Nigeria’s Central Bank one-year treasury Bills rate for the month of September 2022 rose to 12% from 8.5% recorded in the previous month, one day after the apex bank raised the benchmark interest rate to 15.5%.

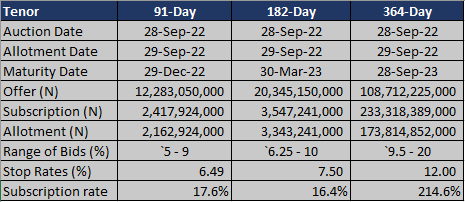

According to the result of the auction seen by Nairametrics, the Central Bank offered to raise a total of N108.71 billion for the one-year treasury and recorded a total subscription of N233.32 billion, representing an oversubscription of 114.6%.

Meanwhile, only N173.81 billion was allotted by the apex bank, which is 59.9% higher than the intended offer of N108.71 billion. The Central Bank during the 287th MPC meeting raised the monetary policy rate for the third consecutive meeting to its highest level in two decades.

In a bid to tame the rising inflationary pressure in the country, the CBN raised the MPR by 150 basis points to 15.5% on Tuesday, 27th September 2022, immediately triggering a 350-basis points uptick in the one-year treasury bills.

The rate change by the apex bank was necessary given growing inflationary pressure in the country as Nigeria’s headline inflation accelerated to a 17-year high of 20.52% in August 2022. It is however worth noting that despite the significant improvement in the t-bills rate, it produced a negative yield of 8.52%.

Highlights of the auction

- The 91-day tenor of the treasury bills recorded a stop rate of 6.49% and attracted a total subscription to the tune of N2.42 billion, representing a 17.6% subscription rate when compared to the offer amount of N12.28 billion.

- Also, the rate for the 91-day treasury bills improved from 4% recorded in the month of August 2022 to 6.49%.

- In the same vein, the 182-day treasury recorded a total subscription of N3.55 billion in contrast to the offer amount of N20.35 billion. This represents a subscription rate of 16.4%, while the stop rate stood at 7.5%.

What the CBN said

- The Monetary Policy Committee of the CBN voted unanimously to raise the Monetary Policy Rate (MPR) and the Cash Reserve Requirement (CRR). Notably, the apex bank raised the MPR to 15.5% and the CRR to a minimum of 32.5%.

- The CBN noted that the tight policy stance would help consolidate the impact of the last two policy rate hikes, which is already reflected in the slowing growth rate of the money supply in the economy.

- It also felt that an aggressive rate hike would slow capital outflows and likely attract capital inflows and appreciate the naira.

Meanwhile, the oversubscription of the 364-day treasury bill (NTB) indicates investors’ positive sentiments towards long-term securities, despite the real negative returns. It is also worth adding that the 12% rate for the one-year treasury bills is the highest since October 2019, when the stop rate stood at 12.94%.

The shorter tenor assets were unattractive to investors in September as seen by the under subscription recorded in both the 91-day and 182-day treasury bills, the same as recorded in the previous month.