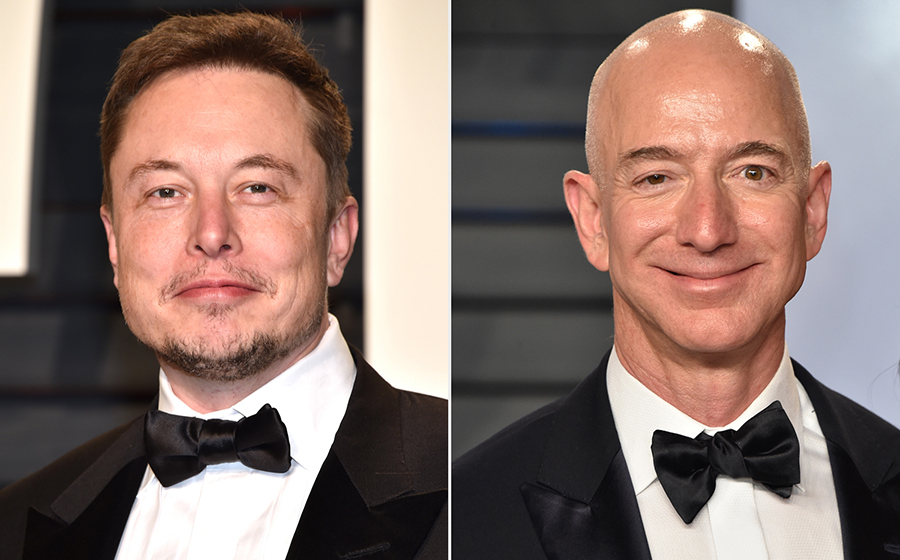

Jeff Bezos and Elon Musk are collectively worth $372bn. They are the two wealthiest individuals on earth. Their wealth has grown significantly over the years and it looks likely to remain so.

To give you a clear picture of the significant increase in the wealth of both men, read the points below.

- According to Business Insider and Bloomberg, Jeff Bezos’ net worth increased by 59.1% in 2020. The tech billionaire added a humongous $67.9bn to his fortunes in 2020 and is currently worth $197bn.

- According to CNBC Elon Musk started 2020 with a net worth of $28bn, he is currently worth $175bn.

Both men have employed some interesting strategies in growing their wealth to the point that it currently is, and this article will harp on one of these strategies.

Reinvestment

Reinvestment as an investment strategy is defined by Investopedia as the practice of using dividends, interest, or any other form of income distribution earned in investment to purchase additional shares or units, rather than receiving the distributions in cash.

In very simple terms, it means ploughing the income you make from an investment back into it, rather than receiving the income as cash. Jeff Bezos and Elon Musk both employed this strategy to grow their wealth in one year.

How the multi-billionaires did it

The Reinvestment strategy has been proven over time to increase the value of a stock or mutual fund. Buying a huge stake in your own company shares encourages more investors to also buy your company shares. Jeff Bezos and Elon Musk increased the stock value of their companies by reinvesting some of their profits and in so doing, they significantly got richer.

Jeff Bezos’ reinvestment strategy

Jeff Bezos retains part of his wealth in his company’s stocks. This means that instead of collecting all of his profits in cash, he retains some in his company by buying its shares. He currently owns about 11% of Amazon’s shares according to a November 2020 SEC filing.

The result

- Jeff Bezos added an extra $67.9bn to his net worth in 1 year.

- Amazon’s stock price rose by a staggering 70% in a calendar year.

- Jeff Bezos is currently the richest man in the world.

Elon Musk’s reinvestment strategy

Like Bezos, Elon Musk also retains part of his wealth in his company’s stocks. He owns over 20% of Tesla stocks. His reinvestment strategy played a major role in driving Tesla shares to a whopping 740% increase in 2020.

The result

- Elon Musk’s Tesla Stock price increased by 740% in just 1 year.

- His net worth increased by over 500% from 2020 to 2021.

- His company got into the S&P 500 index and he became the second richest man in the world.

What you should know

Jeff Bezos is the world’s richest person for the fourth year running, according to Forbes while Elon Musk moved from his 31st position to his current 2nd place on the Forbes billionaire ranking for 2021.

I enjoyed the article nice key points great highlights and good references as far as facts driven thanks for sharing very insightful much appreciated.

Very educative. An excellent way of promoting financial literacy. Keep it up.