Lending rates for commercial and personal loans are expected to climb following the recent hike in monetary policy rates by the central bank monetary policy committee.

This is based on data from the central bank’s money market indicators which shows a relationship between interest rate hikes whenever monetary policy rates are increased.

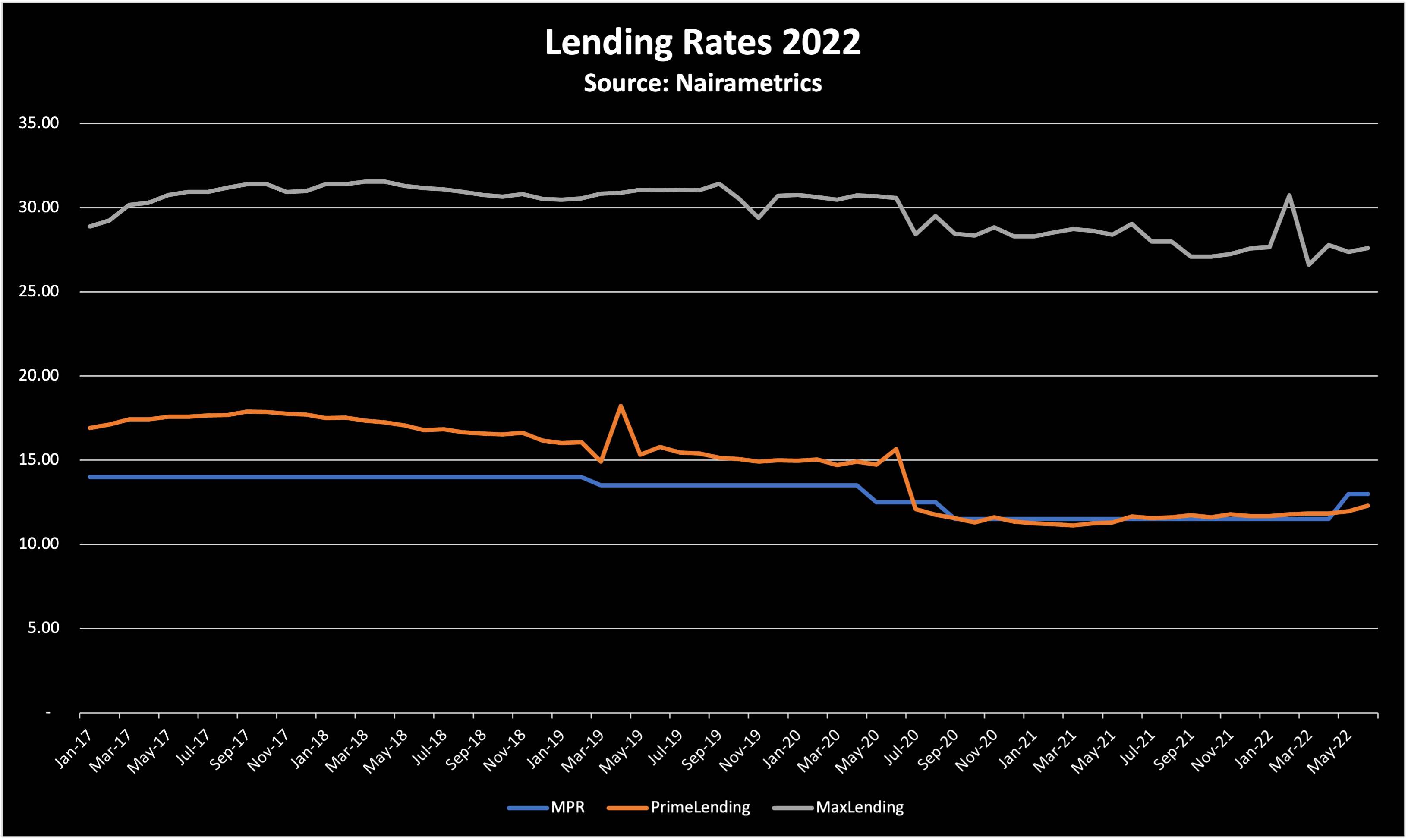

Data from the report shows Nigeria’s prime lending rate (which is the average lending rate in the country) printed at about 12% much lower than the current MPR of 14%. The prime lending rate is the lending rate offered to large corporations and blue-chip companies with near triple-A ratings.

Rates may spike

But while the Prime Lending rate is currently 12%, the Maximum lending rate is 27.6% more than double the existing prime lending rate, a delta that has existed for years as banks price in the risk of lending to small businesses and individuals.

- Things could get worse if the trends we have seen in recent years repeat this time around.

- Nigeria’s CBN raised its benchmark monetary policy rate to 14% in its monetary policy committee. meeting held on July 19, 2022.

- The last time the monetary policy rate was 14%, the prime lending rate was as high as 17.8% while the maximum lending rate also rose to as high as 30%.

- This was in 2017 when the country also faced a similar forex crisis with exchange rate disparity between the black market and official market rate widening frequently amid forex scarcity.

Banks increase interest

Commercial Banks in Nigeria implemented interest rate hikes for loans raising rates by as much as 200 basis points (2%) when the CBN increased MPR from 11.5% to 13%

- The interest rate hike is in response to the recent increase in the central bank’s monetary policy rate (MPR) which was jacked up from 11.5% to 13%, a one-hundred-and-fifty-point basis point increase.

- We believe this trend will continue in the coming days and weeks as the CBN moves to curtail inflation.

- But while banks are often quick to increase lending rates they hardly increase savings deposit rates.

What this means

Nigeria’s central bank has implemented a dovish monetary policy rate since the Covid-19 pandemic broke as it pursued a policy of stimulating the economy.

- This has meant keeping its monetary policy rates low so that lending rates can be low thus inducing borrowing and stimulating the economy.

- However, it had no choice but to jack rates up from 11.5% in September 2020 to as high as 20% in April 2022, in response to surging inflation.

- A rate hike is also being triggered by the huge disparity between the black market and the official rate which is also driven by lower interest rates as people will have access to cheap funds that can borrow and buy dollars for currency speculations.

- If lending rates rise as expected, companies will incur higher lending rates and could see their profits dip due to these additional charges.

- Mortgage rates and rates for other loans such as personal loans and consumer loans could also likely rise.

But, but, large corporate borrowers have also turned to bonds as a viable and cheaper borrowing option meaning that prime lending rates could rise slower while maximum lending rates offered by more risk-averse lenders will have to rise.