Every December, I run a “Financial Health Check (FHC)”. It’s a series of financial activities designed to track and establish net income (or deficits), review assets, and understand the cash flow occurring in and out of your budget. If you have not done or maintained a budget, the FHC is a great way to start one.

The concept of a health check is similar to you going to your doctor to get your annual medical checkup. You do not have to be sick to get a checkup; you go to look over your vitals, like your blood pressure; to catch any problems early, thus allowing corrective action to be taken. Getting a health check is a preventive as well as a curative measure. An FHC is similar; as it offers the opportunity to review your financial plan and take control measures.

A Financial Health Check is not a financial plan

A financial health check is not a plan or goal. The FHC is a self-audit of your budget and spending. Its objective is to manage and control a previously agreed financial plan or purpose. After an adequately done FHC, the investor can make strategic changes to an existing project, e.g., invest more here, spend less here, claim this tax advantage here’.

What do you need to do a Financial Health Check?

To do an annual financial check, you will need your spending record for 30 days (I prefer 90 days). You will also need your record of assets and liabilities, your banks, etc. most importantly, and you will need the time to do this

Process of an FHC

The FHC commences with a review of your life events, government regulations, etc. For instance, did your marital status change? A significant difference is a major fiscal and financial event. What about Inflation? Did it rise significantly in the period under question? These changes should be incorporated into your review, especially if you have done an FHC before.

Next, you must establish where you stand in the present by conducting a static checkup on your finances. To this, we do five steps

A. Track income and expenses

Take a notebook or excel sheet and track every kobo you earned and spent in the last 90 days. Income is easier to follow if it flows to a bank account. Still, because we may be spending using cash, we can use expense tracker applications like Monefy®.

You can also do this for 30 days at the minimum. You record every expense, no miscellaneous. After you generate a record of your income and expenses, you create categories for all your expenses. For instance, below in Figure 2 is my list of 13-day spending.

Figure 2: Expense Tracker

B. Create Categories

From my expense tracker example, I can then create categories for Food, Active Income, Accommodation, Interest paid, and Utilities.

I created four-category headers as below

- Income: Active Income and Passive Income

- Expenses: Non-Discretionary and Discretionary Income

Income Category

Active income is my income generated from actively being in or at work. Passive Income is Income generated without being physically present or running any activity, e.g., If I buy shares in Procter and Gamble, I earn dividends. That’s passive income.

See Figure 2 below; I have broken my Income into Active and Passive. This segmentation is an important step, and we will link this later to our expenses

Figure 2 Income Sheet

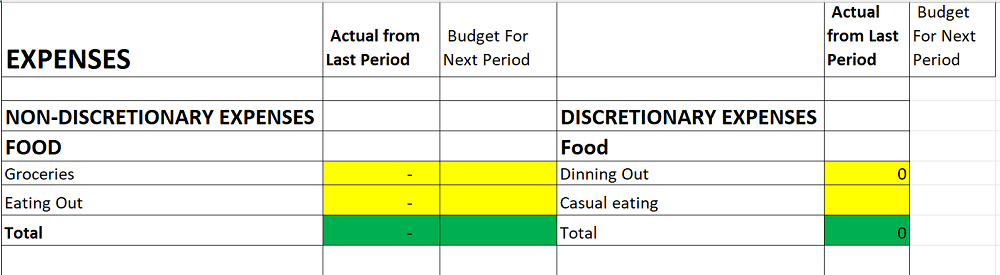

Expense Category

Similarly, for expenses, Discretionary and Non-Discretionary Expenses (NDE). Discretionary are expenses you can make at your discretion, e.g., buying a new pair of shoes, while non-discretionary expenses are those you must make irrespective of income level, e.g., food & Rent

Figure 3: Expenses Sheet

Findings: Income and Expenditure

After posting income and expenses, you have a clear idea of where you stand. You know how much you make and where you are spending your income. You can then take corrective action by either increasing or correcting a budget. E.g., if your spend too much eating out, you can reduce your dining out budget and spend more on groceries

What are my findings from the Income & Expense sheet?

