to N14.43 trillion, equivalent to $34.7 bn.

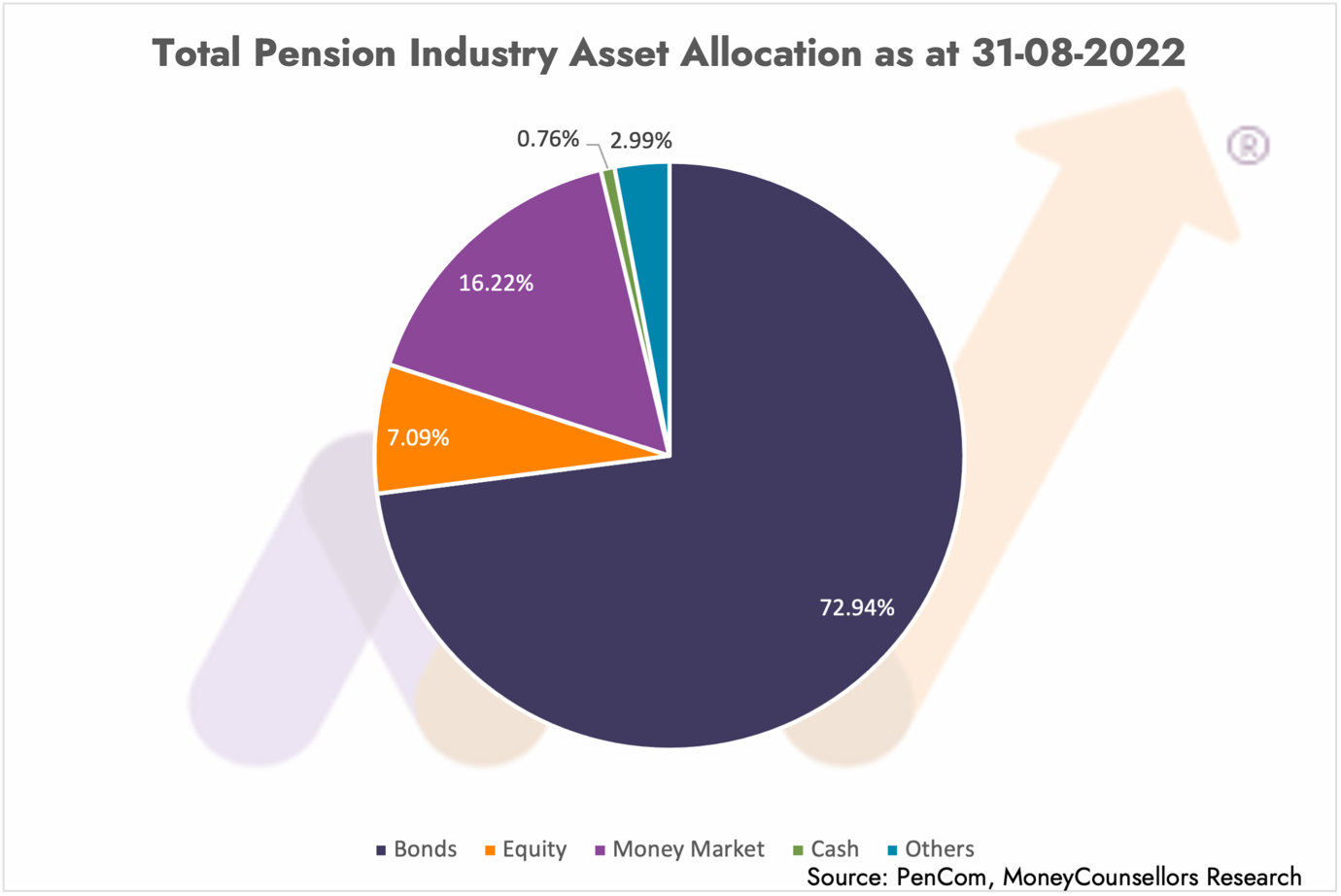

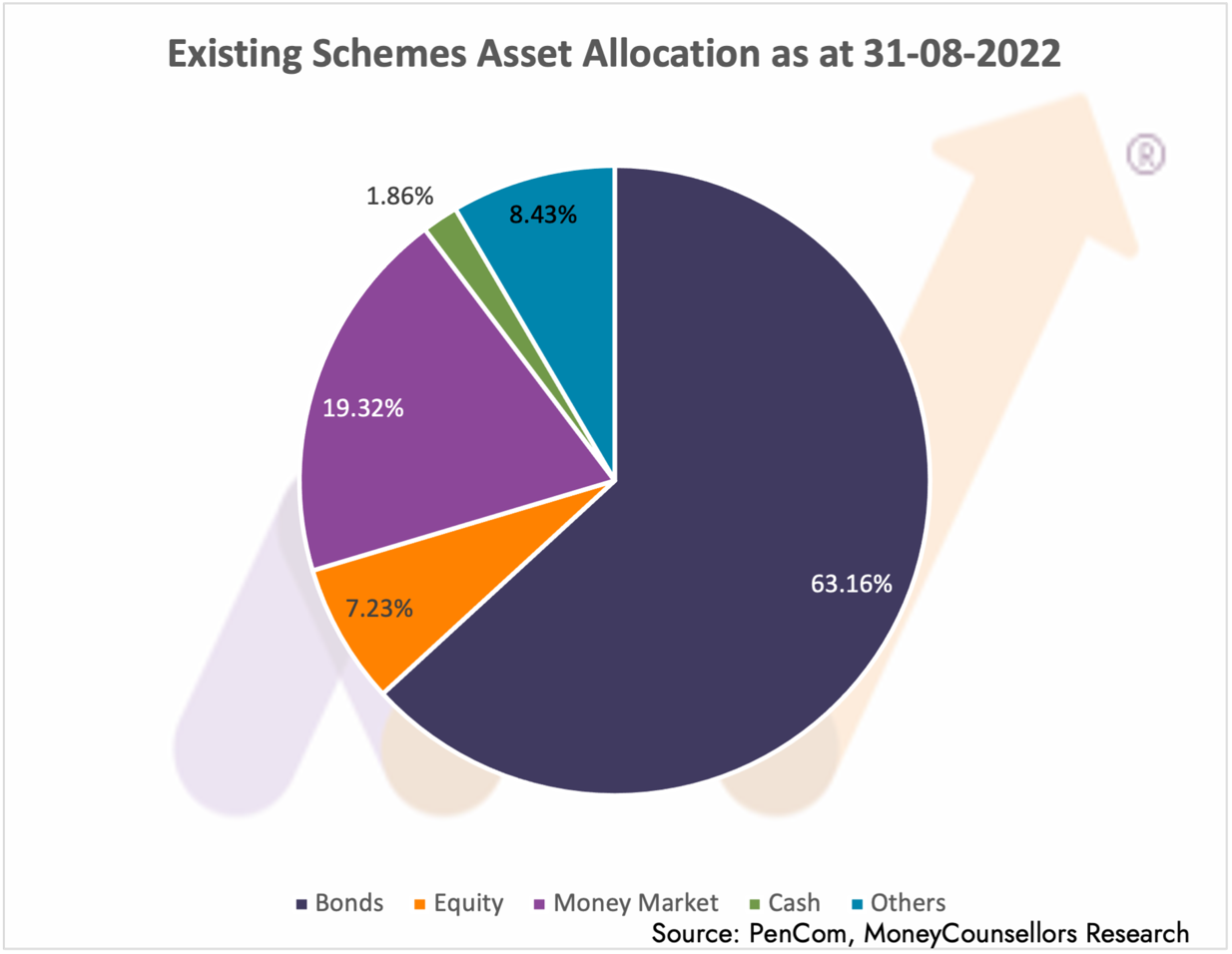

Asset Allocation as of 31 August 2022

Pension Funds Industry Portfolio for the period ended 31 August 2022

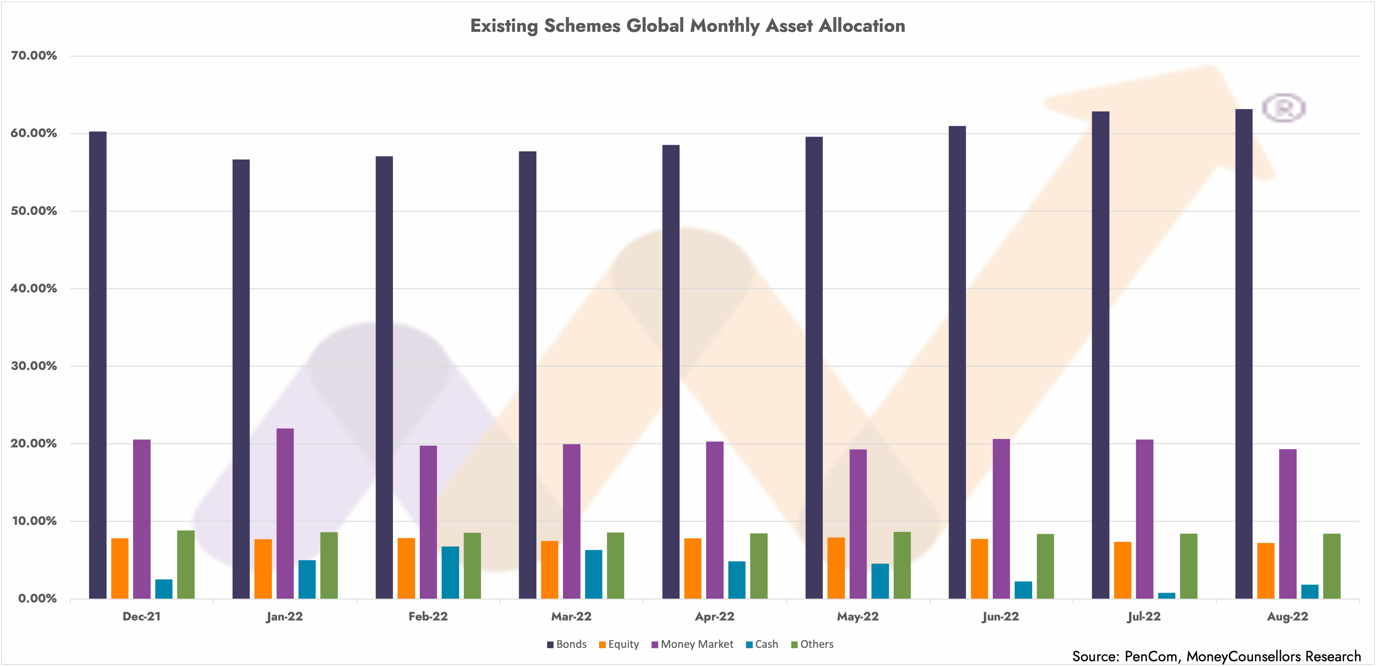

With assets under management for the industry as a whole at N14.43 trillion as of 31 August, 72.94% (or N10.25 trillion) was invested in various fixed-income securities, only slightly up from December 2021 (71.74%).

Whilst AUM continues to grow, it is pertinent to note, as analyzed pictorially below, that the Pension Fund Administrators (PFA’s) who manage the pension funds under the regulatory supervision of the National Pension Commission have consistently skewed asset allocation towards fixed-income investing.

And with interest rates rising, which in turn seems to be pushing fixed income yields higher (though there still seems to be some disconnect between the MPR rate, currently at 15.50%, and treasury bill yields, the last stop rate for the 364-Day T-bill was 13.00%), these rises are yet to be reflected in the unit prices of RSA funds as according to the report, FGN and corporate bonds which make up 68.89% of the total assets are held till maturity (HTM) – as yields rise, prices of bonds fall and vice versa. But all this tends to be revealed in the year-end audited accounts when accounts are prepared in accordance with International Financial Reporting Standards (IFRS) in addition to PenCom guidelines.

Please note: to make the information easy to read, we have summarised assets into 5 classes – Bonds (all fixed income instruments above 1 year), Equities, Money Market (all fixed income instruments of less than 1 year, excluding cash or cash equivalents), Cash and Others (which includes mutual funds, REITS, Real Estate Properties, Private Equity, and Infrastructure Funds). For the full PenCom report please click here.

Further breakdown of the investment of pension fund assets per class of funds are as follows:

