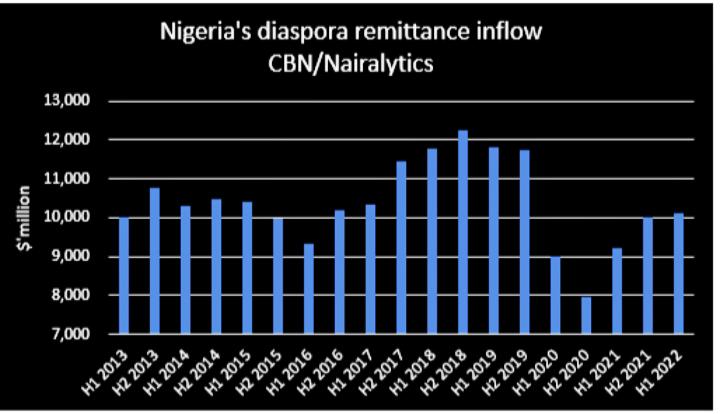

Nigerians received $10.11 billion as diaspora remittances between January and June 2022, representing a 9.6% increase compared to $9.23 billion received in the corresponding period of 2021.

In contrast to the second half of 2021, Nigeria’s diaspora remittance inflow increased marginally by 0.9% from $10.02 billion. This is according to data obtained from the Central Bank of Nigeria (CBN).

In the period under review, a sum of $23.3 million was recorded as remittance outflow from Nigeria, indicating a net inflow of $10.09 billion in H1 2022 as against a net value of $9.99 billion recorded in H2 2021 and $9.2 billion recorded in the corresponding period of 2021.

Nigeria’s remittance inflow rose to its highest level since the second half of 2019, as the CBN Naira4dollar policy continues to support remittance inflows into the Nigerian economy. Recall that the apex bank in March 2021 introduced the Naira 4 Dollar Scheme for diaspora remittances.

This scheme offers recipients of diaspora remittances N5 for every $1 received through the CBN IMROs. The scheme, which was originally meant to last for two months, was later extended indefinitely. According to the regulator, the extension of the scheme was aimed at sustaining the foreign exchange market liquidity in Africa’s biggest economy, which has been negatively impacted by the coronavirus pandemic and drop in oil revenue.

The numbers are beginning to shore up from the dip recorded in 2020 as a result of the covid-19 pandemic. A major boost for the Nigerian economy, which is in dire need of a foreign exchange, considering the sustained liquidity crunch and depreciation of the local currency.

The improvement in Nigeria’s diaspora remittance will give the CBN more firepower to meet the pent-up demand for FX and defend the local currency against volatility. Note that Nigeria currently adopts a managed float exchange rate regime, where the central bank occasionally intervenes in the international currency market.

In case you missed it

Nigeria’s current account balance rose to a 9-year high of $7.7 billion in the first half of 2022, five times higher than the $1.13 billion recorded in the second half of last year and a significant improvement from the negative balance of $2.98 billion recorded in H1 2021.

- Nigeria endured a current account deficit between H2 2018 and the first half of 2021, largely due to a decline in export earnings, an increase in imports, and a drop in diaspora remittances. However, since the second half of 2021, the balance has maintained a surplus and hit a 9-year high in the period under review.

- The improvement in the nation’s current account balance can be attributed to an increase in diaspora remittances and a surge in crude oil export earnings.

- Nigeria recorded a crude oil export of $27.8 billion in H1 2022, a 37.7% increase when compared to $20.16 billion recorded in the second half of 2021 and an 85.1% increase from $14.99 billion recorded in the corresponding period.

- In the same vein, gas export earnings in the period under review increased by 40.7% year-on-year to stand at $3.81 billion.