Efficient capital markets are built on transparency and universally applied rules. These deliver the predictability and – above all – the trust required for individuals and corporates to risk their hard-earned cash for reasonably predictable and safe returns.

As returns increase, and are broadly seen to increase, trust grows.

Registrars play a key role in capital markets. By keeping and maintaining a register of investors on behalf of issuing companies, Registrars ensure that investor data are up to date while disseminating relevant information to shareholders, organising Annual General Meetings and, most importantly, facilitating shareholders’ dividends payment in line with issuing companies’ declarations. Registrars are also involved in the dematerialisation of shares, probate processing for conversion to estate accounts, asset reunification and depository interest administration and payment.

While investors’ journey from the acquisition of shares via application and allotment through to secondary market activities, the Moment of Truth remains the dividend pay-out or direct settlement.

“It is mainly at pay-out that investors form an opinion about the market operators based on their experience. This experience then becomes a form of advocacy – or otherwise – for other people,” says Chiamaka Ugo-Obidike, Head of Customer Experience at Coronation Registrars

Sitting at the interface between the investment industry and individual Nigerian investors, Registrars have a fiduciary obligation to build public and corporate trust in the securities investment process – creating the confidence that the Investors will receive the dividends declared by the issuing companies in an efficient manner.

Unfortunately, since the global financial crisis in 2008, the experience of many Nigerian investors – especially when it comes to The Moment of Truth – has left much to be desired.

The 2008 Global Financial Crisis saw a lot of securities investments fail. Since, at the time, there was very little transparency, and even less detailed reporting, people simply lost their money – without explanation or recourse. Harrowing tales of institutional collapse, oversight failure and customer frustration arising from the attendant financial losses, continue to tarnish the reputation of securities investment in Nigeria.

“Combined with Nigeria’s long history of unclaimed dividends, valued in the region of N154 billion, Nigerian Registrars have their work cut out for them if they are to build broader trust in the country’s capital markets,” says Ugo-Obidike.

Coronation Registrars, formerly United Securities, was rebranded in 2020 – with the express purpose of addressing the trust deficit in the Nigerian securities investment sector. Coronation has invested in people and technology to foster a culture of transparency and accountability. Pioneering the introduction of electronic polling, e-dividends, e-bonus, e-notifications and e-lodgement, Coronation has built a world-class securities register and data administration service in Nigeria. Most recently, Coronation Registrars launched Coronation ShareholderLive, a robust self-service online platform that enables investors to monitor their shareholding while performing a host of other investment functions – all from the comfort of their homes.

But one Registrars business fighting to restore trust in Nigeria’s capital markets – no matter how innovative – is not enough.

Coronation recognised that if “Nigerian investors are to truly trust the securities investment process and broader capital markets, an ecosystem approach is required. Only by enlisting the support and cooperation of all industry players would Nigeria move the dial on investor experience, unclaimed dividends and, ultimately, trust,” explained Ugo-Obidike.

As such, Coronation Registrars is currently championing transparency in Nigeria’s securities investment sector by working with other Registrars, banks and relevant government agencies to identify pain points and then, jointly, coordinate the industry-wide collective solutions required to relegate low trust and unclaimed dividends to history.

Persistent investor pain points include:

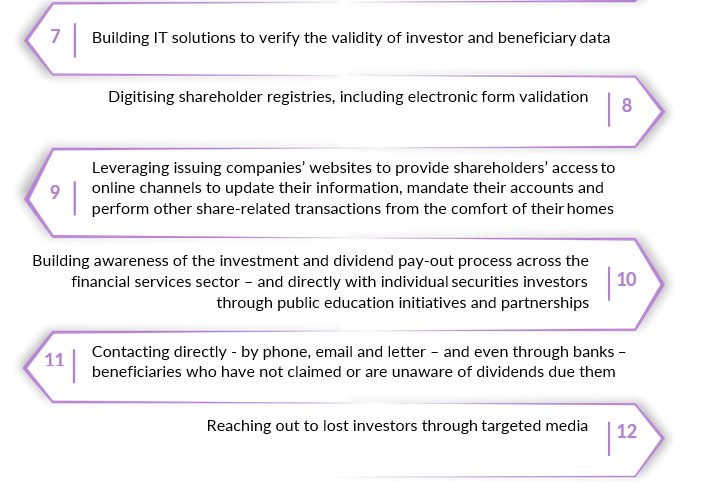

Collective solutions designed to broaden transparency and deepen trust include:

All these initiatives are seeing a reduction in the number of untraceable beneficiaries as Nigerian Registrars increasingly take control of – and responsibility for – the securities investment process, especially from a data and transparency perspective. This is also reducing the number of data-compromised investors on state, bank, client, and registrar inventories. “Collectively these initiatives are fostering a culture of cooperation and transparency across the Nigerian financial services sector,” reports Ugo-Obidike.

Today, there is broad acceptance and support that transparent and efficient capital markets benefit all. Coronation Registrars is confident that these and many other concerted efforts by players in Nigeria’s

capital markets are making securities investment a safe, transparent, and predictable process in which

investors can be confident of efficient dividends payment.