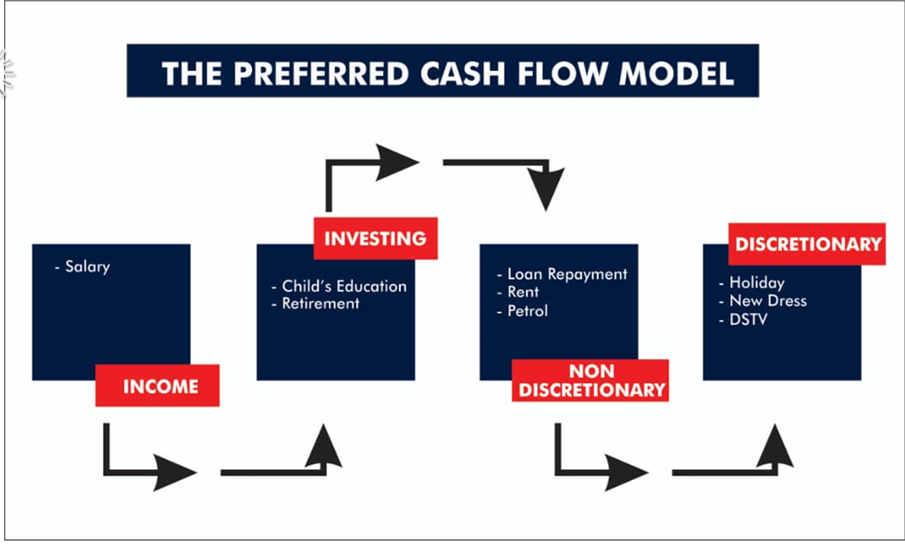

i. Pay Yourself First. My goal is to invest first before I even spend. See Figure 4 below.

Figure 4. The Preferred Cash Flow Model

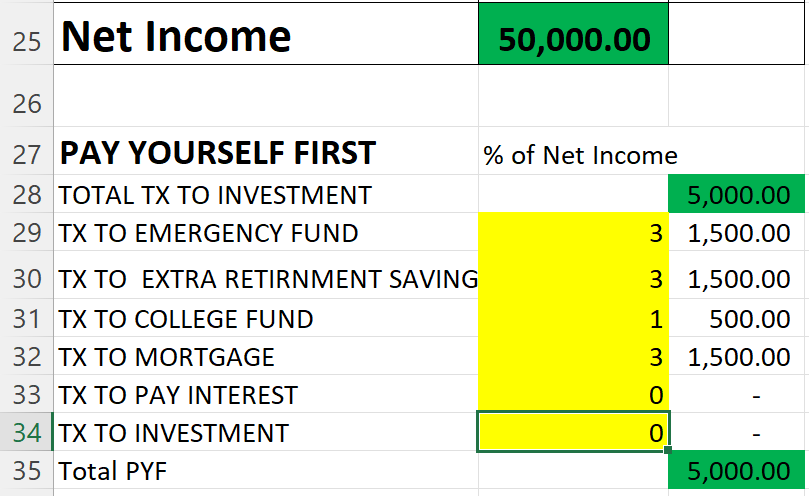

ii. Save and Invest a proportion of your net income surplus to your financial plan. It is essential to continuously invest into your target investment plans, including additional retirement savings or a child’s education fund. I allocate 10% of my net income to my target funds from my table as below in figure 5.

Figure 5: Target Fund Allocation

iii. Next, I compare my total Net Income to my Total Non Discretionary Expense; this must be a positive figure. In essence, what you are earning from all income must cover your Non-Discretionary Expenses. If it does not, you need to stop and review your income or expenses.

iv. Compare my total Net Income to my Total Expense. While we recommend a positive figure, if you are over-geared (borrowing too much) or spending too much, this figure will be negative. You thus have a target to bring it to be positive ny writing a budget that reduces expenses appropriately.

v. Compare my total Passive Income to my Total Non Discretionary Expense; this is your long-term goal. You want to grow your passive income to meet and exceed your Non Discretionary Expenses. This is financial independence, and it equals when you can meet your bills from just your passive income. Look at this as a retirement goal; you can retire when your passive equals your NDE.

