The Nigerian stock market ended the week cumulatively on a bearish note. The NSE All-Share Index and Market Capitalization both depreciated by 0.08% to close the week at 24,287.66 and N12.670 trillion respectively.

All other indices finished lower, with the exception of NSE Lotus II and NSE Industrial Goods Indices, which appreciated by 0.94% and 0.52% respectively while NSE ASeM closed flat.

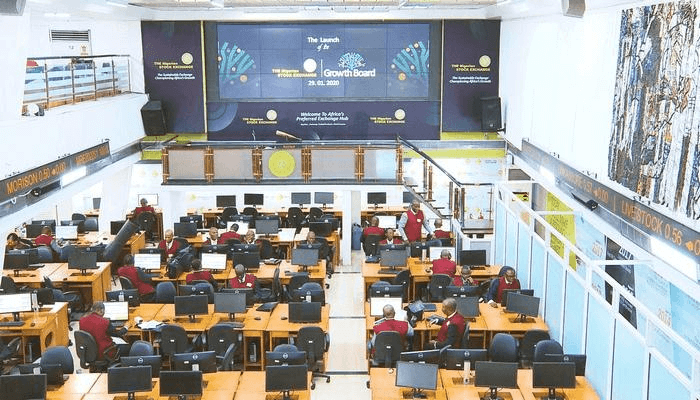

A total turnover of 1.016 billion shares worth N7.436 billion in 18,092 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 901.542 million shares valued at N13.453 billion that exchanged hands last week in 18,676 deals.

The Financial Services industry (measured by volume) led the activity chart with 784.322 million shares valued at N3.305 billion traded in 10,592 deals; thus contributing 77.23% and 44.45% to the total equity turnover volume and value respectively.

The Oil and Gas industry followed with 61.822 million shares worth N418.191 million in 984 deals. In the third place was the Consumer Goods industry, with a turnover of 42.999 million shares worth N1.102 billion in 2,848 deals.

Trading in the top three equities namely Sterling Bank Plc, FCMB Holdings Plc and FBN Holdings Plc (measured by volume) accounted for 416.989 million shares worth N791.078 million in 2,752 deals, contributing 41.06% and 10.64% to the total equity turnover volume and value respectively.

26 equities appreciated in price during the week, higher than 25 equities in the previous week. 36 equities depreciated in price, higher than 33 equities in the previous week, while one 101 equities remained unchanged, lower than 105 equities recorded in the previous week.

Top gainers

CUTIX PLC up 10.30% to close at N1.82

NPF MICROFINANCE BANK PLC up 10.00% to close at N1.32

SUNU ASSURANCES NIGERIA PLC up 10.00% to close at N0.22

IKEJA HOTEL PLC up 9.80% to close at N1.12

PRESCO PLC up 9.28 to close at N49.45

NEIMETH INTERNATIONAL PHARMACEUTICALS PLC up 7.91% to close at N1.50

ARDOVA PLC up 7.73% to close at N12.55

JAIZ BANK PLC up 7.69% to close at N0.56

CADBURY NIGERIA PLC up 7.41% to close at N7.25

LIVESTOCK FEEDS PLC up 7.14 % to close at N0.60

Top losers

LINKAGE ASSURANCE PLC down 14.89% to close at N 0.40

NIGERIAN BREW PLC down 11.89% to close at N30.00

WAPIC INSURANCE PLC down 11.43% to close at N0.31

CONOIL PLC down 10.58% to close at N16.90

11 PLC down 9.97% to close at N173.40

ARBICO PLC down 9.94% to close at N1.54

JULIUS BERGER NIG PLC down 9.88% to close at N15.50

ETERNA PLC down 9.38% to close at N2.03

ECOBANK TRANSNATIONAL INCORPORATED down 9.38% to close at N4.35

UNITY BANK PLC down 8.16% to close at N0.45

Outlook

The Nigerian bourse dropped slightly cumulatively in the trading week that ended on the 17th of July 2020, as falling crude oil prices in the short term, weighed heavily on the energy index. Despite decent buying pressures on Nigerian bank stocks, some institutional investors stayed on the sidelines as recent inflation figures released showed an uptrend; the economic uncertainty concerns strengthened among stock traders.

Nairametrics recommends that you seek the advice of a certified financial advisor when choosing to buy stocks.