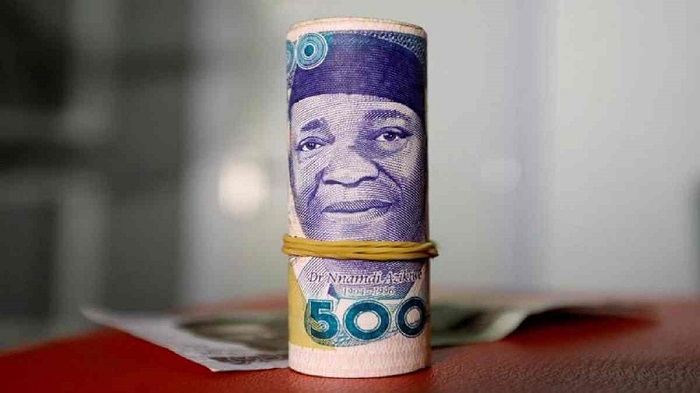

The naira continued to devalue against the dollar as it traded at N630 per dollar on Tuesday. However, the official market saw it trade at N430 to the dollar because of the persistent scarcity of the currency, resulting in a differential of N200.

Due to shortages of dollars and an increase in the number of Nigerians keeping it as a safe haven asset, the naira depreciated as a result of end-user demand pressure.

Despite the fact that many worldwide currencies have declined in value versus the dollar, the naira, which is the largest economy in Africa and a key reserve currency, has fared the worst.

Although it is true that many worldwide currencies have declined in value against the dollar, the situation is worse for the naira because Africa’s largest economy and top oil producer continues to import petroleum products, distorting its export margins.

Nigeria’s economy, which is a genuine reflection of the naira, is in terrible shape. About 40% of Nigerians, or over 90 million people, live in extreme poverty. Food production is anticipated to decline due to fertilizer shortages caused by the Russian/Ukrainian war; Nigeria has also yet to fully recover from the devastating effects of Covid-19; the rising insecurity that has hampered agricultural activities is having a different impact on Nigeria’s food security; food inflation, according to NBS, stood at around 18%; and finally, food prices are expected to rise in the coming years.

The N17 trillion budget for 2022 is being pulled in more than a N6 trillion deficit, and the majority of that money will go toward debt servicing.

The value of the local currency continues to fall, and the country is still not producing much; the unemployment and underemployment rates were 33% and 22% respectively.

Due to the Central Bank’s ongoing involvement in the FX market to maintain the stability of the local currency, the Nigerian foreign reserve has been on the decline.

Complicating Nigeria’s currency liquidity despite high oil prices is Nigeria’s state oil company (NNPC) Limited which has, for many months, failed to remit its statutory funding to the Federation Account which is jointly operated by the federal, state and local governments, amid falling oil production, rising subsidy payments and high oil output costs.

Consequently, for participants in the economy, the exceptional currency depreciation has the following effects: high cost of production due to our manufacturing sector’s heavy reliance on imported raw materials, and high operational costs across industries.

Market analysts say that the nation must concentrate on becoming a producing economy over the medium to long term in order to sustain interest in the local currency. Under any crisis, the exchange rate will be under pressure if Nigeria cannot export high-quality goods coupled with tackling the oil theft menace that is making the country lose billions of dollars yearly.

I could not see how black market play a role in this write up.

Black market in the topic but not in the writeup.

Good write up, what why is the main reason black market rates are so high