The government of Ghana has said the country is committed to managing its debt without assistance from the International Monetary Fund (IMF).

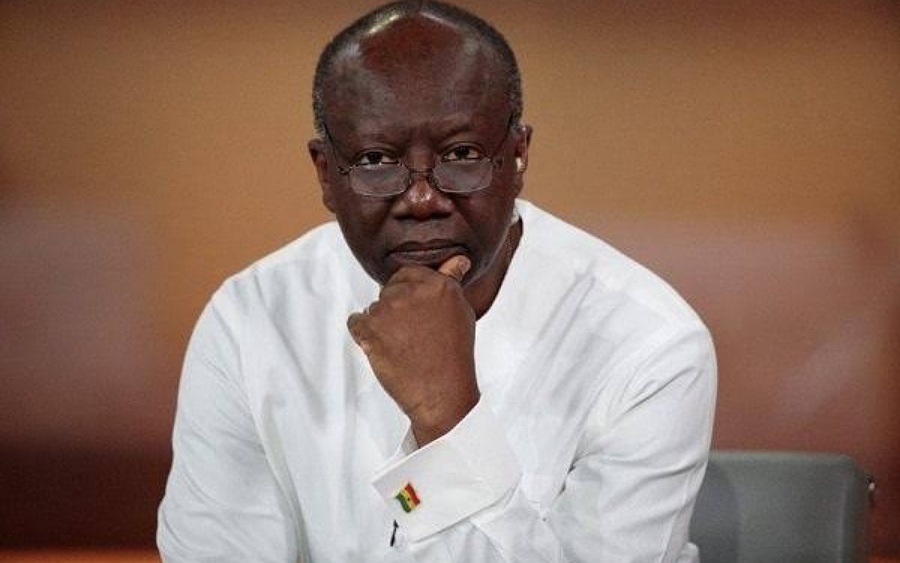

Ken Ofori-Atta, Ghanaian Finance Minister said this while expressing his confidence that government measures were moving the country in the right direction.

According to Government data, Ghana’s total public debt at 77% of its gross domestic product as of 2021, has pushed the country to the brink of crises.

What Ghana is saying

During a media conference in Accra, Ken said, “We have committed to not going back to the Fund. The Fund knows we are [moving] in the right direction. It’s about validating the program we have in place and finding other ways of handling our debt.”

Noting that its interest rate is three to four times higher than foreign debt, the finance minister who said the country is keen on solving the country’s domestic debt added that another interest rate hike would be a knee jerk reaction to imported inflation as prices continue to increase following the March increase.

“We need to decide ourselves what structure would be useful to us. We need to figure out an approach that in a way gives us fiscal space,” he said.

What you should know

- Nairametrics reported that Ghana’s inflation rate reached 23.6% in April from 19.4% in March.

- War in Ukraine and a ban on palm oil export by Indonesia led to higher costs of imported goods such as cooking oil and gasoline and reflected in the headline inflation that surpassed the central bank’s target band of 6% to 10% for the country.

- In its bid to tackle inflation, reduce the public deficit, restore a depreciating local currency and reassure spooked investors, the Ghanaian government had announced a spending cut geared towards reducing its spending.

A Finance Minister and Think Tank roles of the ministry, is answers to persistent and ailing debt and it Continuition, by rivetalized good instituted measures for internally an improved sources of fund than dependency on foreign sources. Like in the case of Ghana and the suggested way out.