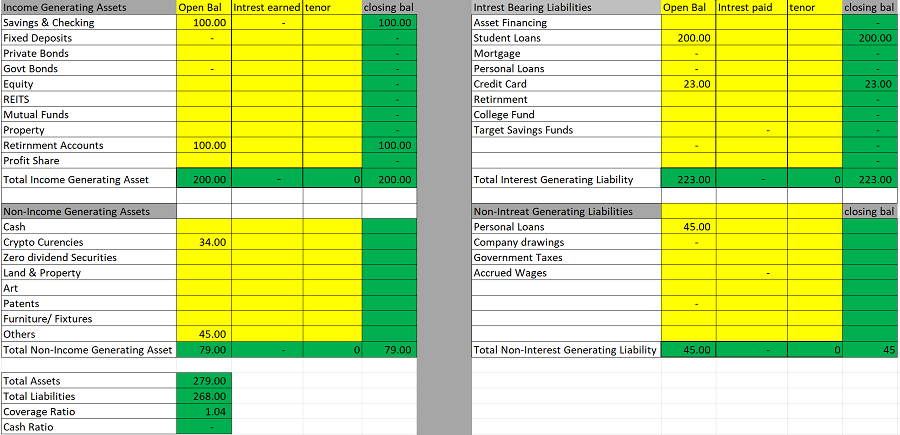

C. Analyze your assets and liabilities.

Get all your assets and liabilities, and then categorize them into

- Assets; Income earning & Non-Income Bearing Assets

- Liabilities: Interest bearing and Non-Interest-bearing liabilities

For instance, if you have a student loan, the loan will fall under interest-bearing assets. What about a loan from the bank to buy a home? The house goes to non-income-generating assets (Income Generating if rented out). Still, the mortgage payments go to Non-Discretionary Expenses.

This is my sample balance sheet

Figure 6: Cash Balance Sheet

Findings: Balance Sheet

- At best, you want to have a positive Networth. Net worth is your assets less your liabilities

- You want to fund your interest-bearing assets with income-generating assets. So if you use a loan, you want loan proceeds to generate income for you or reduce expenses.

- Many assets are non-income generating, e.g., country mansion. Seek to fund these without taking loans.

D. Analyze your cash flow

Looking at the cash flow is very important to determine if your current cash flow is skewed right, i.e., are you living off debt? Analyzing your cash flow also gives a topline visual of what categories are eating up cash flow. It is essential to understand assets are very different from cash. Cash generation is vital to pay off loans and invest. You can be asset-rich and cash-poor, which is not harmful but essential to remain liquid.

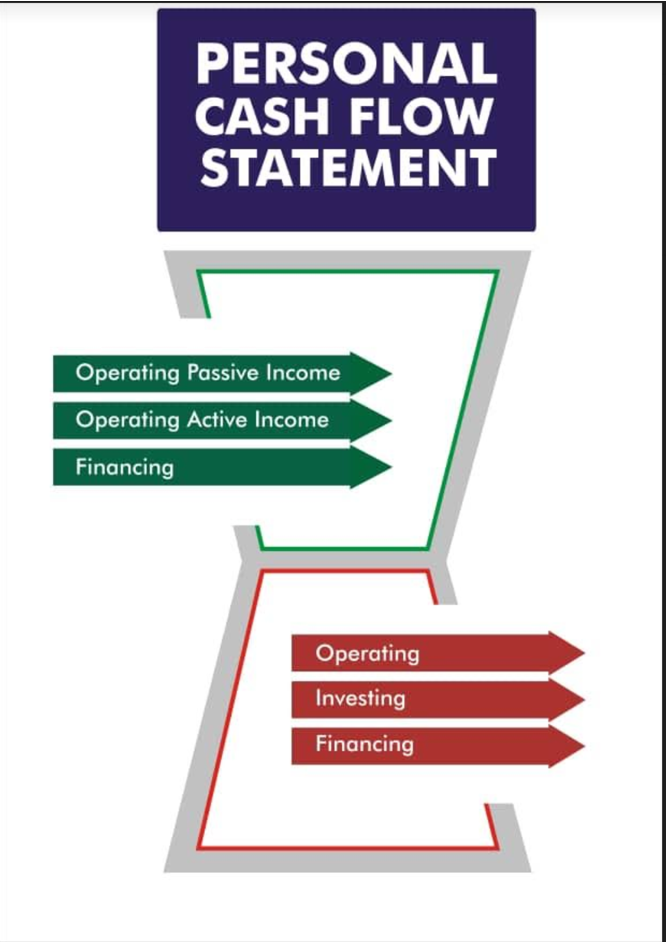

There are three main cash inflow and outflow categories

- Operations; day to day spending

- Investing; cash used in buying more assets

- Financing; cash used to pay interest costs

This is a sample

Figure 7: Personal Cash Flow Statement

Cash Flow Findings

Seek to have positive cash flow, reduce financing cash flow as you get older, look to grow passive income

Final Review

If this is your first time doing a financial health check, this year 0 becomes your base to review annually or even quarterly. Suppose you can afford to work with a financial adviser? In that case, it’s preferred, but this can be DIY with an app like Mint, which can track expenses. It is also essential to constantly update your plan significantly if life events change. The FHC, if appropriately done, should make you ask questions, e.g., why are my assets growing? Contributions or investment returns? You can then see what you are doing right and improve what to improve upon.

Most importantly, you get a deeper grasp of your money, which is always a good thing.

.gif)