Ghana is likely to ask the International Monetary Fund (IMF) for as much as $1.5 billion in a quest to strengthen its finances and regain access to international capital markets.

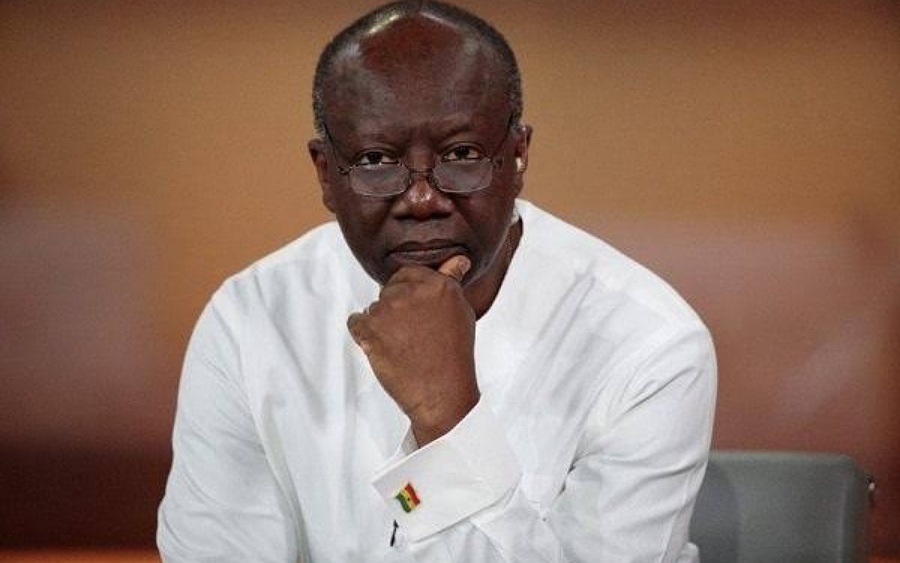

This was disclosed by the country’s Finance Minister, Ken Ofori-Atta in a phone interview with Bloomberg, hours before talks begin with the IMF in the nation’s capital, Accra.

Until now, Ghana, the continent’s second-biggest gold producer, had refused to seek IMF support to rescue an economy crippled by the pandemic, rampant inflation, and a depreciating currency, despite analysts warning it is close to a debt crisis.

What Ghana’s Finance Minister is saying

Ofori-Atta stated that it was a hard decision, but the right one “because the global outlook was really grim and its negative effects on the Ghanaian economy was glaring.”

After Moody’s Investors Service cut Ghana’s rating, the nation lost access to overseas capital markets and “hence our inability to get the needed dollars, which created balance of payment problems and a possible rundown of our reserves.”

Ghana will present the IMF with its own plans. The nation’s finance ministry said on Tuesday in an emailed statement that the government’s plan, which would last at least three years, aims to restore debt sustainability and macroeconomic stability, improve the monetary policy of the central bank, and provide buffers against economic shocks.

“This program allows for a catalytic engagement, including regaining access to the capital market,” Ofori-Atta said in the interview, adding that Egypt’s talks with IMF earlier this year encouraged the North African nation to sell Samurai bonds.

What you should know

- The Ghanaian cedi came under pressure after racking up a whopping loss of 22.44% against the US dollar. This comes despite the attempt by Ghana’s central bank to hike interest rates to offset shortfalls caused by global tensions in Europe

- Ghana’s foreign-exchange reserves have dropped to $8.3 billion at the end of April, from $9.7 billion at the end of last year.

- The nation’s central bank in May lifted its benchmark interest rate by 200 basis points to 19% in a bid to slow inflation, which accelerated at 27.6% in May.

Furthermore, the conflict between Russia and Ukraine is expected to have a substantial impact on Ghana’s exchange rate, particularly in the construction, agriculture, and international trade sectors.

Russia and Ukraine accounted for around 2.5% of Ghana’s total, non-oil imports and 0.4% of Ghana’s total exports in the recent past.

Ghana has been working to reduce its debt, which at the end of March 2022 was 78% of its GDP, up from 62.5% five years earlier.