As tech firms outperformed, the Dow Jones Industrial Average dropped and the Nasdaq gained. The top-performing blue chips were Apple (AAPL) and Microsoft (MSFT).

Even while other meme stocks like GameStop (GME) struggled to get traction, AMC Entertainment (AMC) soared. The bears were mauling the little caps.

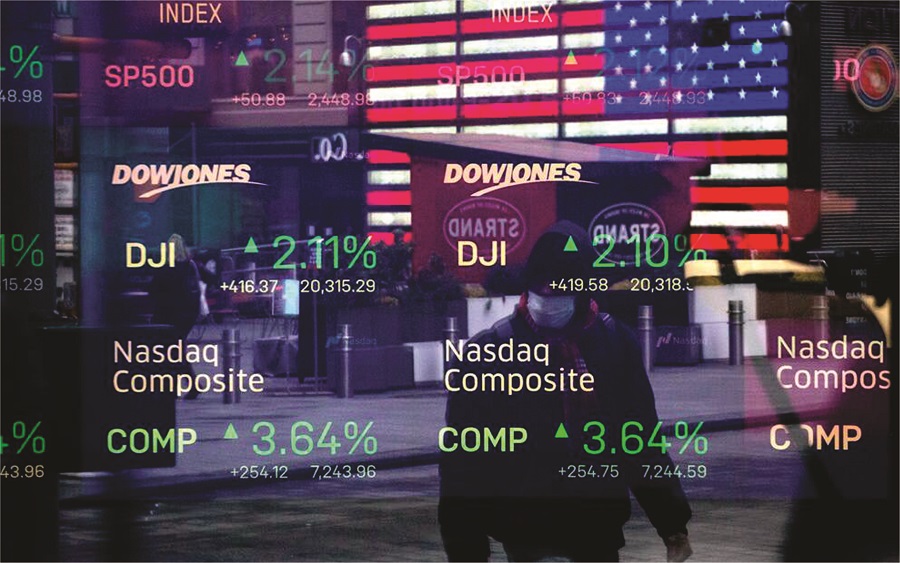

Following a two-day sell-off for the Dow in the wake of the Federal Reserve’s policy update, U.S. stock futures edged up modestly on Thursday night. The Dow Jones Industrial Average futures were up 0.08%. The S&P 500 futures increased by 0.13%, while the Nasdaq-100 futures increased by 0.21%.

The Dow Jones Industrial Average lost 210 points or 0.62% to 33,823.45 during the regular session. The S&P 500 index dropped 0.04% to 4,221.86. The Nasdaq Composite Index increased 0.87% to 14,161.35 points. The Dow was down 1.9% this week, while the S&P 500 has dropped 0.6%. The Nasdaq has increased by 0.65% this week.

With a gain of slightly over 1%, Apple stock was one of the top performers. The action saw the iPhone behemoth break through its 50-day moving average. According to MarketSmith’s research, it still has a long way to go before reaching a flat base purchase target of $137.17.

Microsoft was also doing well, with a gain of slightly over 1%. The stock of Leaderboard is currently attempting to hit a new purchase mark of $263.29. Amazon.com Inc. and Facebook Inc. all shrugged off pre-market losses.

Commodity prices have plummeted as China tries to temper surging costs as the currency grows. Copper, palladium, and platinum futures dropped, while oil prices in the United States plummeted more than 1%.

Investors are speculating on when the Federal Reserve may begin to reduce its monthly asset purchases after Chairman, Jerome Powell stated in his post-meeting news conference that policymakers are open to discussing the possibility. The conference also revealed that the central bank would begin hiking interest rates sooner than previously anticipated, with two rises planned before the end of 2023.

The Federal Reserve’s widely anticipated announcement on Wednesday triggered a sell-off in stocks. The central bank kept interest rates steady, increased its inflation forecast for 2021 to 3.4%, and accelerated scheduled interest rate rises.

The stats in this article are frightening and heartbreaking. God help Nigeria!

I need to have this loan to pay my school fees