The Nigerian banking industry attracted $1.47 billion as capital inflows in the first half of 2022, an increase of 109.8% compared to $698.2 million received in the second half of last year and 46.5% higher than the $1 billion inflows recorded in the corresponding period of 2021.

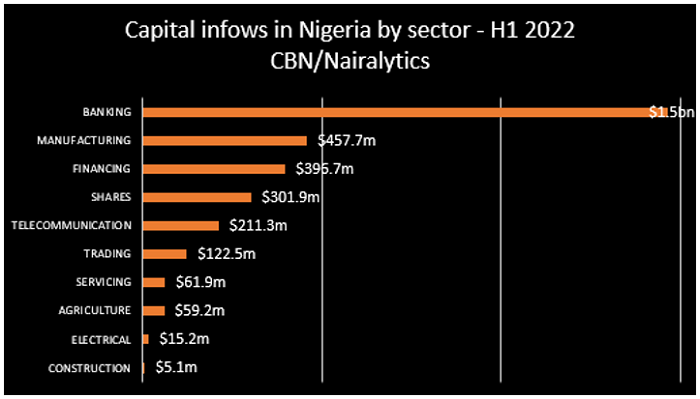

This is according to data from the Central Bank of Nigeria (CBN). The banking sector recorded the highest foreign inflow in the period under review compared to other sectors in the Nigerian economy, accounting for 47.1% of the inflows into the country. The manufacturing and financing sectors followed with $457.7 million and $396.7 million respectively.

Meanwhile, a total of $3.11 billion in capital was imported into the Nigerian economy as foreign inflows between January and June 2022, most of which were in form of foreign portfolio investments. In contrast to the first half of last year, foreign inflows grew by 11.8%, however, when compared to the second half of 2021, it declined by 20.7%.

Capital inflows into the country recorded a significant decline in the second half of 2020, following the covid-19 pandemic, which triggered a downturn in the global economy, with investors wary of moving their monies to the African giant. However, since the second half of 2021 inflows have begun to pick up, albeit still very low compared to pre-pandemic levels.

The decline in the number of foreign inflows has caused a huge FX supply shortage in the economy, piling more pressure on the exchange rate as demand for FX has outpaced supply leading to a depreciation in the local currency in the official and parallel markets.

Consequently, the inability to grow export earnings from oil export and the non-remittance of proceeds by the NNPC to the apex bank has caused the foreign reserve to fall further from the $40 billion threshold, currently standing at $38.9 billion.

Highlight of Nigeria’s foreign inflow

- Most of the inflows into the country came in as foreign portfolio investments (FPI) at $1.71 billion in H1 2022, accounting for 55.2% of the total inflows recorded in the review period.

- A closer look at the data shows that 33.4% of the total fund was invested in money market instruments at $1.04 billion, which could include mutual funds, TBills, commercial papers amongst others.

- Others, which include loans, currency deposits, trade credits, and other claims accounted for 35.1% of the total inflows, at $1.09 billion. This is however lower than the $1.59 billion recorded in H2 2021.

- Meanwhile, foreign direct investments (FDI) which involve the purchase of interest in a company by a foreign investor accounted for only 9.7% of the total inflows into Nigeria, despite having a strategic impact on the growth of the economy. Also, FDI declined from $466.04 million recorded in H2 2021 to $302.1 million in the review period.

A major factor that has been attributed to the decline in Nigeria’s foreign inflows is the inability of foreign investors to repatriate their earnings from the economy as a result of FX scarcity. Recall, that the International Air Transport Association (IATA) stated in June that Nigeria is withholding an estimated $450 million in revenue belonging to foreign airlines due to forex shortages.

Banking sector taking the lead

- The Nigerian banking sector overtook others as the most attractive industry for foreign investments in the first half of 2022, after attracting a sum of $1.47 billion, the highest in two years.

- The banking industry has been growing significantly in recent years, owing to the stellar performances by traditional banks as well as new entrants into the industry.

- The FinTechs have also helped spur growth in the sector, with most inflows coming through these startups either from international venture capitalist firms or angel investors. According to the Nairametrics Deals Book tracker, financial technology (FinTech) firms raised a sum of $658.4 million in funding in H1 2022 across 23 deals.

- In the same vein, other financial services firms recorded total deals worth $345.3 million across 12 deals in the same period. Traditional banking giants have also visited the international debt market to raise dollar funding in recent years.

Fidelity Bank raised $400 million through Eurobond issuance in 2021 following a similar issue in 2017. Also, banking giant, UBA redeemed its $500 million 5-year Eurobond in June 2022, while Zenith Bank completed the redemption of its $500 million Eurobond in the previous month.

This is an indication of the credit worthiness of the Nigerian banking industry, and possible confidence for foreign investors to be willing to invest in the sector.

I want chichke my results waec

I want chichke my results