The South-East Amalgamated Markets Traders Association has addressed a petition to the Central Bank of Nigeria alleging indiscriminate bank charges by commercial banks .

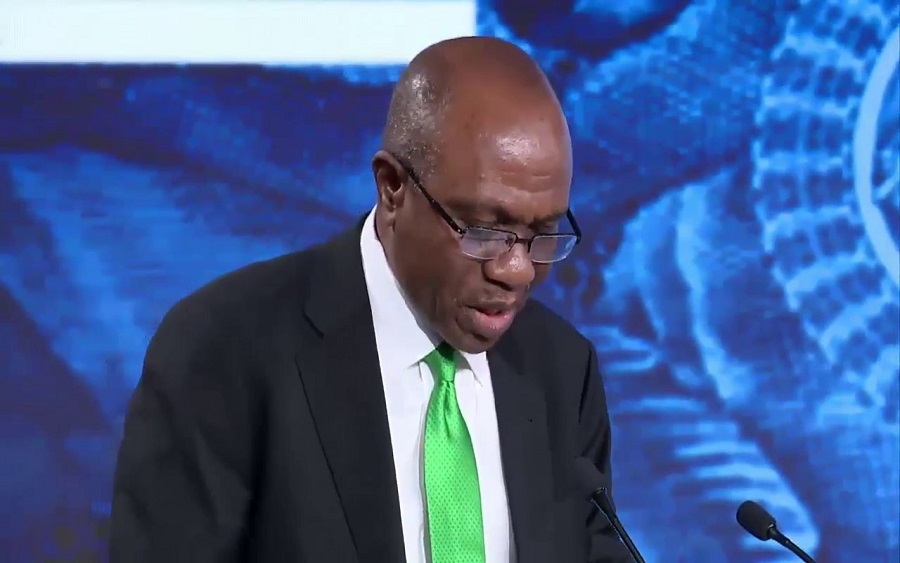

In an open letter to the Governor of the Central Bank of Nigeria, Mr Godwin Emefiele, signed by the association’s President-General, Chief Gozie Akudolu, and Secretary-General, Mr Alex Okwudiri, the association expressed its dissatisfaction with the bank charges.

The association called for the CBN’s intervention in bringing an end to what it described as multiple and indiscriminate charges and deductions on customers’ accounts.

Read: How to know if your bank account is being overcharged

What the Association is saying

The open letter reads, “Part of the major responsibilities of the commercial banks, we know, is to accept money deposits from customers and keep safe custody of the same, and perform such other transactions for and as directed by the customer through various bank instruments.

“Most of the transactions, we also know, are the social responsibility of the banks. But today, the banks make deductions and charges for virtually every transaction ranging from deposits to even confirmation of signature.”

According to the group, the CBN’s cashless economy policy has been extremely beneficial to its members, especially in reducing armed robbery incidents to a bare minimum.

It cited “indiscriminate levies and deductions,” particularly in online purchases, as an example, saying “When a customer makes an online transfer of funds, the transfer is charged a certain amount of money deducted from his/her account and the recipient’s account is also charged and deductions made for receiving the money.”

Read: Nigerian banks commence charging their customers N6.98 for USSD transactions

“In addition, charges and deductions are also made for SMS, which most of the time were not received. Finally, at intervals, charges and deductions will be made on the same account as service charge.”

The group claimed that its members had approached the banks individually to express their dissatisfaction, but that they had been unsuccessful.

As a result, it appealed to the CBN governor to persuade banks to halt “the indiscriminate charges and deductions and, if possible, refund all the deductions”.

What you should know

The CBN Governor had earlier noted at the last MPC meeting that the CBN has published guidelines on bank charges, and that if commercial banks violate these criteria, they should be notified.

In a similar fashion, the Nigerian Deposit Insurance Corporation (NDIC) had stated that customers who realize they have been overcharged can petition the CBN or the NDIC for a refund.