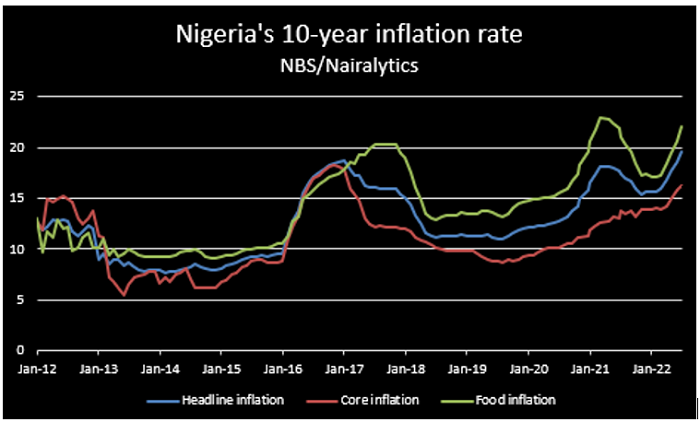

Nigeria’s inflation rate in the month of July 2022 rose to a 17-year high of 19.64%. This compares to 18.6% recorded in the previous month of June 2022.

The latest inflation data is according to the recently released Consumer Price Index (CPI) report for the month of July 2022, by the National Bureau of Statistics (NBS).

The last time Nigeria’s inflation was above 19.64% was in September 2005 when it rose to 24.32%. This is according to Nairalytics, a web portal that publishes Nigeria’s historical macroeconomic data. Notably, the uptick in the inflation rate was driven by increases in the food and core index.

Further breakdown of the report shows that the urban inflation rate rose by 2.08% to 20.09% in July 2022 from 18.01% recorded in July 2021, while the rural inflation rate hit 19.22% from 16.75% recorded in the corresponding period of 2021.

Food inflation

- The closely watched indicator rose to its highest level in 14 months, standing at 22.02% in July 2022, representing a 1.42%-point increase compared to 20.6% recorded in the previous month. On a month-on-month basis, the food inflation rate in July stood at 2.04%, this is 0.01% lower than 2.05% recorded in the previous month.

- According to the NBS, the rise in food inflation was caused by increases in prices of bread and cereals, food products, potatoes, yam and other tubers, meat, fish, oil, and fat.

- Meanwhile, the average annual rate of food inflation for the twelve-month period ending July 2022 over the previous twelve-month average was 18.75%, which represents a 1.42% points decline from the average annual rate of change recorded in July 2021 (20.16%).

Core inflation

- The ‘’All items less farm produce’’ or Core inflation, which excludes the prices of volatile agricultural produce stood at 16.26% in July 2022, compared to 15.75% recorded in the previous month. This also represents the highest core inflation rate since January 2017, when the rate stood at 17.8%.

- On a month-on-month basis, the core inflation rate was 1.75% in July 2022. This was up by 0.20% when compared to 1.56% recorded in June 2022.

- Notably, the highest increases were recorded in prices of Gas, Liquid fuel, Solid fuel, Passenger transport by road, Passenger transport by Air, Garments, Cleaning, Repair and Hire of clothing.

States with highest inflation rate

Akwa Ibom State recorded the highest inflation rate in the month under review with 22.88%, closely followed by Ebonyi State with 22.51%. Others include Kogi (22.08%), Bayelsa (21.6%), and Rivers State (21.37%).

In terms of food inflation rate, Kwara State recorded the highest with 29.28%, followed by Akwa Ibom (27.22%). Kogi State recorded 26.08% food inflation rate in July 2022, while Ebonyi, and Ekiti State recorded 25.83% and 24.78% respectively.

What this means

- Nigerians have had to deal with the rising cost of goods and services following the Russia-Ukraine war, which caused a significant rise in energy prices, spiralling into a global energy crisis and food supply issue.

- Nigeria is one of the countries with significant uptick in its cost of living as a result of high inflationary pressure. On a year-to-date basis, Nigeria’s inflation rate has increased by over 400 basis points from 15.63% recorded in December 2021 to 19.64% in the review month.

- This implies that the consumer price index has increased by 12.7% between January and July 2022. This means that the purchasing power of Nigerians has been eroded. In basic term, keeping income at a fixed level, Nigerians are not able to purchase as much as they have been able to with their monies.

Surely our country is under pressure, we pray for mercy