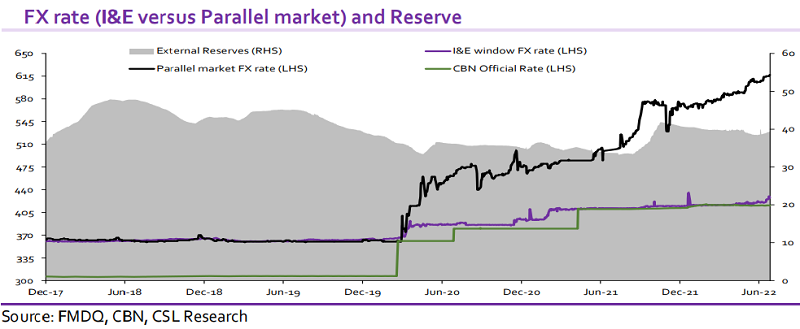

The Naira has fallen to low levels during the week, as traders adjusted prices to reflect the rate Central Bank of Nigeria sold the currency amidst the ongoing dollar scarcity. The Naira fell 0.1% to N428.16/US$ at the investors and exporters window (I&E window) yesterday. Nigeria is experiencing one of its worst FX crises in history due to increasing demand for FX amidst low supply.

According to bank treasurers, the CBN has stopped its bi-weekly sale of FX to Foreign Portfolio Investors (FPIs) for the second week. This, many believe, is to clear the outstanding backlog of contractual obligations to supply FX to FPIs through the banks that have not been met. Based on CBN data, foreign reserves are down 2.9% compared to the position as of December 31, 2021.

Despite the high oil price, occasioned by the Russia-Ukraine war, Nigeria has failed to benefit from it due to limited production and the maintenance of a subsidy regime, which is estimated to cost the country at least N4trn this year. High oil prices imply an increased cost of refined products and Nigeria continues to spend a huge part of its FX earnings on the importation of Petroleum Motor Spirit (PMS) and other refined products due to the complete absence of local refining capacity. The country has also failed to increase its non-oil exports despite a few projects introduced by the CBN, such as the RT200 FX programme.

Crude oil with decreasing production capacity continues to dominate the export earnings with a total value of N5.62trn representing 79.16% of total exports as of Q1 2022. CBN is unlikely to ramp up intervention levels at the I&E window in the near term as inflows remain tepid. We project the FX reserves to deplete to US$35.00 billion by the end of 2022.

Meanwhile, the current parallel market premium of c.44% continues to fuel arbitrage opportunities while FX rationing at the IEW has magnified the demand pressure at the parallel market. Our prognosis is for the premium to remain widened, as the CBN is yet to resume FX sales to the BDCs, and importers of many items remain barred from sourcing FX from the official window. Also, there has been a surge in demand from FX from an increasing number of Nigerians migrating to the UK, taking advantage of the new immigration laws.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.

A man who knows the job and he deserves applause