Nigerian banks’ credit to the private sector rose to N26.8 trillion as of June 2022 the highest on record. This is according to provisional data from the Central Bank of Nigeria.

Commercial banks also known as deposit money banks lent out a total of N26.8 trillion as of June 2022 up from the N24.378 trillion lent out to the private sector as of December 2021, representing a 10.15% growth in 6 months.

Deposit Money bank lending to the private sector was N21.89 trillion as of June 2021 thus adding N5 trillion in loan growth in one year.

Nigeria’s central bank has over the last 5 years pursued an aggressive policy of lending to the private sector, expecting that this will help spur economic growth in the real sector, while also creating jobs. Loans to the private sector were just N15.7 trillion as of December 2015 thus around N11 trillion has been added in under 7 years.

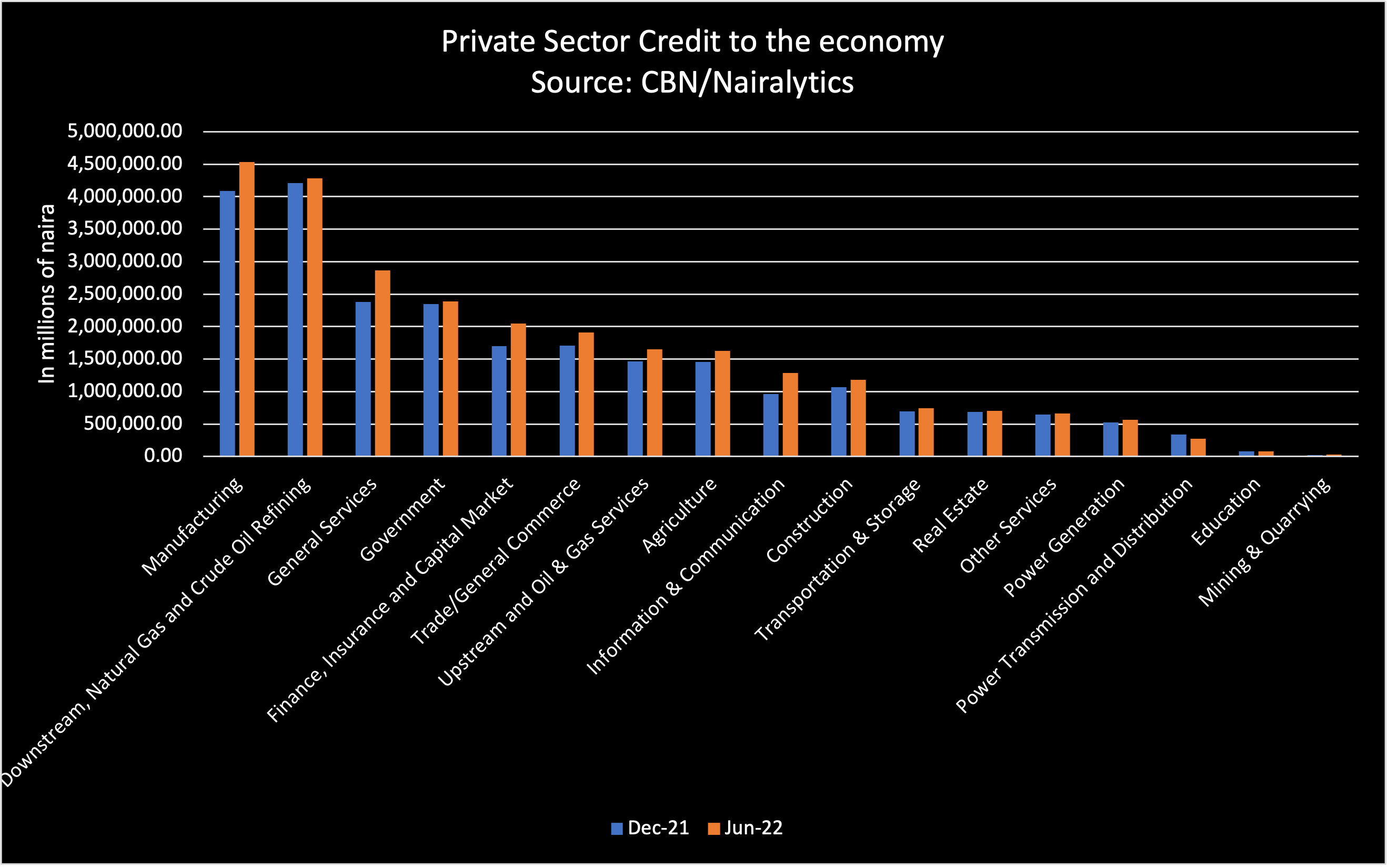

Further insight into the data reveals the Manufacturing sector has for the first time led the pack as the sector with the largest proportion of loans. Total loans to the manufacturing sector printed at N4.53 trillion or 16.9% of the total.