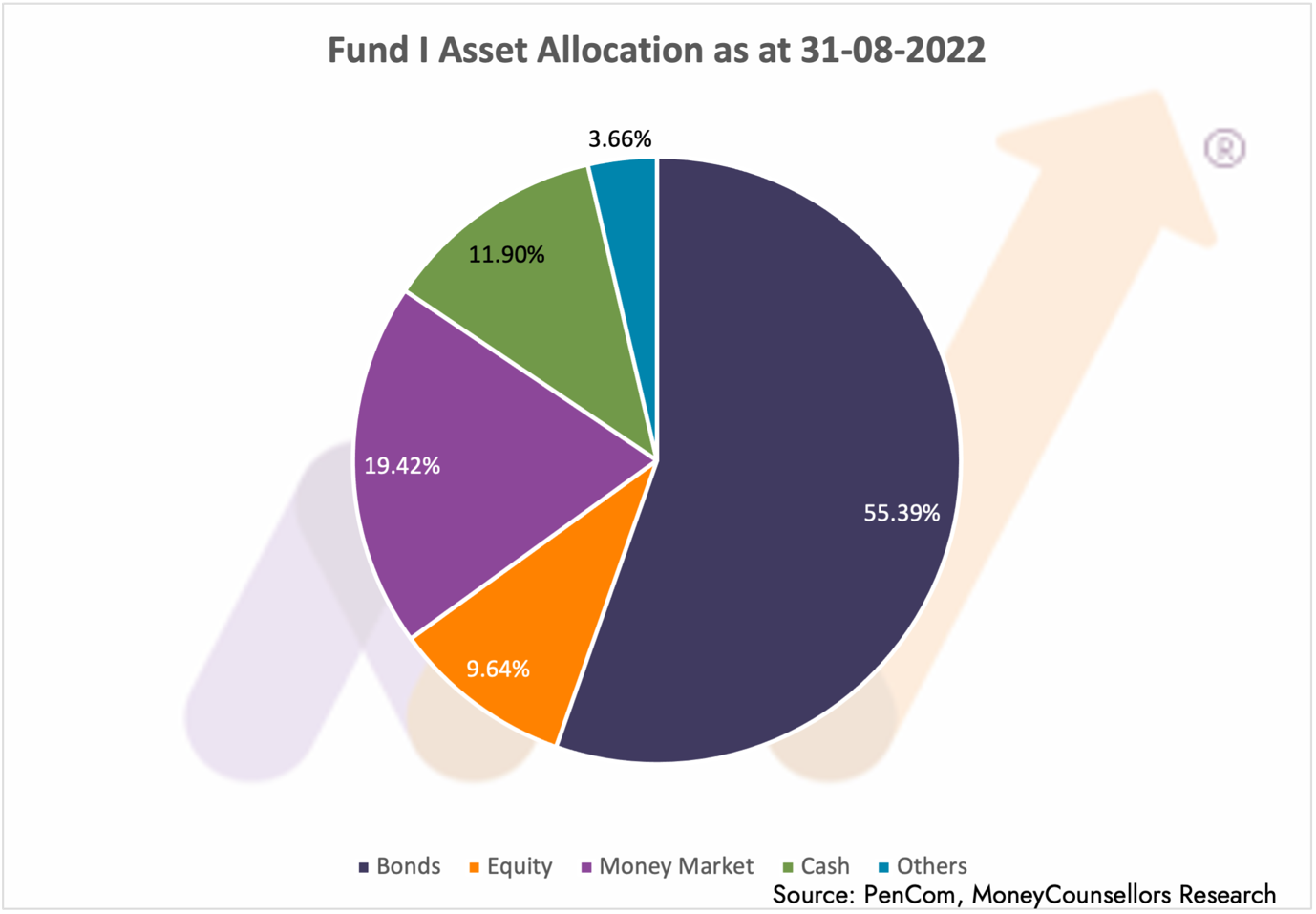

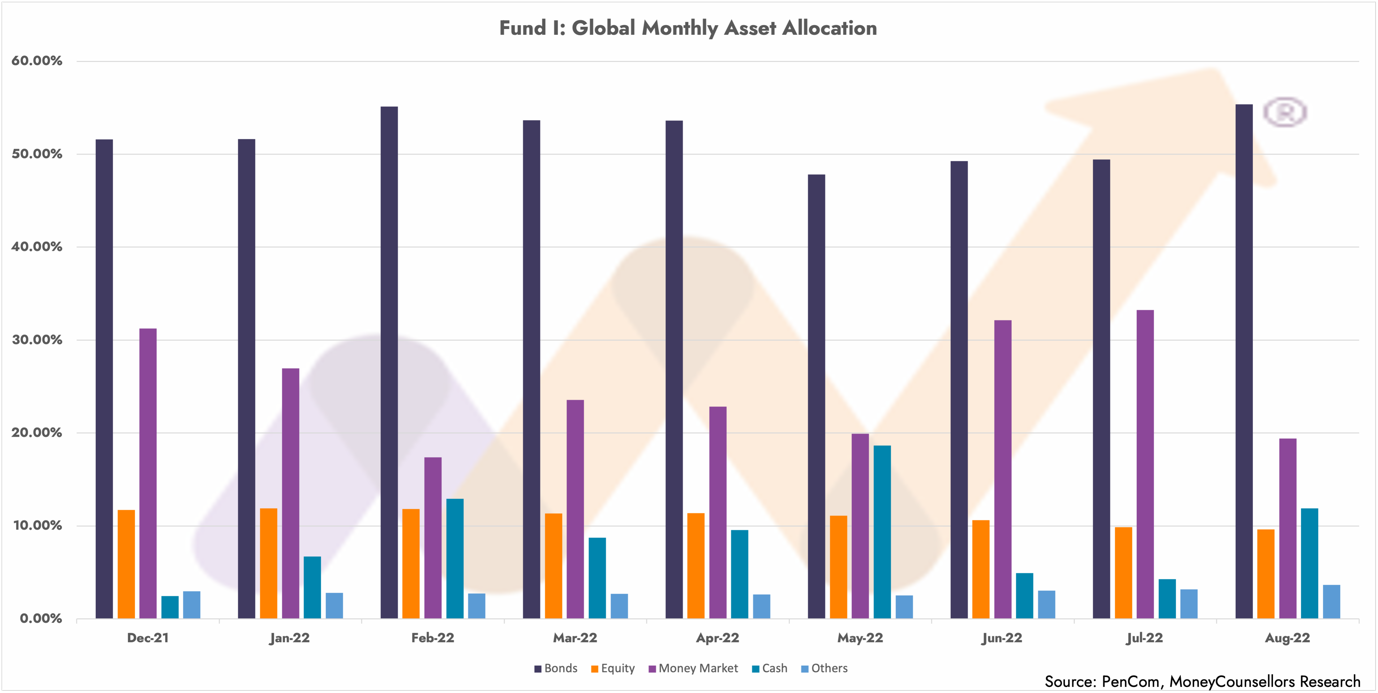

Fund I

Fund I is accessible strictly by formal request of the contributor and only for those aged 49 years and below. Fund I is allowed a maximum exposure to Variable Investment Instruments of 75%.

