The first MPC meeting for 2022 ended with no dramatic outcomes, as the apex bank stuck to the policy posture maintained all through the preceding year. Caught between the policy tightropes of managing inflation and economic growth, the Monetary Policy Committee (MPC) maintained a hold approach in January.

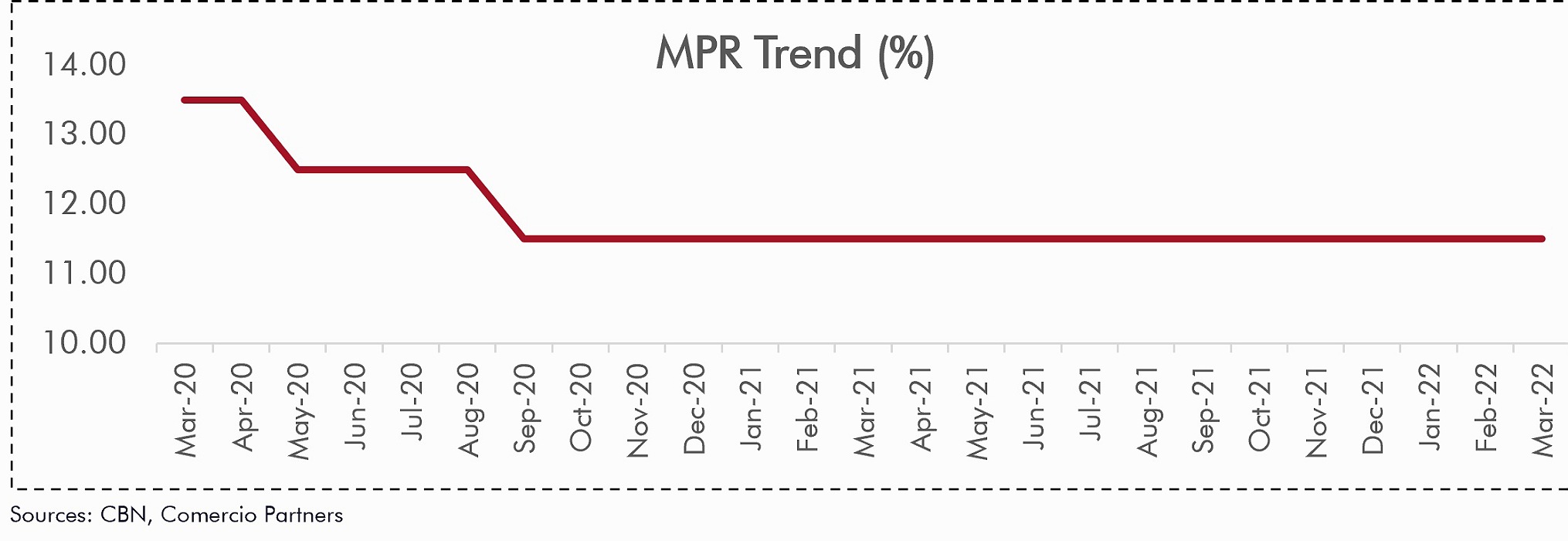

The MPR was kept at 11.50%, with an asymmetric corridor of +100/-700 basis points around the benchmark interest rate; CRR was retained at 27.5%; and the Liquidity Ratio was left at 30%.

Major domestic economic changes since last Meeting

Since the last MPC meeting in January 2022, there have been noticeable movements in dominant macroeconomic variables. The YoY headline inflation reversed a trend of deceleration that was seen in January 2022, as headline inflation for February 2022 rose by 10bps to 15.70%; Brent futures surged by 22.37% from $88.20/bl on the 25th of January 2022 to $107.93/bl last Friday; local crude oil production fell by 10.08% from 1.40mbpd in January 2022 to 1.26mbpd in February 2022; the exchange rate of the Naira on the I&E FX Window fell by 17bps from $1/ ₦416.33 to $1/₦416.50; and the position of our FX reserves declined by US$548.27 million from US$40.21 billion on the 25th of January 2022 to $39.67 billion on the 18th of March 2022, as the central bank continues to tap into the nation’s buffers to defend the naira.

March’s MPC Outcome

While acknowledging the trend of economic growth witnessed over the last five quarters, the MPC noted the economic distress posed by global inflationary drivers that have been exacerbated by the crisis in Eastern Europe. Nonetheless, given the limited ability of monetary policy levers to effectively tame the impact of the convergence of global and domestic inflation forces, the committee sought to sustain its hold approach, albeit with some dissenting voices.

Accordingly, at the end of the two-day bi-monthly MPC meeting, all policy levers were maintained, with six members voting to retain the benchmark rates, three looking to hike rates by 0.25%, while the last member recommended a 0.50% increase.

- Monetary Policy Rate (MPR): 11.50%

- Asymmetric corridor around the MPR: +100/-700bps

- Cash Reserve Ratio: 27.50%

- Liquidity Ratio: 30.00%

Analyst’s Comments

The MPC’s move to retain its policy posture is predicated on the limited impact of the MPR to assuage worsening inflationary pressures, as well as the committee’s confidence in its balanced policy approach which leverages the relatively high cash reserve ratio and liquidity ratio to moderate liquidity, while simultaneously achieving some level of economic growth.

However, the inability of the committee members to unanimously agree on the direction of the MPR essentially signals a level of hawkishness. On inflation, the MPC’s optimism regarding a sustained moderation in both food and headline indexes may be constricted, as the comfort provided by the CBN’s strategic grain reserves may be dampened by an energy-driven surge in the freight cost of food items, the usual food scarcity seen during planting seasons, and legacy problems that typically disrupt food production and supply.

Looking ahead, the decision by major economies like the U.S. to commence hiking interest rates should eventually compel a similar move from the MPC in subsequent meetings, in order to limit the repatriation of foreign funds that typically succeeds hawkish policy decisions in developed economies. Already, we saw four dissenting voices in the ten-man committee advocating for an increase in the benchmark interest rates at the just concluded MPC meeting, and we see the position to raise the MPR becoming more compelling as advanced economies sustain their hawkish stance, while local inflation worsens.

Click HERE to download the report.