Recently, the Obajana Cement Plant powered by the Dangote Industries, the biggest in Nigeria was shut down by the Kogi State government, over allegations that the purchase of the plant was flawed.

This has once again sent disturbing signals to the global community, especially as it has to do with investments, mergers, and acquisitions.

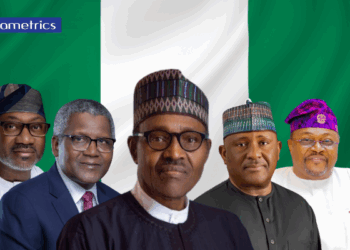

Aliko Dangote the businessman and President of the Group has demonstrated a remarkable commitment to investing in Nigeria, and the Obajana Cement plant is one of them.

The forceful closure of the plant which has provided jobs to the youth, revenue to the Kogi State government, and infrastructure for the people is an unfortunate chapter in Nigeria’s polity.

At a time that the continent of Africa is fast-tracking the ‘AFCFTA’ which is the Free Trade Agreement Area, designed to boost industrialization, trade, and development the actions of the Kogi state government are shocking.

For the benefit of the doubt, Nigeria is a democratic state, and where there are issues of concern around the operations of a multinational in a state.

There are four reasons why the recent action of the Kogi state government on the Obajana Cement plant, speaks to the effect of signaling to investors.

Ease of Doing Business

Part of the role of government at the federal, state, or local government level is providing an enabling environment for businesses to thrive.

The actions of Kogi State undermine this and create a hostile environment for businesses.Investment Promotion

Nigeria is doing well in the area of attracting foreign direct investments, which was below $500m in Q2,2022. This current action could create additional shocks for potential foreign investors, who will be worried at the treatment meted out to a major domestic investor.

Sanctity of Contracts

It will raise the fundamental question of how Nigeria regards the sanctity of contracts and engagements.

If there are issues like the Manufacturers Association of Nigeria raised, then the best way to approach it is going through the courts. The laws of engagement should be respected without which investors will develop cold feet for investing in Nigeria.Security of Assets

Prior to this incident, Kogi State was highly rated for security whether for assets or communities. With reports that people were shot during the forceful closure, efforts must be made by the government to resolve the issues amicably and bring back stability to the state.

In as much as we all condemned the action of the Kogi State Government, we should also look at the corruption aspect of the acquisition process, non remittances of appropriates tax & others accrued interest to kogi state governor. Remember kogi state is also a shareholder in that company, secondly he used kogi state government documents to borrowed 63B not dangote holding. This will also serve as a warning to all the investor coming with corrupt intentions to acquire our asset via backdoor.

@James Agbo

If the Kogi State government feels it has a legal case, then it should have headed to the law courts, instead of resorting to Agbero thuggery tactics. If the government does not respect the rule of law, then little wonder why Nigeria is a Banana Republic crap-hole.

Anyway, just when one starts feeling empathy for ordinary Nigerians, comments like yours validate the saying that every nation DESERVE their leaders. A nation of ANYHOWNESS where BOTH the government and ordinary CITIZENS subscribe to LAWLESSNESS!

Kogi State Government cannot be the judge and accuser in its own case. You claim you have 10% of the Obajana Cement – Good. You have closed the factory from operating. You have started vandalizing the Company and you maimed the workers of the Company. Therefore, you are judging your own case. Why not allow the Company to operate but you approach the court for adjudication by presenting your facts. Let us agree you have 10% of Obajana Cement as you claim. 10% of Obajana does not equate 10% of Dangote Cement because when your 10% is brought into the total Cement portfolio of DIL, it might be like 4-5%. Please let us thread gently in resolving this matter. Your actions sends dangerous signals internationally considering that you are in conflict with easily Nigeria largest brand. Whatever happens investors are watching and it has begun to affect the value of your 10% gradually. You need the value you are destroying. The final resolution of this matter might stretch beyond this administration. So closing the factory and its vandalization including maiming staff has exposed the meagre revenue of Kogi State Government as the consequences of your actions must be restituted. Tread carefully!

Most of these remote and backward states seem to have inordinate sense of entitlement and exaggerated expectations towards medium to large external investors in their locality. By constantly harassing businesses with political touts and hoodlums, they seem to prefer to remain poor, rather than cooperate progressively with investors for the mutual benefit of both parties.