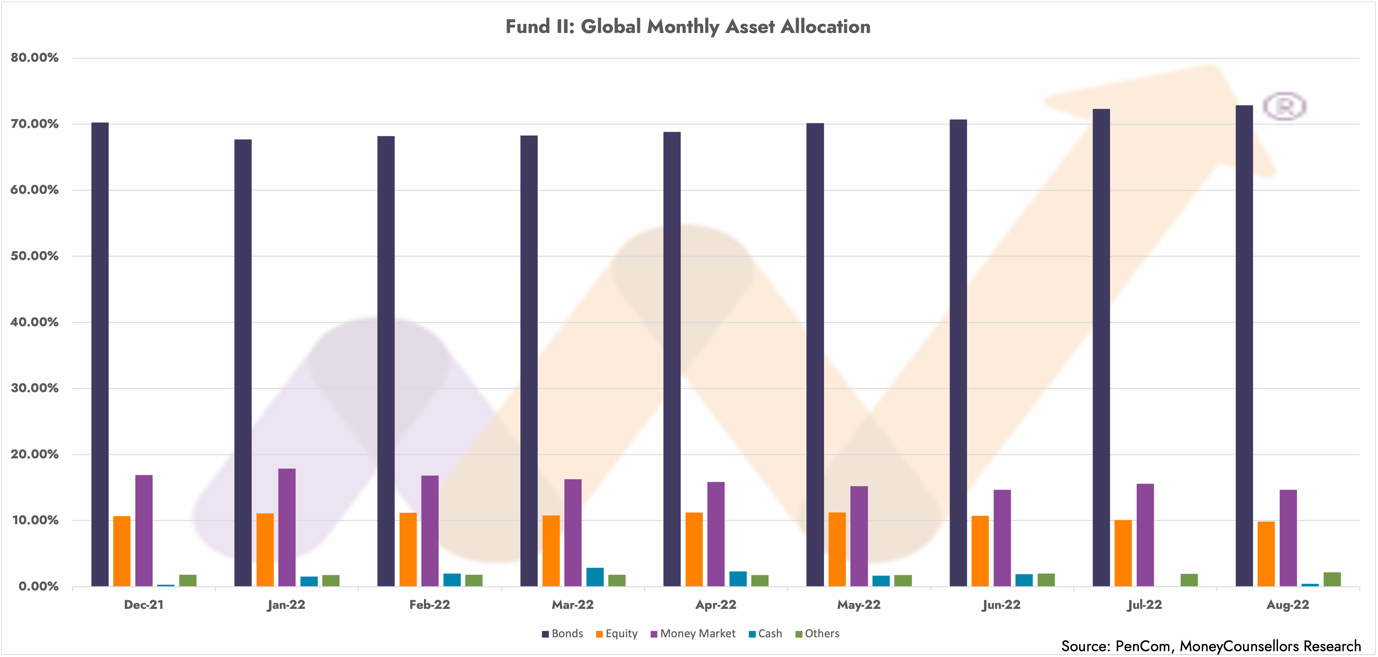

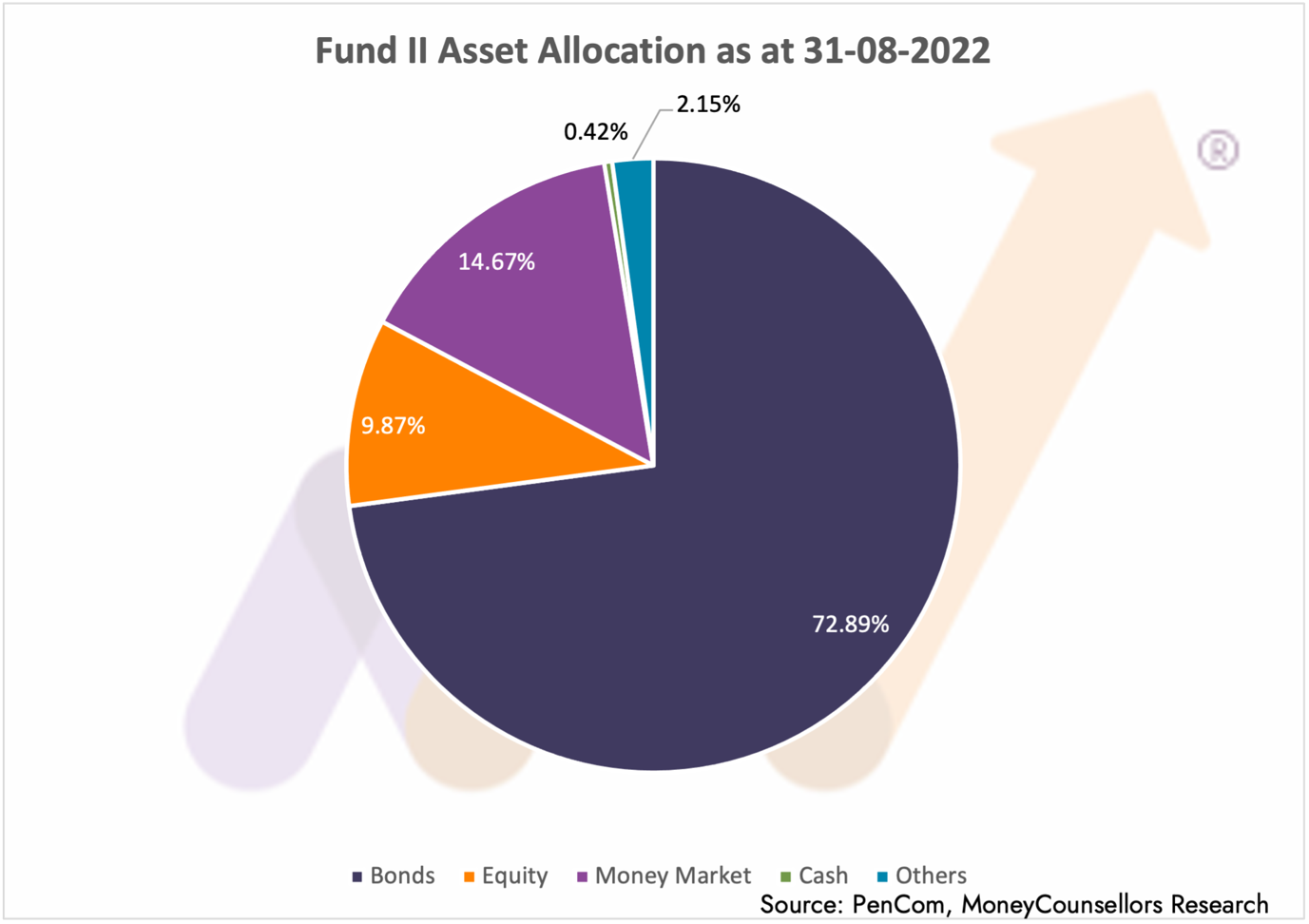

Fund II

Fund II is the default fund for all active contributors that are 49 years and below. Fund II is allowed a maximum exposure to Variable Investment Instruments of 55%.

