The Nigeria Inter-Bank Settlement System (NIBSS) has revealed that bank customers in Nigeria transferred a total of N9.2 trillion over mobile devices between January and July this year. The 7 months data just released showed a surge in the usage of mobile for financial transactions as the value of deals over the platform has surpassed N8 trillion recorded in the full year 2021.

Year-on-year, the NIBSS data showed that the value of mobile transactions has grown by 155% in the 7 months of this year compared to the N3.6 trillion recorded in the same period last year.

According to NIBSS, the volume of mobile inter-scheme transactions also rose by 122% year on year from 135 million recorded between January and July last year to 300 million in the same period this year.

The surge in the use of mobile for financial transactions is buoyed by the rising mobile connections across the country. According to the Nigerian Communications Commission (NCC), active subscriptions for mobile services across the networks of MTN, Airtel, Globacom, and 9mobile rose by 10.9 million in the first six months of 2022.

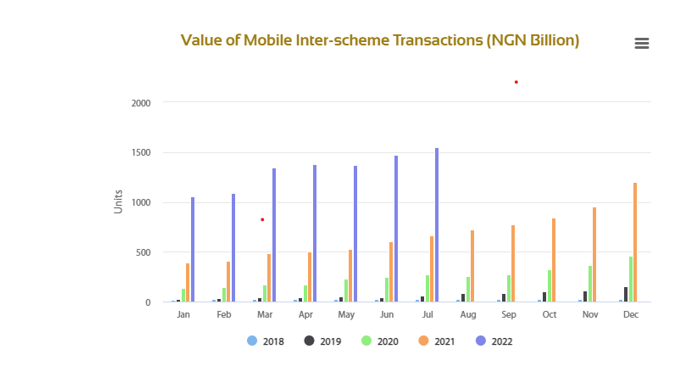

Monthly analysis of mobile transfers

- Analysis of the value of the transactions for the 7 months showed that the sum of N1.05 trillion was transferred via mobile in January this year.

- In February, transactions worth N1.09 trillion were carried over the mobile, while in March a total of N1.37 trillion was recorded as mobile transfers.

- In April, the value of mobile transactions also stood at N1.37 trillion, while the same figure was recorded in May.

- The NIBSS data showed that bank customers in the country carried out financial transactions worth N1.47 trillion in June this year, while the figure rose to N1.55 trillion in July.

Meanwhile, as more Nigerians embrace electronic payment, fraudsters have also upped their game in their attacks leading to a 186% increase in financial frauds from 16,128 in 2019 to 46,126 in 2020. According to the fraud report recently released by NIBSS, the criminals are focusing more on the mobile payment system, hence, fraud attempts on mobile increased by 330% between January and September 2020.

Aside from the mobile, NIBSS in the Q3 2020 fraud report disclosed that the fraudsters are also targeting web payment and Point of Sales (PoS) both of which recorded 173% and 215%increase in fraud attempts in the period.

Yes

A well detailed report there. Thanks for the information