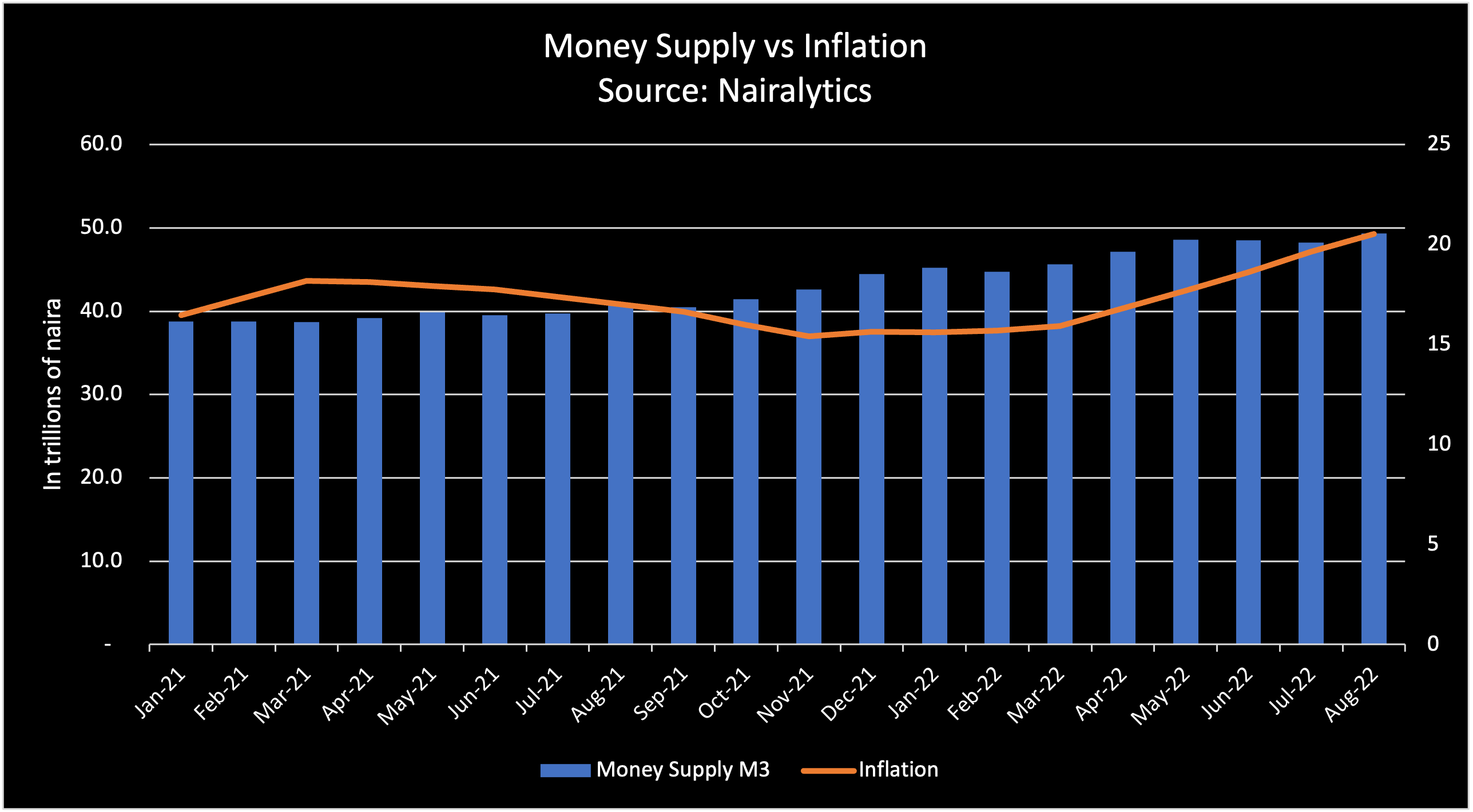

The money supply in the economy is at its highest level on record, at almost N49.3 trillion in August, topping the previous record set in May 2022.