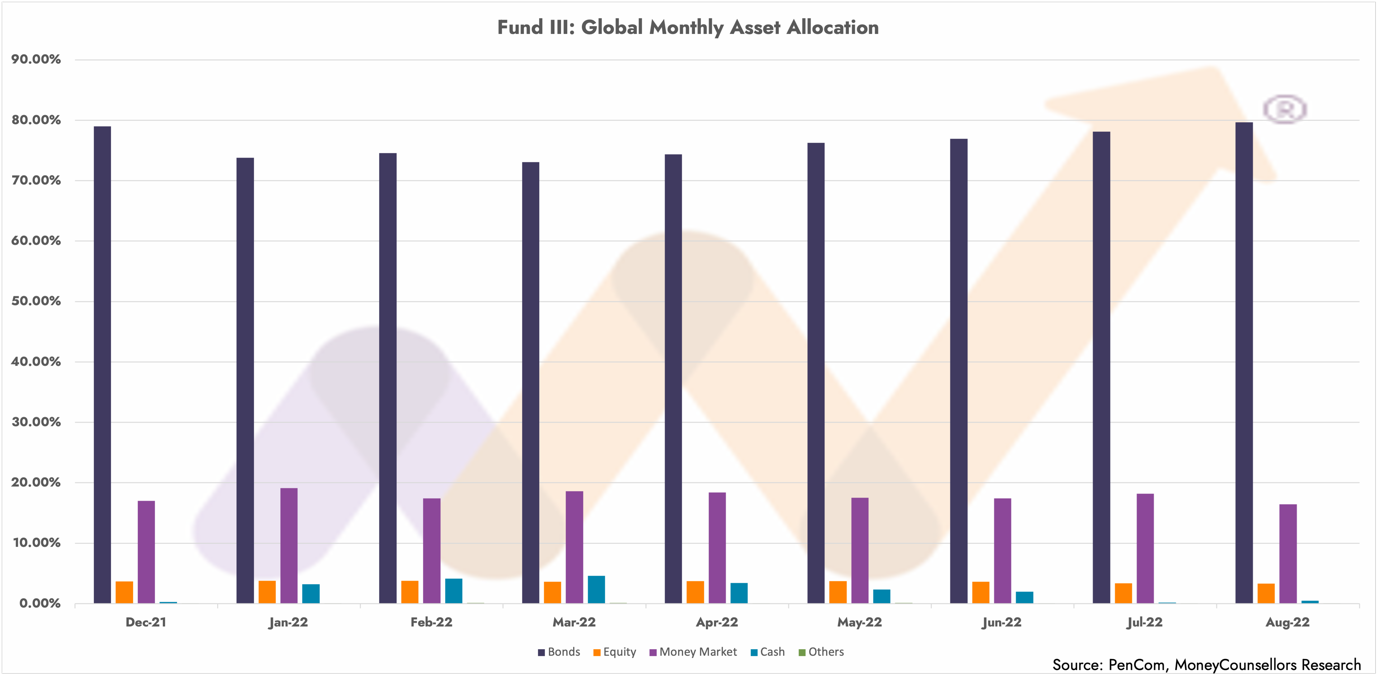

Fund III

Fund III is the default fund for active contributors that are 50 years and above. Fund III is allowed a maximum exposure to Variable Investment Instruments of 20%.

