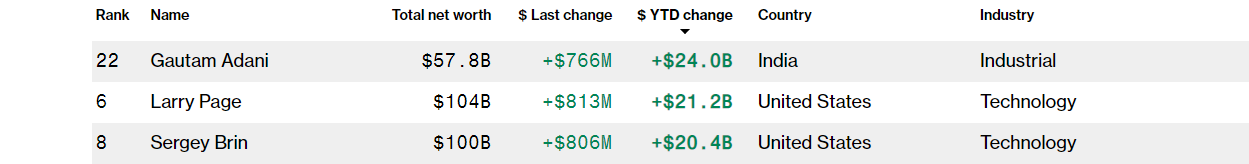

Google founders Larry Page, 48 and Sergey Brin, 47 have earned more money collectively than the total foreign cash reserve holdings of Africa’s biggest economy.

Larry Page, currently worth $104 billion, has earned $21.2 billion in 100 days; while Sergey Brin, with a wealth valuation of $100 billion, earned $20.4 billion in the same period. Collectively, both men have earned $41.6 billion, dwarfing Nigeria’s foreign cash reserve which currently stands at a gross valuation of $35 billion.

The majority of Larry page’s wealth comes from his stake in Alphabet, the parent company of Google. The Standford trained entrepreneur currently holds $12.6 billion in cash.

READ: Aliko Dangote’s net worth falls by $1.4 billion in Q1 2021 amid stock market sell-off

Sergey Brin’s wealth valuation is also derived from his stake in the world’s most popular search engine and presently, his cash holding is valued at $12.7 billion.

Impressive growth from the world’s most powerful economy boosted buying pressure on Google shares and its founders saw their wealth valuation surge. Global investors are increasingly holding on the tech juggernaut’s shares as amazing economic data from America’s service industries coupled with an advance in the tech sector fueled the hike in Google shares seen in recent months.

READ: Why Warren Buffett holds only 1% of his wealth in cash

Consequently, investors are piling significant amount of funds into Alphabet Inc., the parent company of Google, with reports saying it won its most recent supreme court case against Oracle, a case that has lingered for about 3 years.

Recent price action reveals the stock is presently trading at $2,285.88 nearing its 52-week high of $2,289.04 with a yearly return on investment currently pegged at 89%.

READ: Fintech: Ex-Google employee becomes billionaire in 24 hours

Stock pundits are surprised by such record gains in Google shares despite a swift move seen lately by some institutional investors into utility, energy-based stocks and of late U.S Treasury bonds.

The company currently has a market value of about $1.54 trillion.