What is in the data

Source: CBN/Nairalytics

Commercial bank lending to the downstream sector has for years taken a large chunk of private sector credit.

- Lending to the manufacturing sector rose 23% year on year to N4.53 trillion representing 16.9% of total banking sector credit to the private sector.

- It has now taken over from the downstream sector of oil and gas which posted total sector credit of N4.2 trillion or 16%.

- The general services sector was a distant third at 10% of total sector credit.

- The fastest growing sector was the Agriculture sector has risen a whopping 41% year on year to N1.6 trillion.

- Loans to the trade sector also grew 39% to N1.9 trillion.

- Loans to the power transmission and distribution sector however fell by 20%, the only sector that did not record growth.

Focus on the Manufacturing sector

Nigeria’s central bank has in recent years pursued a policy that forced banks to increase lending to the private sector. Through its combined policy of cash reserve ratio and liquidity ratio, banks are forced to lend more to the real sector of the economy.

- In one of its recent monetary policy communique, a member of the committee noted that “all sectors of the economy have benefitted from the increased lending with the top three being Oil and Gas, Manufacturing, and General.”

- Data from the National Bureau of statistics also reveal the Manufacturing sector has posted a GDP growth rate every quarter since 2021.

- The sector grew by 5.89% in the first quarter of this year the fastest quarter in about a decade. The manufacturing sector is also now contributing 10% of GDP up from 9% in 2016.

Apart from forcing banks to extend credit to the private sector, especially manufacturing, the CBN has also contributed its fair share via several intervention policies.

In its latest MPC, it stated, that Cumulative disbursements under the Real Sector Facility currently stand at N2.183 trillion for the financing of 414 real sector projects across the country.

Challenges still abound

Despite the increase in lending to the sector, the Manufacturers Association of Nigeria complains of higher interest rates, inflation rates, and access to forex as challenges affecting growth in the sector.

Recent Nairametrics data reveal maximum lending rates are on track to top 30% as banks.

- Just recently, Mr. Mansur Ahmed, President of MAN, noted urged the need for both sectors to work together to reduce poverty, attract investment and boost economic growth.

- He said, “The traditional industry-bank lending relationship is no longer supporting the growth of the industry, the bank, and the economy, as a whole. Industry activities have massively declined to show a rising number of moribund industries across the country and the increasing capital flight. “Based on this information, it is important that the commercial banks and the industry should come together to chart new ways of supporting each other to the benefit of all.”

However, CBN’s Deputy Director, Financial System Stability Directorate Mr. Eboagwu Ezulu, recently urged the Manufacturers Association of Nigeria (MAN) seeking cheaper loans to approach the development financing institutions like the Development Bank of Nigeria and Bank of Industry for their funding needs.

Credit Boom

Data from the central bank also shows total credit to the Nigerian Economy is now at all-time high of N57.2 trillion made up of N17.9 trillion to the government and N39.2 to the private sector. Private sector lending of N39.2 trillion includes loans from banks, non-deposit money banks, and the central bank’s intervention loans.

- A recent Nairametrics article detailed the effect of the credit boom on Nigeria’s galloping inflation rate, indicating that the economic growth it is creating is not outpacing the inflation rate.

- Growth in the money supply is now seen as a major catalyst for driving the inflation rate. Most of the growth is in the form of loans to the public and private sectors of the economy respectively.

- As credit rises across the economy, the central bank will hope that it leads to faster economic growth by the time the Bureau of Statistics releases its second quarter GDP data.

A greater percentage of workers in the banks( especially Polaris) are contract staff . These workers are underpaid, no profit sharing and even suffer inadequate health scheme etc. This amounts to poor output coming from demoralised staff. Most a graduates and have spent many years in the industry without due consideration and are asked to leave afterwards without adequate compensation. FGN, please look into this keenly.

Thank you.