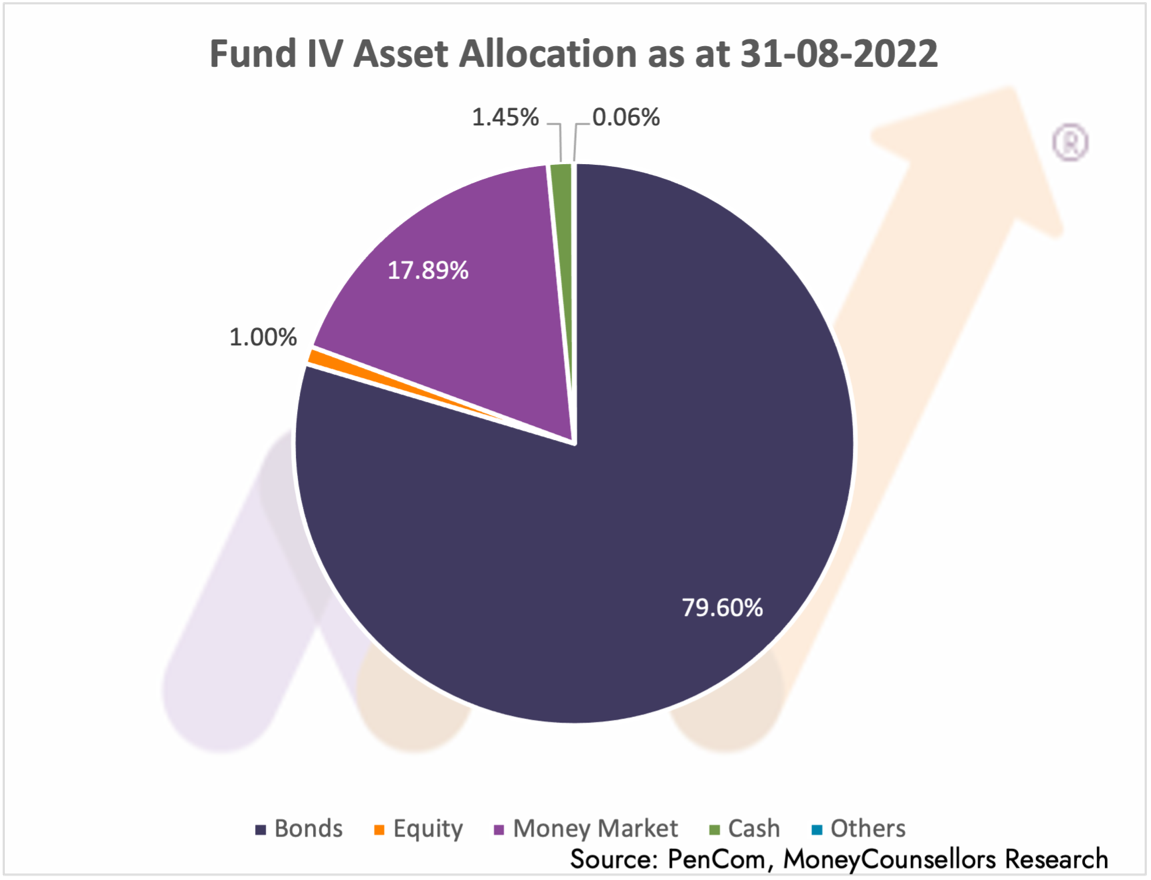

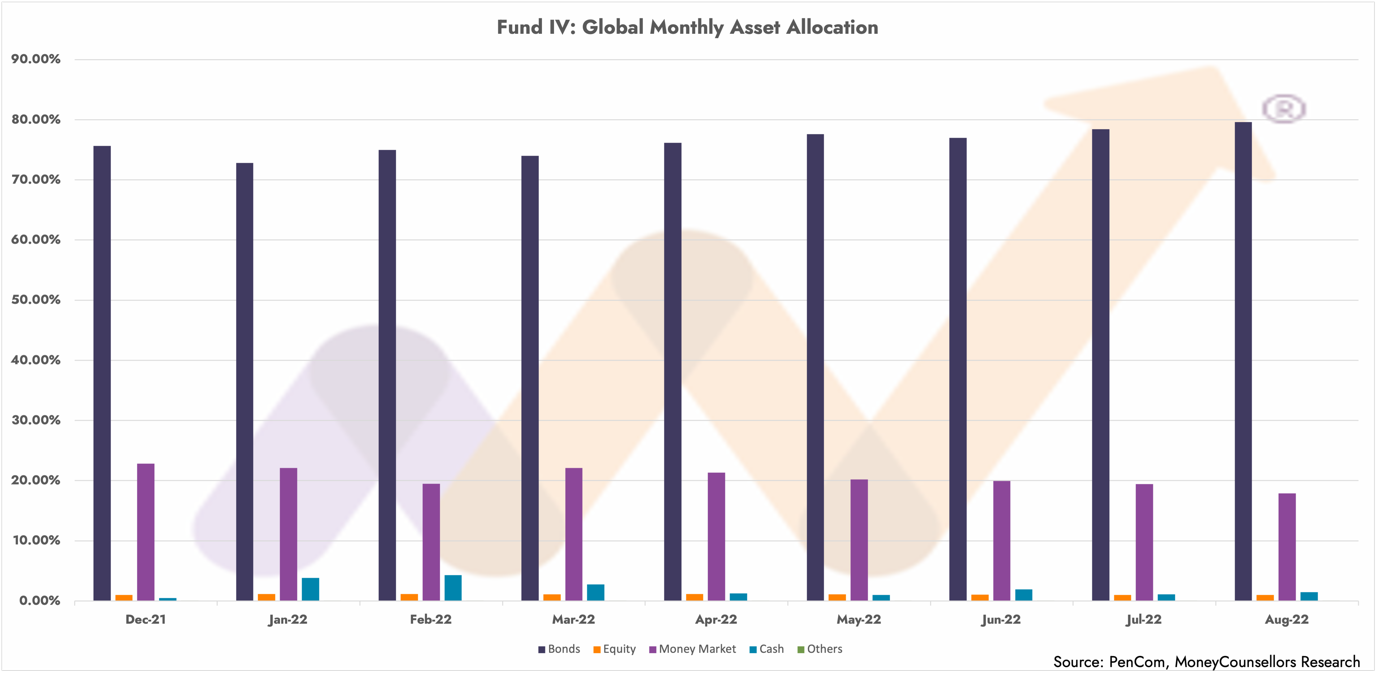

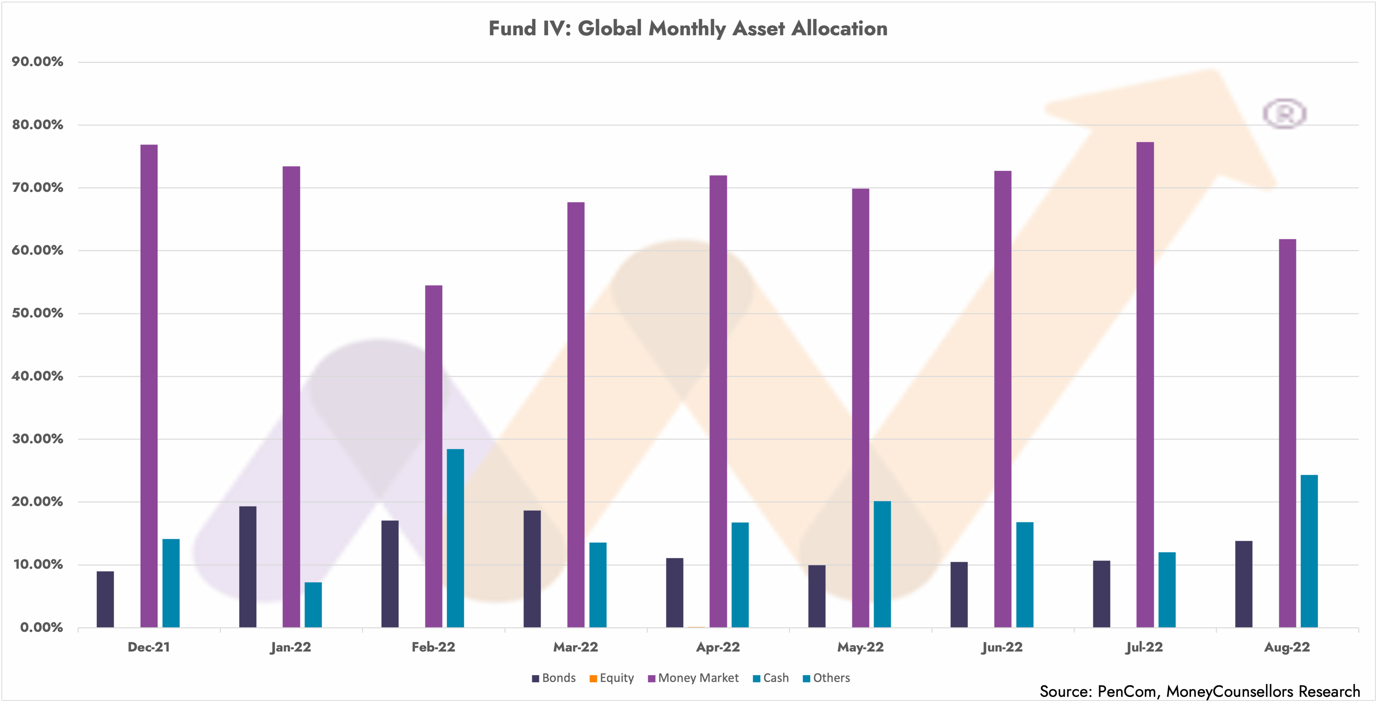

Fund IV

Fund IV is strictly for retirees only. Fund IV is allowed a maximum exposure to Variable Investment Instruments of 10%.

