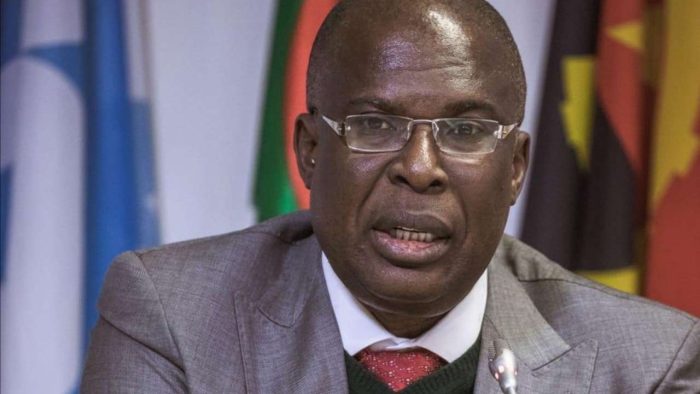

Mr Timipre Sylva, the Minister of State for Petroleum Resources has said that NNPC has kicked off steps for the implementation of the Petroleum Industry Act (PIA) in the upstream sector of the oil and gas industry.

He said this at a 2-day upstream stakeholders forum organised by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) in Abuja.

He said the forum was convened to enable them harness the necessary inputs from various stakeholders to further clarify the draft regulations and the eventual firming up of the final regulations for use.

What the Minister is saying

The minister noted that in order for Nigeria to be relevant in the global market, it must focus on balancing the energy-based load for Nigeria in designing any regulation.

- Speaking on the importance of the event, he said, “It is believed that a robust engagement such as this will create the platform for all of us to brainstorm in a constructive manner.

- “It will also harness the necessary inputs from various stakeholders to further clarify the draft regulations and the eventual firming up of the final regulations for use.

- “However, the challenge posed by the huge divestments in the hydrocarbon explorations by oil majors in the country in the past as a result of the global energy transition calls for more innovative ways in the exploitation and exploration of fossil fuel in the country.

- “If we must continue to be relevant at the global stage, we must, in designing any regulation, put in focus how we can balance the energy base-load for Nigeria.

- “This will ensure that we will not be left behind in the energy transition train while still harnessing our rich natural hydrocarbon reserves.”

Also speaking at the event, Mr Gbenga Komolafe, the Chief Executive Officer of the NUPRC said the stakeholders’ forum is a critical milestone in the implementation of the PIA.

“Also, aside from the statutory imperative on the part of the commission to have the regulations finalised in time-specific manner, there is also the compelling need for us as a nation to conclude the regulation-making process for implementation of the PIA.

“This will ensure that the PIA is in full throttle and in a manner that will enable Nigeria hedge against the impact of energy transition while taking advantage of the oil and gas supply gap resulting from the current developments in Russia and Ukraine,” Komolafe said.

He said the six draft regulations up for review at the forum include: The Nigerian Upstream Fee and Rent Regulations, the Petroleum Licensing Round Regulations, the Domestic Gas Delivery Obligations Regulations, the Nigeria Conversion Regulations, and the Nigeria Royalty Regulations and the Nigeria Host Community (Commission) Regulations.

What you should know

- The PIA was signed into law by President Buhari on August 16, 2021. It was enacted to repeal the extant Petroleum Act 2004

- It provides for the legal, governance, regulatory, and fiscal framework for the Nigerian Petroleum Industry.

- It also provides for the establishment, and development of host communities and other related matters in the upstream, midstream and downstream sectors of the petroleum industry.

- Nairametrics Reported that in August 2021, President Muhammadu Buhari approved a steering committee for the commencement of PIA implementation.

- The committee was to be headed by Mr Sylva with a duration of 12 months for the completion of the assignment.