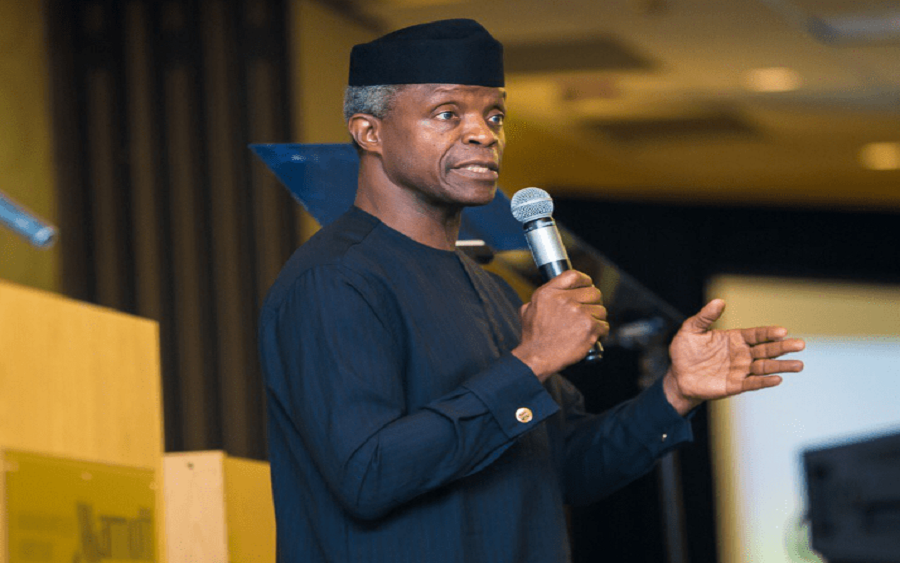

The Office of the Vice President has clarified Prof Yemi Osinbajo’s latest comments on monetary policy at the Mid-Term Ministerial Performance Review Retreat, stating that the Vice President did not call for Naira devaluation, but rather for a flexible exchange rate to stop the huge arbitrage in the sector.

This was disclosed in a statement by Laolu Akande, Senior Special Assistant to the President on Media and Publicity, Office of the Vice President, clarifying Vice President Yemi Osinbajo’s view on the naira exchange rate.

They argued that the VP urged for more policies to improve the supply side.

Read: Nigeria needs over $30 billion to achieve currency stability

What they said

“Our attention has been drawn to statements and reports in the media mis-characterising as a call for devaluation, the view of the vice president that the Naira exchange rate was being kept artificially low.

“Osinbajo is not calling for the devaluation of the Naira; he has at all times argued against a willy-nilly devaluation of the Naira.

“For context, the vice president’s point was that currently, the Naira exchange rate benefits only those who are able to obtain the dollar at N410, some of who simply turn round and sell to the parallel market at N570.

“It is stopping this huge arbitrage of over N160 per dollar that the vice president was talking about; such a massive difference discourages doing proper business, when selling the dollar can bring in 40 per cent profit,“ he said.

Read: FG rejects IMF’s advice to devalue the naira

They added that the Vice President argued for improved supply-side policies rather than simply managing demand which opened up the sector for many exploits.

“It is a well-known fact that foreign investors and exporters have been complaining that they could not bring foreign exchange in at N410 and then have to purchase foreign exchange in the parallel market at N570 to meet their various needs on account of unavailability of foreign exchange.

“Only a more market reflective exchange rate would ameliorate this; with an increase in the supply of dollars, the rates will drop and the value of the Naira will improve,” the statement read.

Read: How inflation and devaluation are killing savers in Nigeria; the Xend Finance solution

They added that the major issue confronting the economy on this matter is how to improve the supply of foreign exchange, but this will not happen if we do not allow mechanisms like the importers and exporters window to work.

“If we allow this market mechanism to work as intended, we will find that the Naira will appreciate against the dollar as we restore confidence in the system,’’ they said.

In case you missed it

Recall Nairametrics reported that Nigeria’s Vice President, Professor Yemi Osinbajo tasked the Central Bank of Nigeria (CBN) on better forex demand management, citing also, the need to allow the naira to reflect market realities, which economists often refer to as a floating exchange rate.

Professor Osinbajo had said on Moday, “As for the exchange rate, I think we need to move our rates to [be] as reflective of the market as possible. This, in my own respective view, is the only way to improve supply.

“We can’t get new dollars into the system, where the exchange rate is artificially low. And everyone knows by how much our reserves can grow. I’m convinced that the demand management strategy currently being adopted by the CBN needs a rethink, and that is just my view,” Osinbajo said.

He noted that these were issues that the CBN governor should address when he has the time.

The VP is right. Can’t bring in your inflow and sell at rate of N410.00 and when time comes for you to buy, the only option left for you is to source it at parrall market rate of N570 and up because even if you apply through the banking system you end up with nothing at all because of somany red tape in the system.