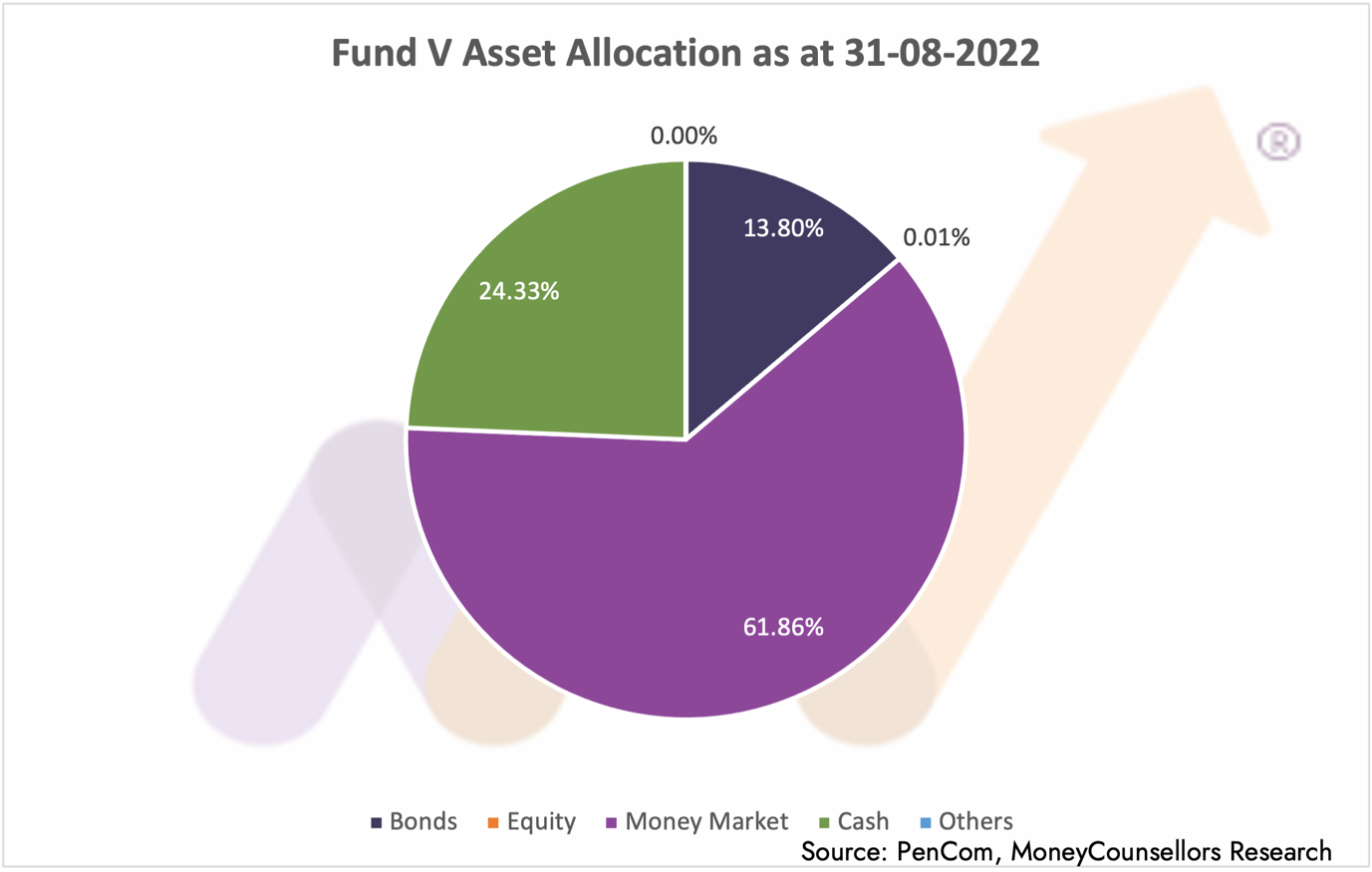

Fund V

Fund V is only for Micro Pension Fund contributors. Fund V is allowed a maximum exposure to Variable Investment Instruments of 5%.

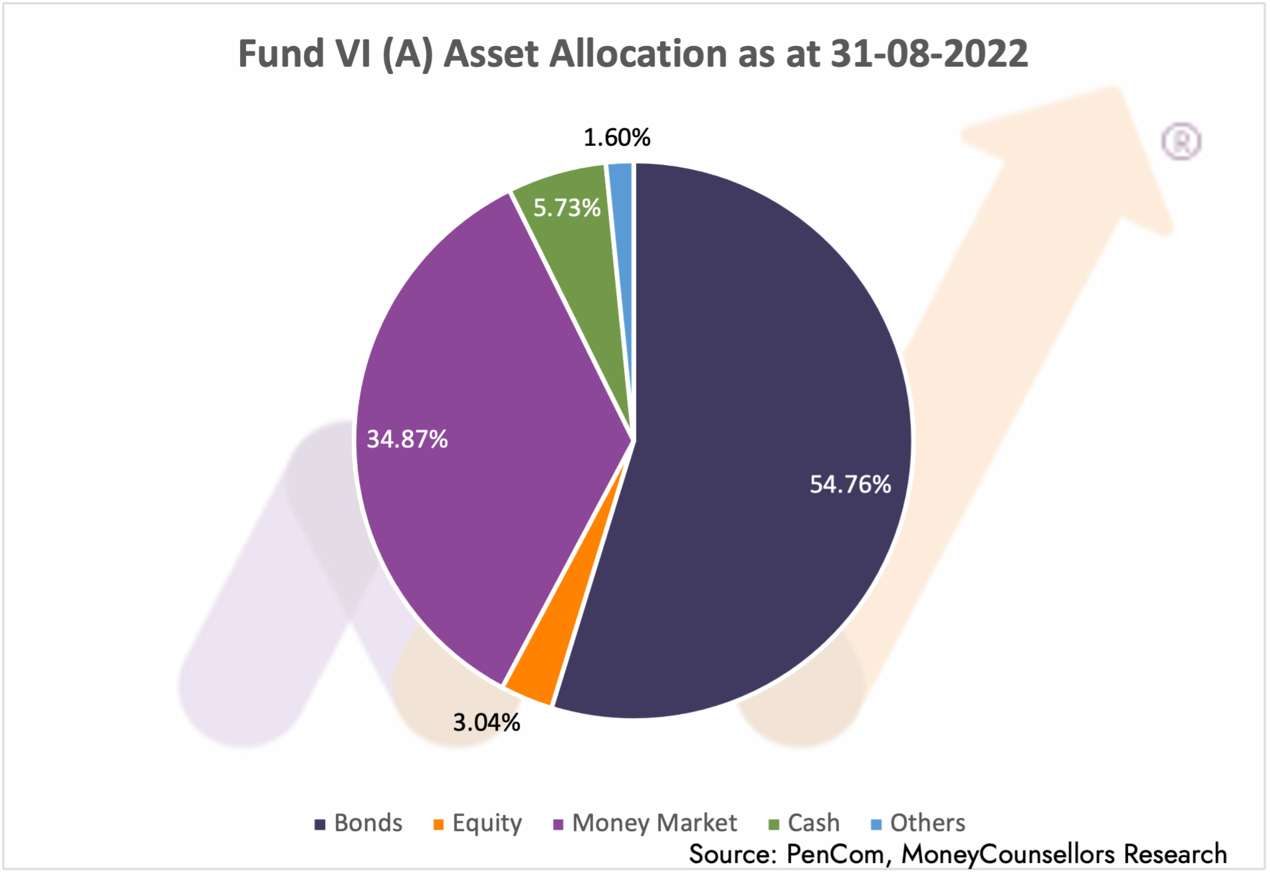

Fund VI (Active)

Fund VI (Active) is for those that choose to have their contributions invested in Non-interest Money and Capital Market Products. Fund VI (Active) is allowed a maximum exposure to Variable Investment Instruments of 55%.

