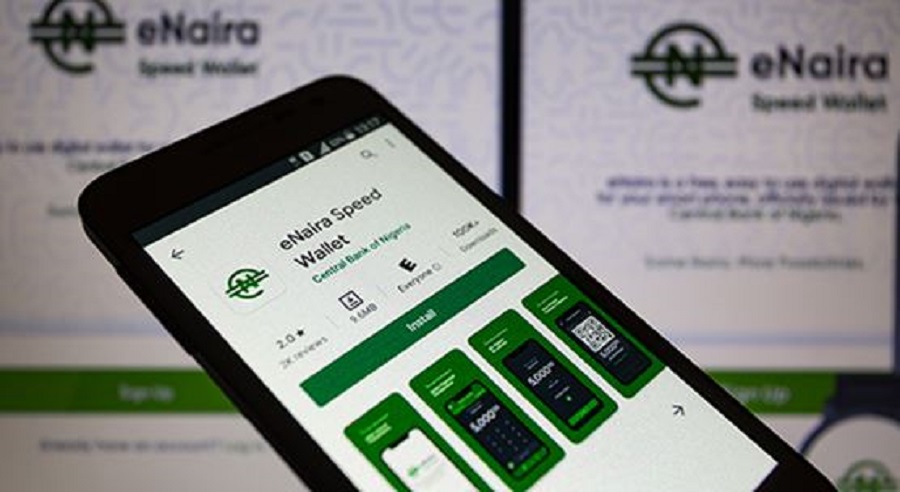

The Central Bank of Nigeria (CBN) has announced that the eNaira’s next update would support DSTV renewals, recharge card purchases, air travel ticket payments, among others.

This was disclosed by Yusuf Abdul Jelil, eNaira project representative, at an event for the sensitisation and activation of e-Naira Wallet organised by the CBN in collaboration with Oshodi Market leaders.

According to NAN, traders at Kairo Market in Oshodi, Lagos, praised the Central Bank of Nigeria (CBN) for introducing the digital currency, e-Naira.

What the CBN is saying

Yusuf Abdul Jelil revealed that the CBN will broadcast a message over eNaira from now until next week, urging users to update their speed in order to make use of services such as DSTV renewals, recharge card payments, and air trip ticket purchases, among others.

“Any moment from now, there is an update coming, you will get a message on your app directing you to update your eNaira speed wallet. Once you update, those services you are asking for will be there whereby you can pay for DSTV, buy a recharge card, pay for airfare and so on. Within this week or early next week, you will get an alert asking you to update on your app and once you update, all these will be available,” Jelil said.

He added, “Even if you do not have an account, we are also going to have a USSD whereby you can make transactions. The USSD code is 997. It is coming with the update.”

He explained that the CBN is now in the second phase of the eNaira onboarding process, with the first part focusing on persons who already have bank accounts.

“But now we are focusing on people who do not have any bank accounts. So that means there will be USSD code they can use to onboard and do transactions,” he said.

Mr Obinna Umeh, the Secretary of the Oshodi Market Union, praised the CBN for providing a long-term solution to the frequent bogus alerts received by traders, saying that they had been impeding their operations.

He said, “The CBN couldn’t have come at a better time to educate us about e-Naira; there’s almost no day we don’t have to settle disputes about fake alerts, times that we could channel into more productive things.

“I want to applaud CBN for bringing this to Oshodi; as we all know once e-Naira gets running at our market, other big markets and small ones will queue in too. Don’t forget Oshodi is the hub of business in Lagos State. I’m happy that e-Naira will help us find lasting solutions to our challenges. We have lots of questions but I am confident that we will get all the answers,” he added.

What you should know

- Africa’s first digital currency, eNaira, has been ranked No 1 global retail CBDC, and app downloads have jumped to 756,000 from 700,000 seen in December 2021.

- PwC disclosed the ranking in its 2022 CBDC Global Index and Stablecoin Overview. The eNaira has also recorded 700,000 downloads as of December 2021, while over 35,000 transactions have been conducted on the platform.

- The report also gave Nigeria’s eNaira a retail index value of 95 while the country also ranked number one in Africa. The index is based on a BIS working paper, the World Bank, and PwC analysis.

- The IMF has warned about the potential expansion of the use of the eNaira for cross-border fund transfers and agency bank networks could lead to new money-laundering and terrorism financing risks.

- The IMF welcomed the gradual rollout of the CBDC and highlighted the need for vigilance to various risks, including monetary policy implementation, bank funding, cyber security, operational resilience, and financial integrity and stability, through regular risk assessment and contingency planning.

Masha Allah day will be a great well done job, we really do appreciate u for bringing us into dis.