Money Supply is now at a 9.9% gain from December 20, 2021, when the country recorded N44.4 trillion. This is based on statistics acquired by Nairametrics from the Central Bank of Nigeria (CBN) on the country’s money supply.

In its last monetary policy committee meeting, the central bank explained the growth in money supply was due to an increase in net domestic assets.

Recommended reading: What is CBN interest rate?

“The Committee noted that broad money supply (M3) grew by 11.05 per cent in August 2022, compared with 8.66 per cent in July. This was driven largely by the growth in Net Domestic Assets (NDA) of 26.19 per cent in July 2022, compared with 22.78 per cent in the preceding month. The sustained growth in Net Domestic Assets (NDA) was driven largely by increased claims on the Federal government and other financial corporations and the private sector.”

Considering the multiple interest rate hikes implemented since July is intended to combat inflation and lower the amount of money in circulation, this increase in the money supply is concerning.

The CBN also mentioned that the recent rate hike could help slow down the pace of money supply, though Nairametrics believes this will take some time to occur effectively.

“The MPC noted that a tight policy stance would help consolidate the impact of the last two policy rate hikes, which is already reflecting in the slowing growth rate of money supply in the economy.”

Source: Nairalytics

Money supply and inflation

A country’s money supply is a crucial factor in whether or not inflation develops, and Nigeria’s money supply is at an all-time high. The amount of money in circulation has grown over time, owing largely to the CBN’s low-interest policy implemented to stimulate economic growth.

- Trillions of naira in CBN intervention funds, as well as CBN bailouts of federal and state governments through its Ways and Means powers, have boosted the money supply and created a strong inflationary environment.

- According to the data, the Ways and Means balance was N16.1 trillion in August 2021 but has since risen to N22.068 trillion in August 2022. This is a 36% increase year on year.

- A cursory examination of the data also reveals that the private and public sectors received sector credit worth N40.1 trillion and N21 trillion, respectively.

As of August 2022, Nigeria had the highest-ever net domestic credit to the economy, at N61.1 trillion as earlier reported by Nairametrics.

- The data also shows that Nigeria’s economy expanded by an average of 1.3% from 2016 to 2021. In contrast, during the same period, the money supply increased from N23.6 trillion to N43 trillion.

Despite several interest rate hikes announced by the central banks, the money supply has continued to grow. This prompted the CBN to take more aggressive measures to limit the money supply and inflation.

What the CBN is saying

In October 2022, the Central Bank raised the interest rate to 15.5%, its third and most aggressive hike since the beginning of the year. The actions are being taken to combat Nigeria’s rapidly rising money supply and inflation.

- The CBN said, “The MPC was concerned that within four months, inflation had accelerated aggressively by 280 basis points from 17.71% in May 2022 to 20.52% in August 2022. The committee was thus, of the view that given the primacy of its price and monetary stability mandate, it was expedient that significant focus is given to taming inflation.”

Given the increasing inflation, the bank noted that the options of holding or loosening were not being considered at the last MPC meeting. This is because easing policy would increase the negative real interest rate gap and aggravate financial market conditions by reducing savings mobilization and investment inflows.

- The bank maintains that a more aggressive rate hike will reduce the economy’s money supply. The CBN said, “The MPC noted that a tight policy stance would help consolidate the impact of the last two policy rate hikes, which is already reflected in the slowing growth rate of money supply in the economy. It also felt that an aggressive rate hike would slow capital outflows and likely attract capital inflows and appreciate the naira.”

- The CRR was also raised to a minimum of 32.5% from 27.5%, while the liquidity ratio remained at 30%. Following the initiative to mop up liquidity from the Nigerian economy, Nigerian banks received N838 billion in CRR debits from the CBN.

Why you should be worried

If the Central Bank’s interest rate hikes continue to be inefficient in managing the money supply and inflation, the average Nigerian would be faced with massive erosion of purchasing power and worsening economic conditions.

- Also, further aggressive rate hikes tend to derail economic growth and create unemployment in the economy because firms must deal with an increase in borrowing costs. Moreover, a high inflationary environment would hasten the depreciation of the Naira in the black market.