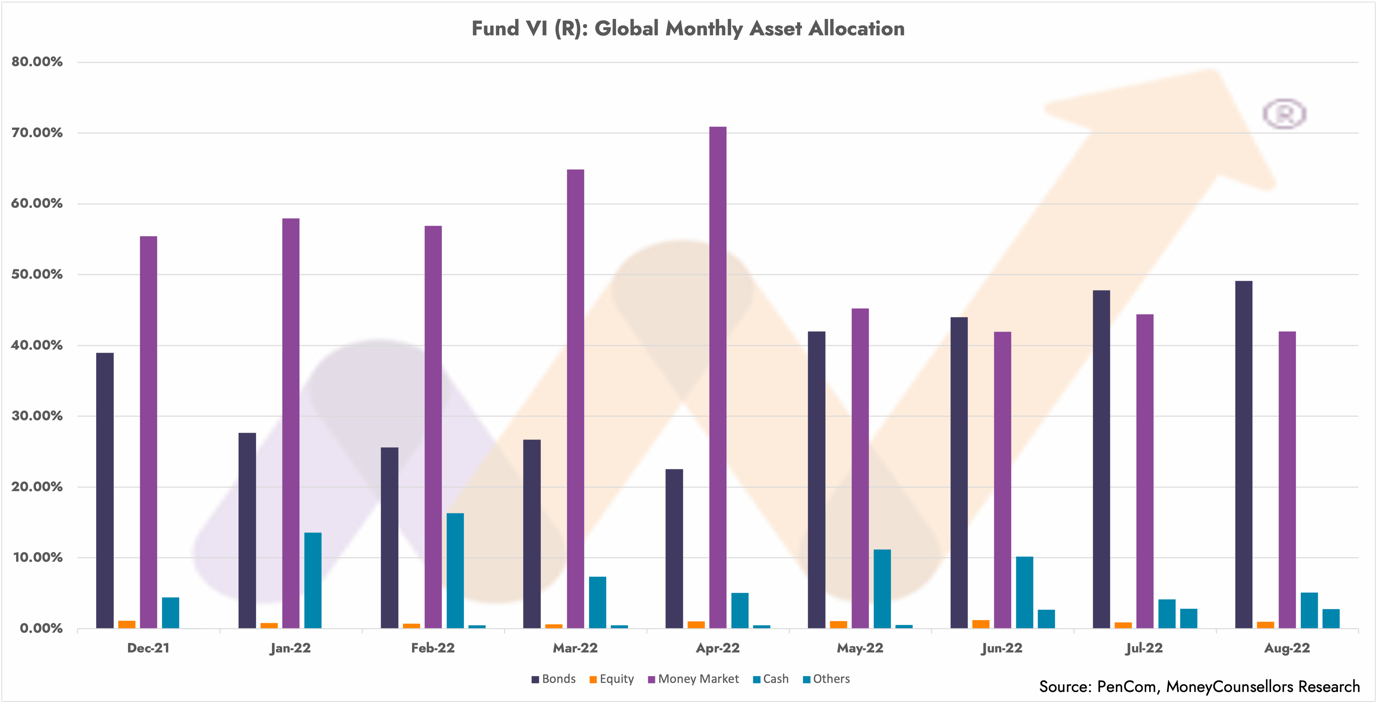

Fund VI (Retiree)

Fund VI (Retiree) is for those that choose to have their contributions invested in Non-interest Money and Capital Market Products. Fund VI (Retiree) is allowed a maximum exposure to Variable Investment Instruments of 10%.

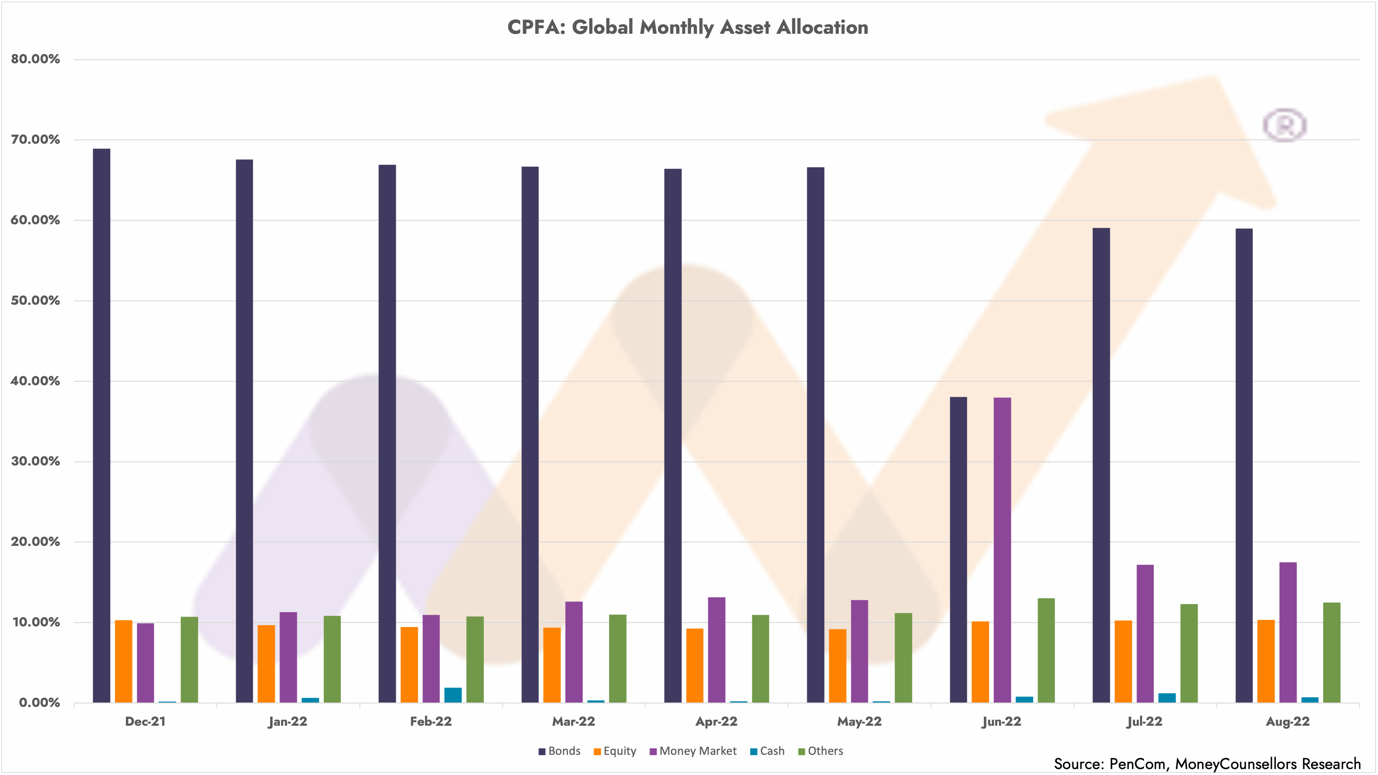

Closed Pension Funds

Closed Pension Funds are schemes managed and operated by private sector firms that had schemes in existence before the introduction of the Contributory Pension Scheme (CPS) in 2004. The schemes are subject to guidelines issued by PenCom.

Existing Schemes

Approved Existing Schemes are pension funds that have assets less than the amount to be a Closed Pension Scheme and are now under the purview of PFAs with assets held by PFCs and regulated by PenCom.

Whilst PenCom is conscientious and consistent in publishing its monthly, quarterly, and annual reports on activities in the industry, the same cannot be said of the PFAs. On a majority of websites, asset allocation per fund which is mandated to be published is not published.

Only a very few publish their RSA numbers, though not in any detail, and as you can see from the ‘View Pension Fund Prices’ page on our website, the publication of daily prices falls short too. With 9.7m Retirement Savings Accounts and N14.43bn ($34.7bn) of retirement funds being managed by them, PFA’s must do better at providing and making public, information to clients and non-clients, after all, what is the basis of choosing a PFA, remaining with a PFA or switching PFA?

For a more detailed analysis of your pension or mutual fund or for a report on the performance of your pension fund and your PFA, visit the Literature & Download section of your fund at moneycounsellors.com.