Nasdaq recorded impressive buying pressures with the so-called “stay-at-home” winners, including Facebook, Apple, and Microsoft, which rose after upbeat results from Netflix Inc recorded last week.

Netflix’s share price had earlier recorded impressive gains after it beat market expectation, powering the video streaming stock to close on the account that it added more customers than expected and revealed it no longer needed debt to build its entertainment empire.

- The positive upbeat guidance on free cash prompted bullish remarks from Wall Street analysts, though some questioned how much of the subscriber growth was pulled forward.

- The Nasdaq index had earlier hit a record high on hopes of impressive earnings later this week from the likes of Apple, Facebook, and Google, but the Dow Jones Industrial Average index, dominated by industrials and airlines, struggled to keep such bullish momentum.

That said, the U.S Equity market generally pulled back from its record highs in recent days, waiting to see if COVID-19 vaccines could reduce COVID-19 infection rates globally.

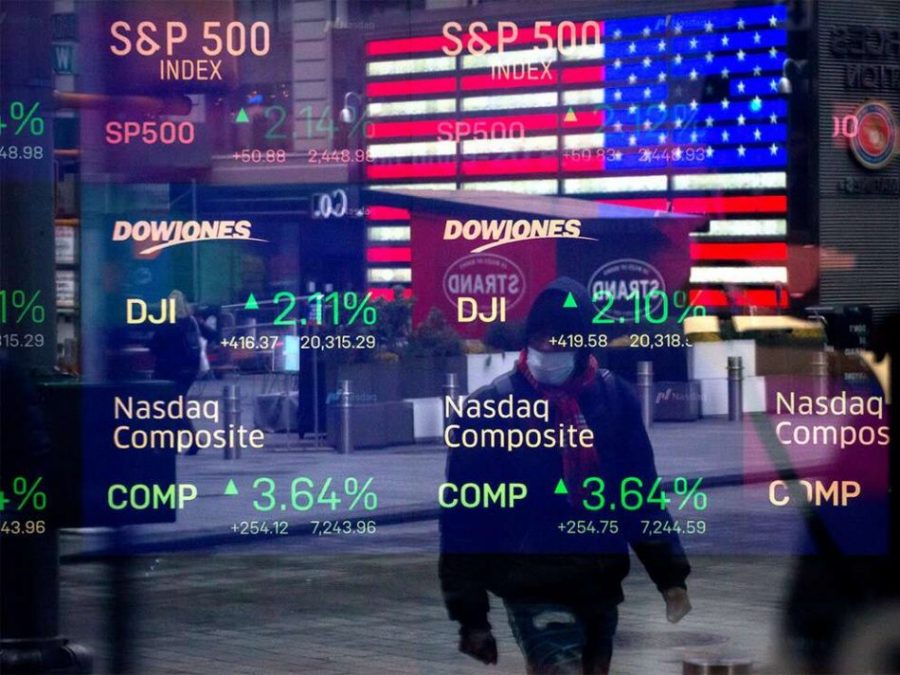

The Dow Jones Industrial Average fell by 0.12%, to settle at 30,960 pints; however, the S&P 500 gained 0.36%, to close at 3,855.36 points and the Nasdaq Composite added 0.69%, to settle at 13,635.99 points.

In a note, Stephen Innes, Chief Global Market Strategist at Axi, spoke on the bullish rally sighted in U.S based tech brands.

“One argument for the outperformance could be that tech enjoys low rates, so the fixed-income performance helps amid lockdowns. After all, in a foreshadowing effect, Netflix rose 16% last week after subscriber numbers soared by a record 37mn in 2020.

“Unsurprisingly, it seems lockdowns and TV go hand in hand and by extension, so does gaming and the use of cutting-edge software and hardware components.

“And with the bulk of Tech market cap (75%) reporting during the next two weeks, it’s clear investors like the pack’s heavyweight leaders instead of buy-the-laggards, leading to these eye-catching moves. And I’m not sure that logic doesn’t make sense.”

What to expect: But at some point, the stock bears might come back to haunt the stock market. There’s nothing in the investment world that’s quite like hitting a patch of black COVID-19 economic ice when traditional investing wisdom suggests the best offence is a good defence by taking your foot off the gas pedal as the most straightforward function of damage control.