Experts are canvassing policy reform in Nigeria in order for the country to attract foreign investor participation.

This was discussed at the Global Research Briefing by Standard Chartered Bank Nigeria Plc to identify the key concerns for the Nigerian financial market as well as pool solutions from a cross-section of financial and oil sector experts to chart a course in a bid to reverse the negative situation.

The event saw market leaders dialogue on an array of key economic issues ranging from the expected implementation of foreign exchange and monetary policy reforms to interventions needed to address the challenges in the oil and gas sector.

What they are saying

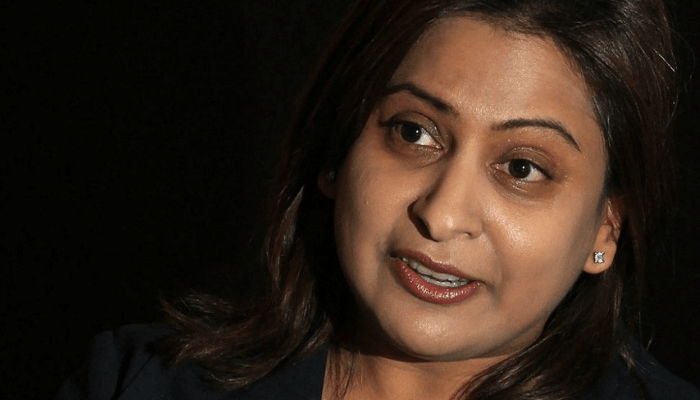

Razia Kahn, Standard Chartered Bank’s regional head of research, Africa & the Middle East, during her keynote presentation, highlighted the need for greater reassurance on FX and other policy reforms in order for Nigeria to attract foreign investor participation.

She explained, “In terms of the policy response, Nigeria has perhaps been more tested than many other economies. A lot of the transmission of the different pressures into the great slowdown has been exacerbated by the policy decisions in Nigeria. Still, Nigeria stands apart from many of its African counterparts simply because it is seen to be an economy that has scaled.”

Speaking during the Financial Markets panel, David Alao, CEO of Leadway Asset Management Company noted that serious FX reforms are necessary for the international investing public to regain confidence in Nigeria.

Leke Ogunlewe, former head of global banking/corporate and institutional banking, SCB, noted that there were concerns regarding the regulation of significant investments by oil & gas companies in social initiatives, particularly as they relate to their host communities.

“We now have a regulator that monitors these organizations in a way that is unfavourable to the communities. I am curious to see how that is going to work out because I know from experience that several oil & gas companies spend much more than the PIA stipulates,” he stated.

In his remarks, Femi Ogunbi, treasurer, ExxonMobil underscored the need for market forces of demand and supply to play a greater role in Nigeria’s oil & gas policies. According to him, Nigeria needs more enablers and more respect for market forces in virtually every sector.,

Meanwhile, Lamin Manjang, CEO, SCB, Nigeria pointed out that the session came at a time of great uncertainty and volatility both globally and locally marked by the spectre of high inflation and slow growth.

He stated, “We have seen a very aggressive tightening of monetary policy across almost all central banks in the world. in Nigeria, we have seen the same phenomenon of high inflation. But it’s not all doom and gloom. We have been through similar challenges in the past and we eventually came out of it.”

Olukorede Adenowo, executive director, corporate commercial and institutional banking said, “As a global bank with a rich network of experience and expertise in Africa and the Middle East, we are in a unique position to support the massive shift of capital towards sustainable finance, which has become a priority for stakeholders (investors, clients, etc) alike.

“The people and businesses we serve are the engines of trade and innovation, and central to the transition to a fair, sustainable future. The global research briefing provided an opportunity for us to share insights into the challenges within the country and more so the tremendous opportunities that exist as well as providing solutions that governments can take to make their markets more attractive for investment.

We are determined to support our clients by identifying such opportunities and developing significant sustainable finance solutions to grow their businesses. This will ensure that we are able to deliver on our aspiration to be the bank that’s continuously driving commerce and prosperity for our clients and the economies we operate in.’’