The Reserve Bank of India could launch its first digital currency pilot programs by December.

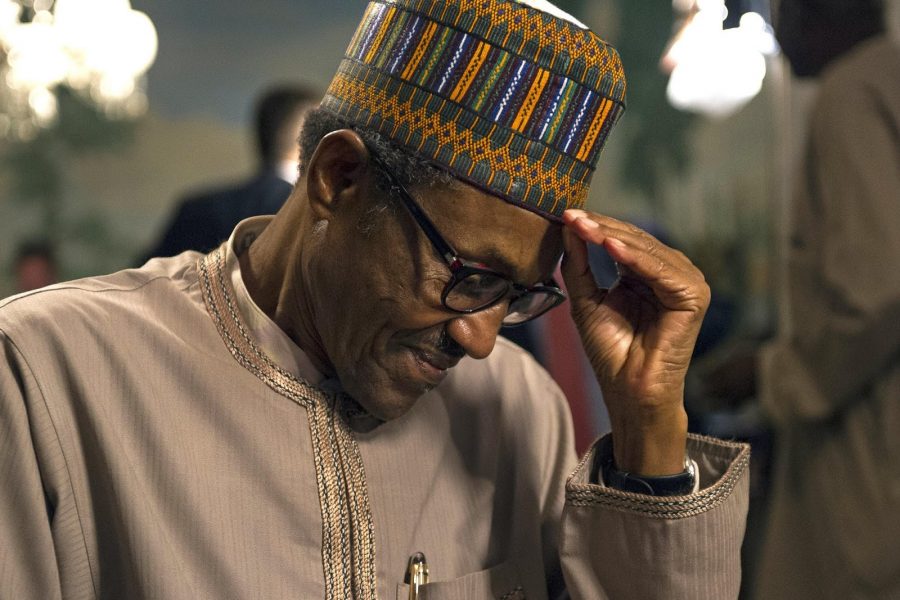

This was disclosed by the Central Bank governor, Shaktikanta Das to CNBC.

He said, “We are being extremely careful about it because it’s completely a new product, not just for RBI, but globally,”

“I think by the end of the year, we should be able to — we would be in a position, perhaps — to start our first trials,” Das told CNBC.

His deputy, T Rabi Shankar, last month said the central bank was working toward a “phased implemental strategy” for a digital currency.

According to the governor, the RBI is looking into many aspects of a digital currency, including its security, influence on India’s financial industry, and how it would affect monetary policy and cash in circulation.

Das went on to say that the central bank is weighing the pros and cons of using a centralized ledger for digital money against using so-called distributed ledger technology (DLT).

What you should know

- Central bank digital currencies or CBDCs are essentially the online versions of their respective fiat currencies. That would be the digital rupee in India’s scenario.

- Nigeria, China, Europe, and the United Kingdom are all looking into issuing digital currency, either to commercial lenders or to the general public.

- A distributed ledger technology (DLT) is a digital database that allows numerous users to access, share, and record transactions at the same time. The database is owned and administered by a single entity — in this case, the central bank — in a centralized ledger.